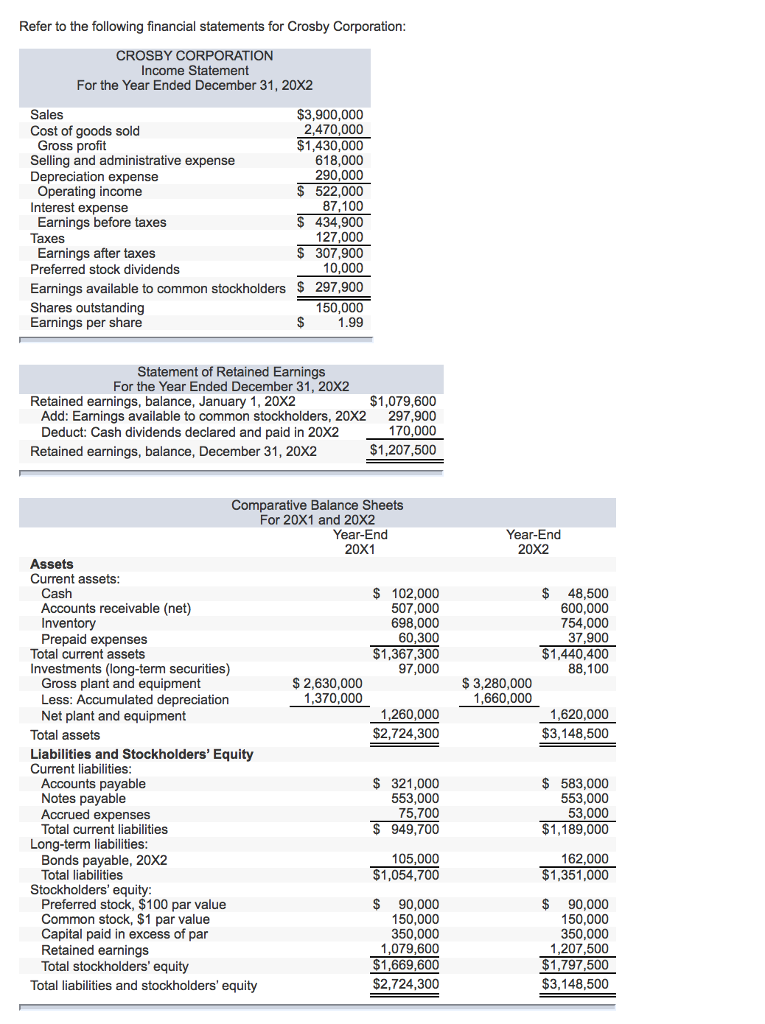

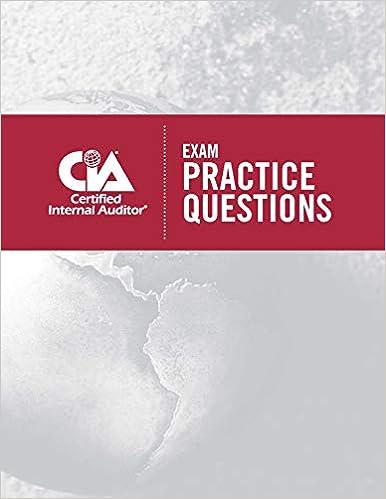

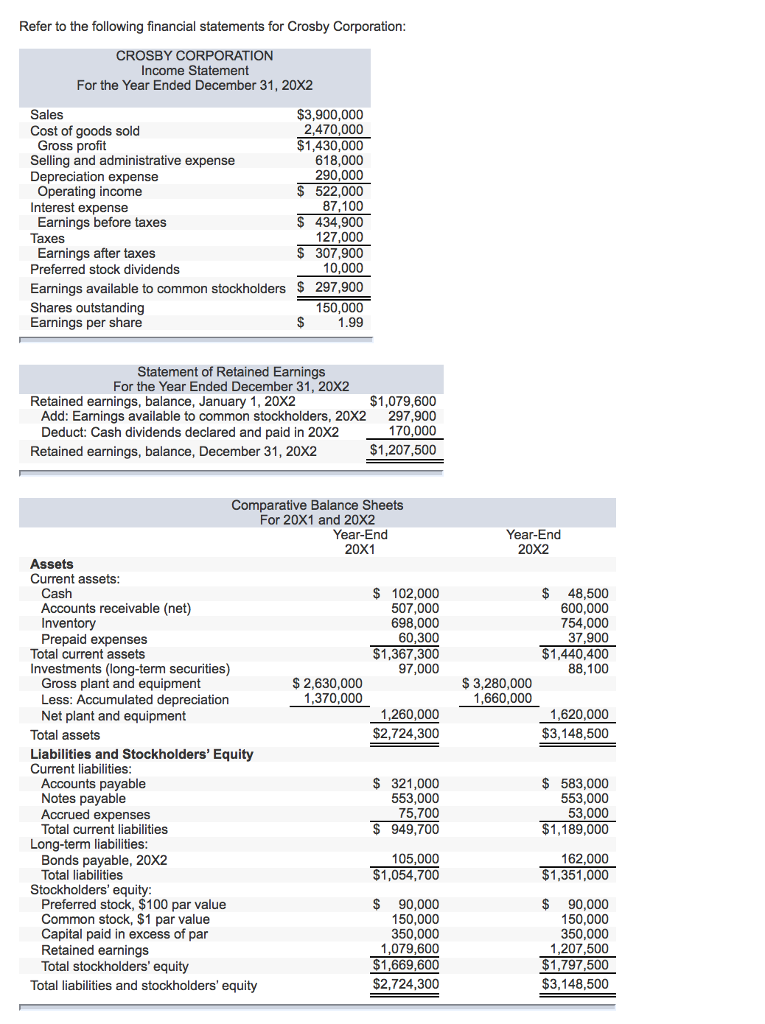

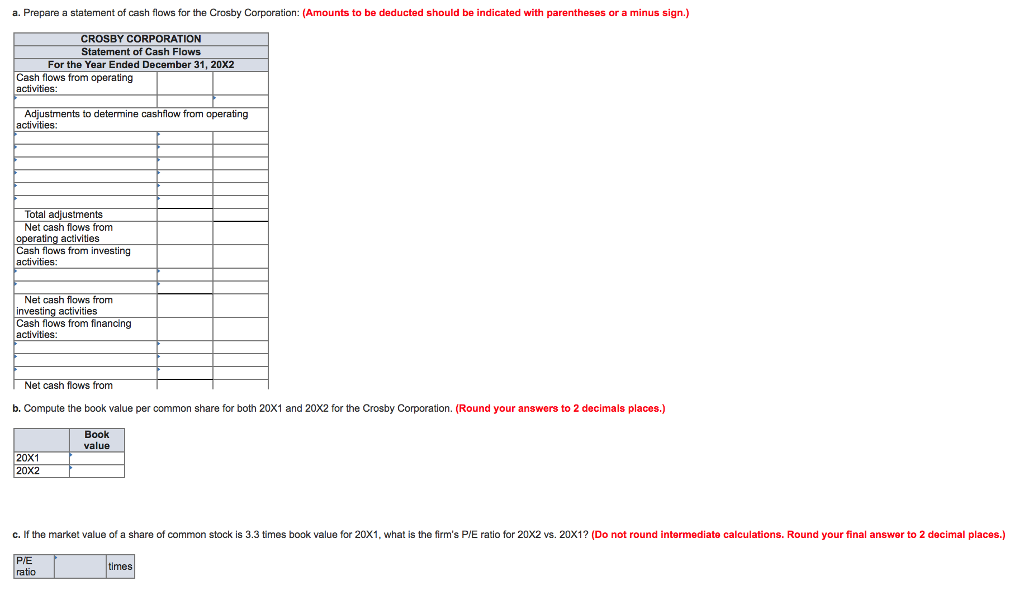

Refer to the following financial statements for Crosby Corporation CROSBY CORPORATION Income Statement For the Year Ended December 31, 20X2 Sales Cost of goods sold Gross profit Selling and administrative expense Depreciation expense Operating income Interest expense $3,900,000 2,470,000 $1,430,000 618,000 290,000 $ 522,000 Earnings before taxes Taxes $ 434,900 127,000 S 307,900 Earnings after taxes Preferred stock dividends Earnings available to common stockholders Shares outstanding Earnings per share 297,900 150,000 Statement of Retained Earnings For the Year Ended December 31, 20X2 Retained earnings, balance, January 1, 20X2 $1,079,600 Add: Earnings available to common stockholders, 20X2 297,900 170,000 $1,207,500 Deduct: Cash dividends declared and paid in 20X2 Retained earnings, balance, December 31, 20X2 Comparative Balance Sheets For 20X1 and 20X2 Year-End 20X2 ear 20X1 Current assets $ 102,000 507,000 698,000 60,300 $1,367,300 97,000 $ 48,500 600,000 754,000 37,900 $1,440,400 Accounts receivable (net) Inventory Prepaid expenses Total current assets Investments (long-term securities) Gross plant and equipment Less: Accumulated depreciation Net plant and equipment $ 2,630,000 1,370,000 $ 3,280,000 1,660,000 1,260,000 $2,724,300 1,620,000 $3,148,500 Total assets Liabilities and Stockholders' Equity Current liabilities $ 321,000 553,000 75,700 S 949,700 $ 583,000 553,000 53,000 $1,189,000 Notes payable expenses Total current liabilities Long-term liabilities Bonds payable, 20X2 Total liabilities 105,000 $1,054,700 162,000 $1,351,000 Stockholders' equity: Preferred stock, $100 par value Common stock, $1 par value Capital paid in excess of par Retained earnings Total stockholders' equity $ 90,000 150,000 350,000 1,079,600 $ 90,000 150,000 350,000 1.207 500 $1,797,500 $3,148,500 Total liabilities and stockholders' equity $2,724,300 a. Prepare a statement of cash flows for the Crosby Corporation: (Amounts to be deducted should be indicated with parentheses or a minus sign.) ROSBY CORPORATION Statement of Cash Flows For the Year Ended December 31, 20X2 Cash flows from operating activities Adjustments to determine cashflow from operating activities: Total adjustments Net cash flows from operating activities Cash flows from investing nvesting ativities Cash flows from financing activities: Net cash flows from b. Compute the book value per common share for both 20X1 and 20X2 for the Crosby Corporation. (Round your answers to 2 decimals places.) value 20x1 20X2 c. If the market value of a share of common stock is 3.3 times book value for 20x1, what is the firm's P/E ratio for 20X2 vs. 20X1? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) ratio