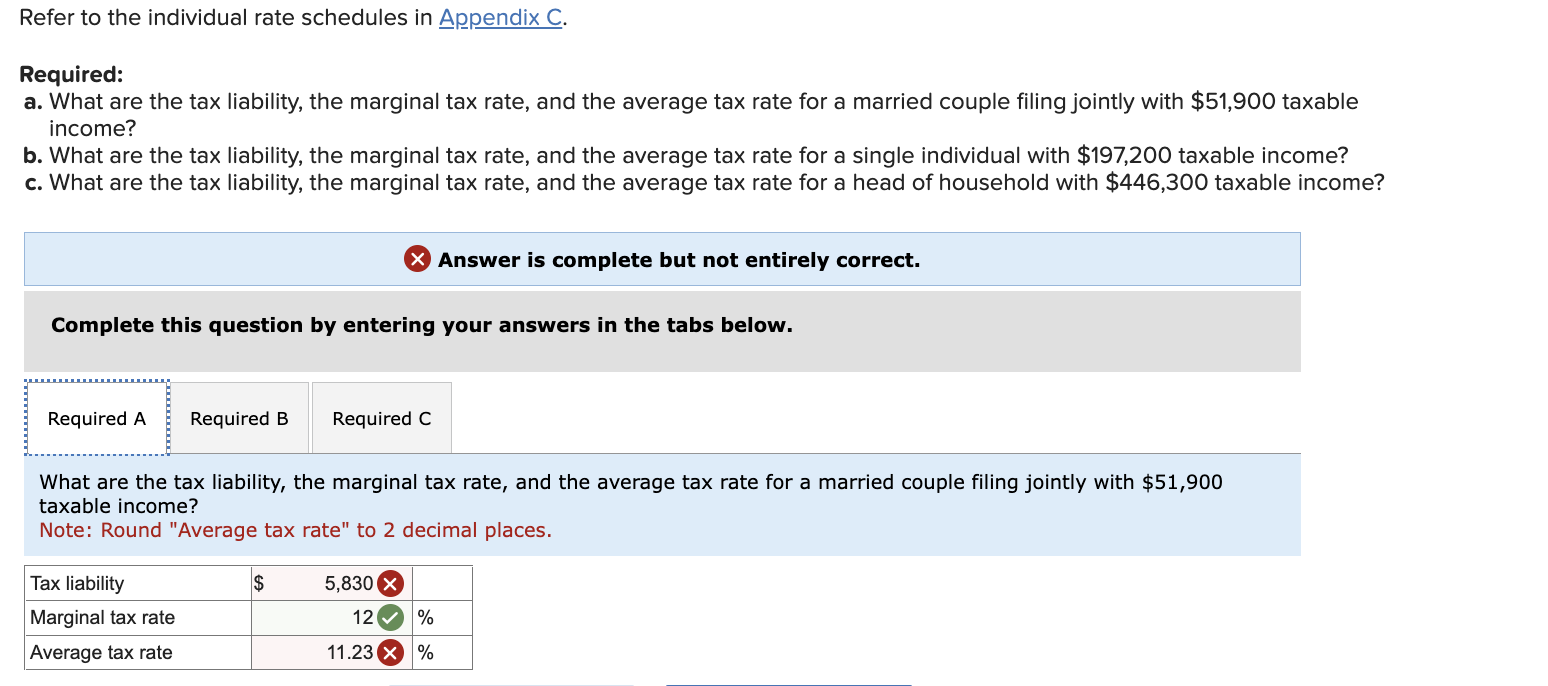

