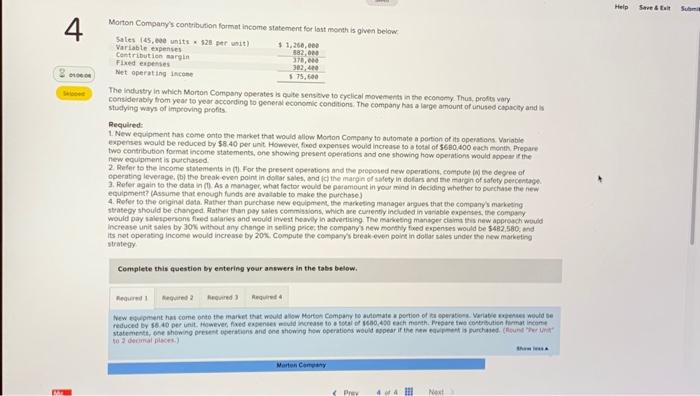

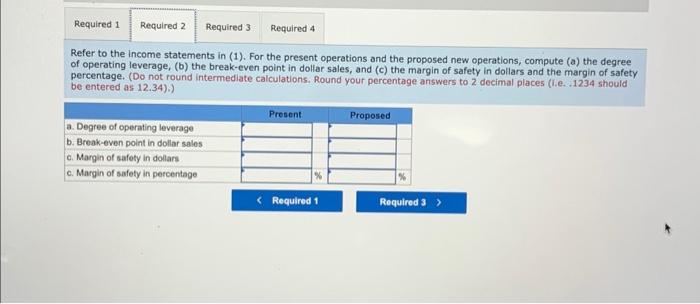

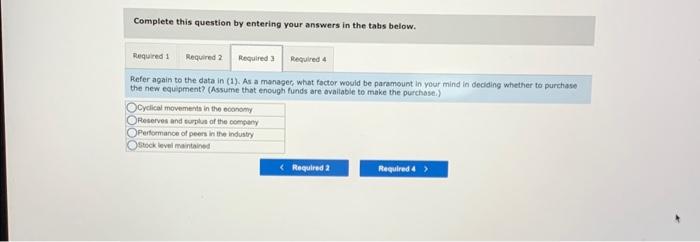

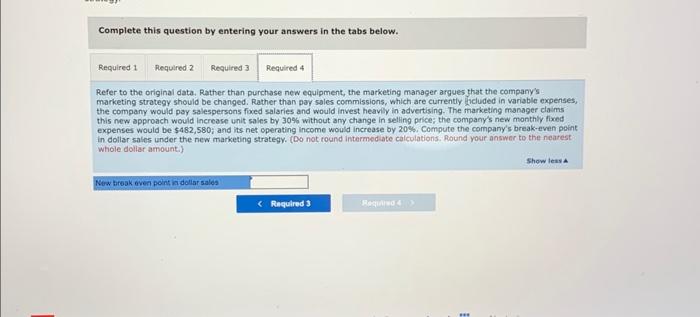

Refer to the income statements in (1). For the present operations and the proposed new operations, compute (a) the degree of operating leverage, (b) the break-even point in dollar sales, and (c) the margin of safety in dollars and the margin of safety percentage. (Do not round intermediate calculations. Round your percentage answers to 2 decimal places (i.e. .1234 should. be entered as 12.34).) Mortan Compary/s contribution formot income statement for last month is ghvin below The industy in which Morton Compary operates is cuite sensive to cyelical movemerit in the econcely. Thus, prodts vary considerably from year to year according to geners economic condations. The compony has a large amount of unused capoiciz and is studying ways of improwing profits. Requlted: 1. New equipment has come anto Die Itarket that would allow Morton Company to automote a portion of its operasions Variable expenses would be reduced by $8.40 per unit However, ficod expentes would increase to ofotal of 5680,400 each month, Prepure two contribution format income statements, one showing present coerabions and one showing how operations would sopes if the ferw equprment is purchased. 2 Reler to the income stalements in (1) For the present opetotions and the proposed new operations, computeinj fue degree of 3. Refer again to the data in (1) As a managec, what factor would be patamount in your mind in deciding whether to parchase the new equipment? (Assume that eneugh huds are avaliable to muke the purchise) 4. Refer to the original data. Aather than purchase new eculpment the marketing manoger argues that the companys maketing strategy Complete this questien by entering your anwwers in the tabs below. to 2 docimal places.) Complete this question by entering your answers in the tabs below. Refer to the original data, Rather than purchase new equipment, the matkeking manager argues that the company's marketing strategy should be changed. Rather than pay sales commissions, which are currently licluded in variable expenses, the company would pay salespersons foced salaries and would invest heavily in advertising. The fmarketing manager cla ims this new approach would increase unit sales by 30% without amy change in selling price; the company's new monthly fixed expenses would be $482,580; and its net operating income would increase by 20%, Compute the company's break-even point in dollar salos under the new marketing strategy. [Do not round intermed ate calculations. Round your answer to the nearest whole dollar amount.) Complete this question by entering your answers in the tabs below. Refer again to the data in (1). As a managet, what foctor would be paramount in your mind in declaing whether to purchase the new equipment? (Assume that enough funds are avaliable to make the purchose.)