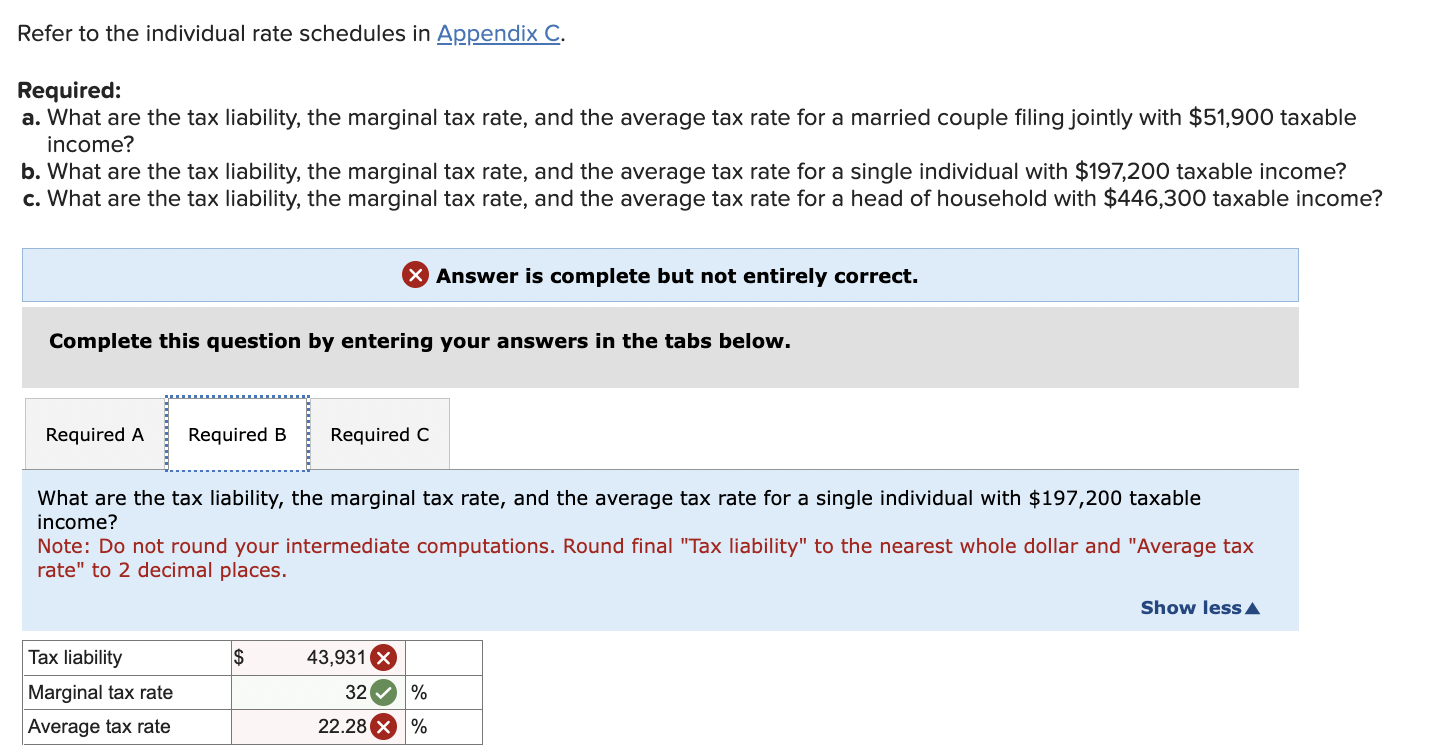

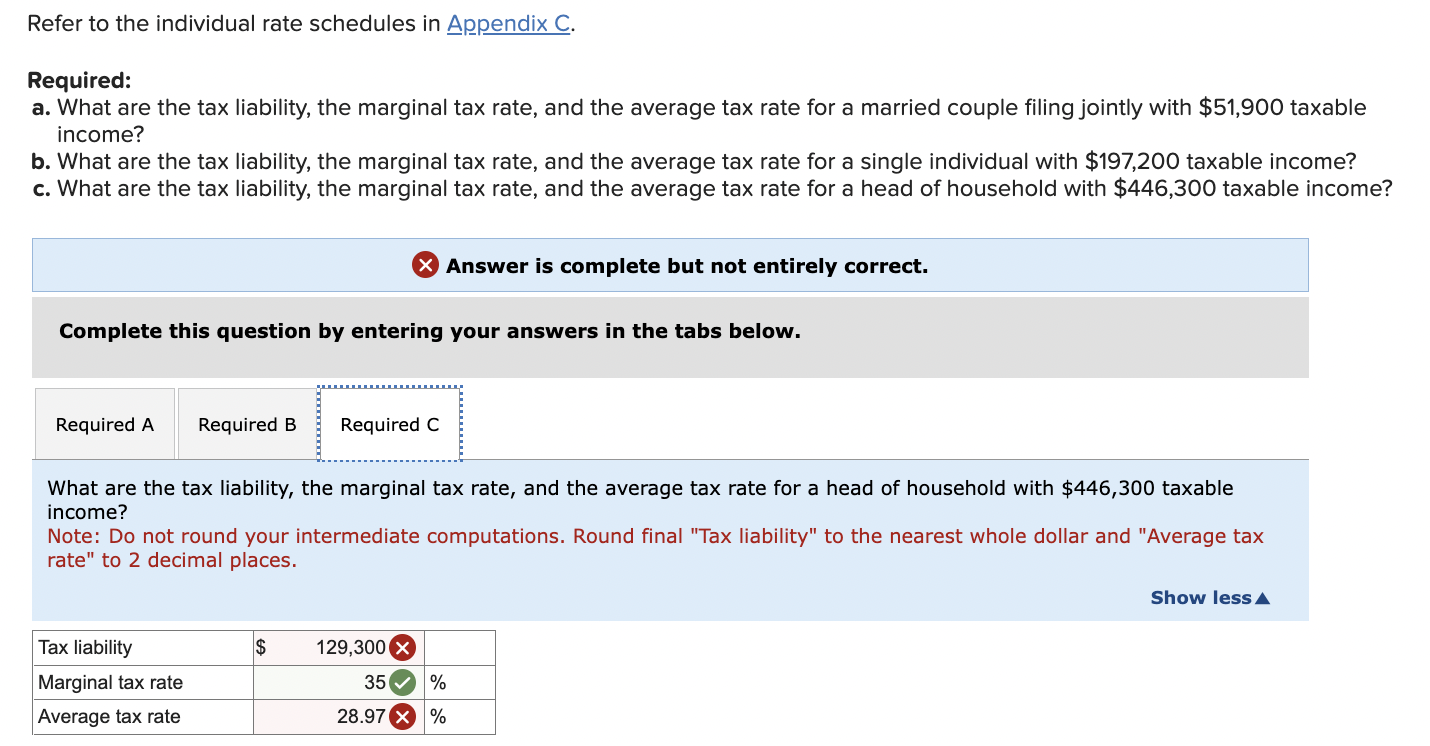

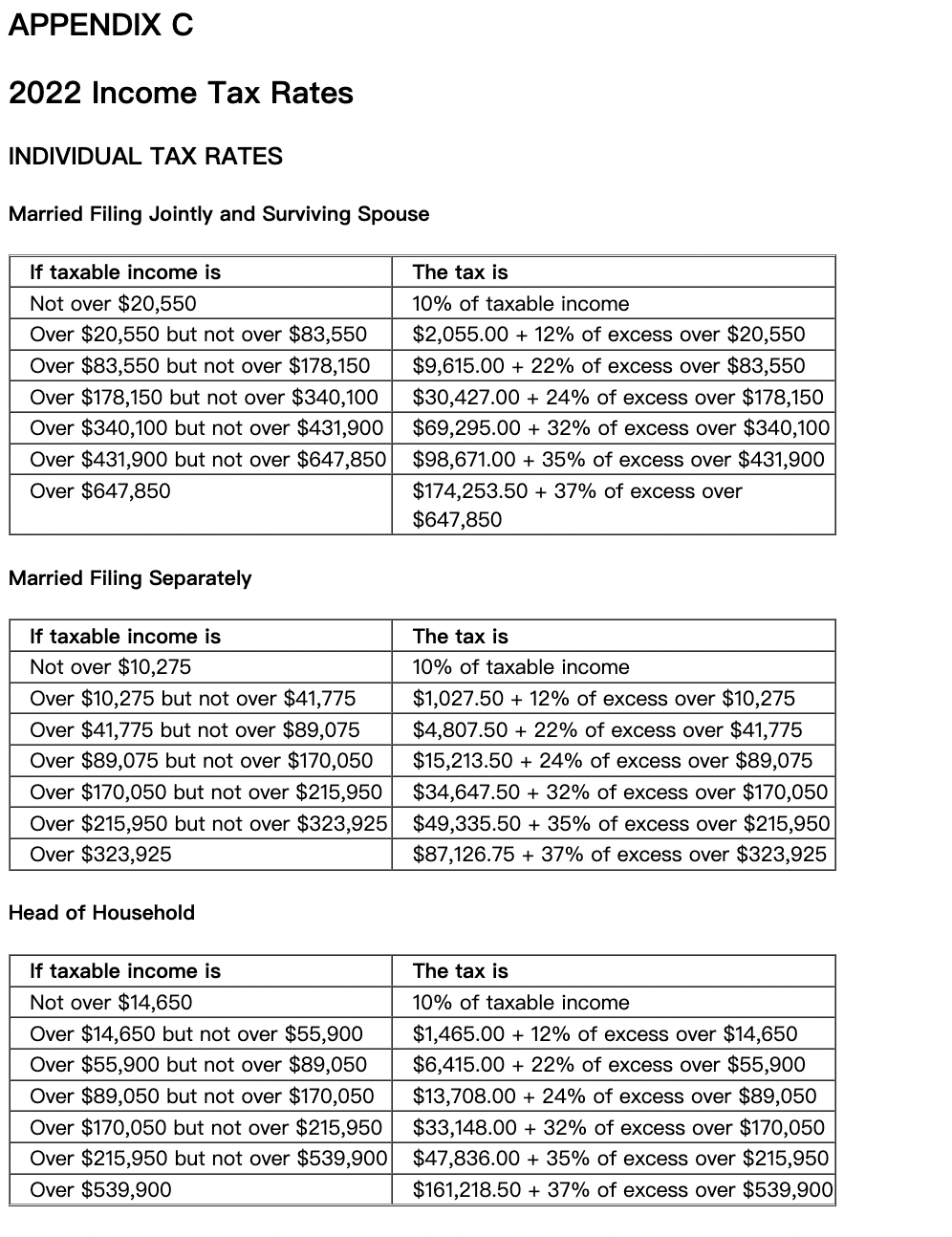

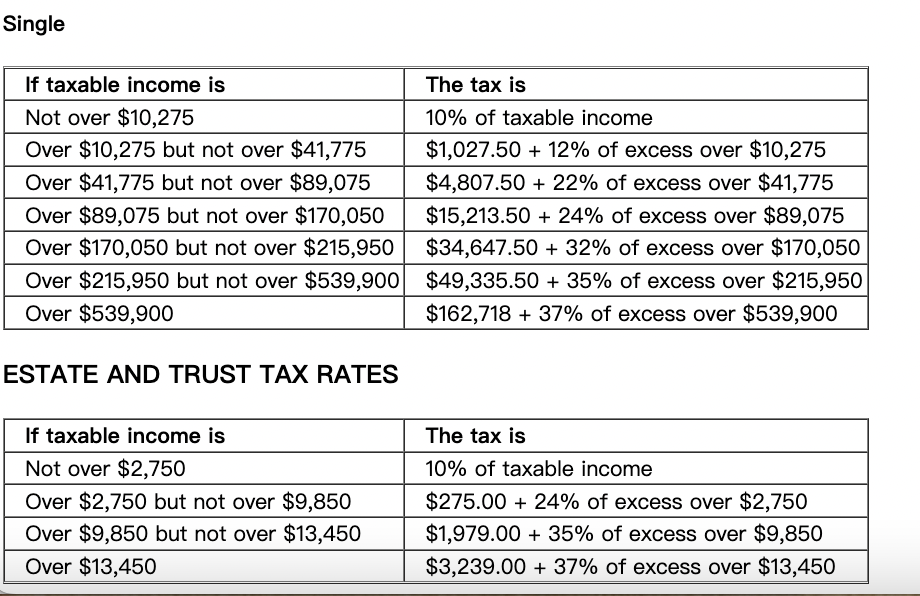

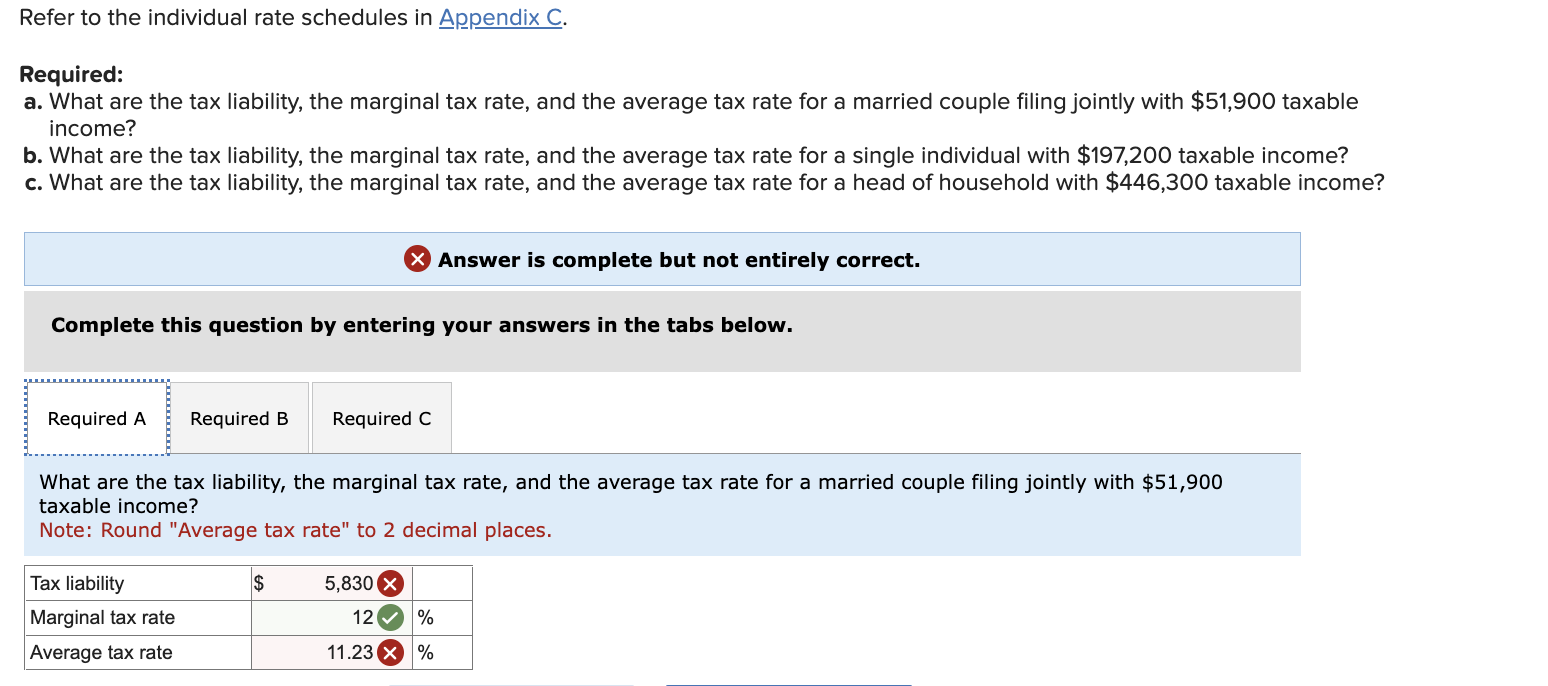

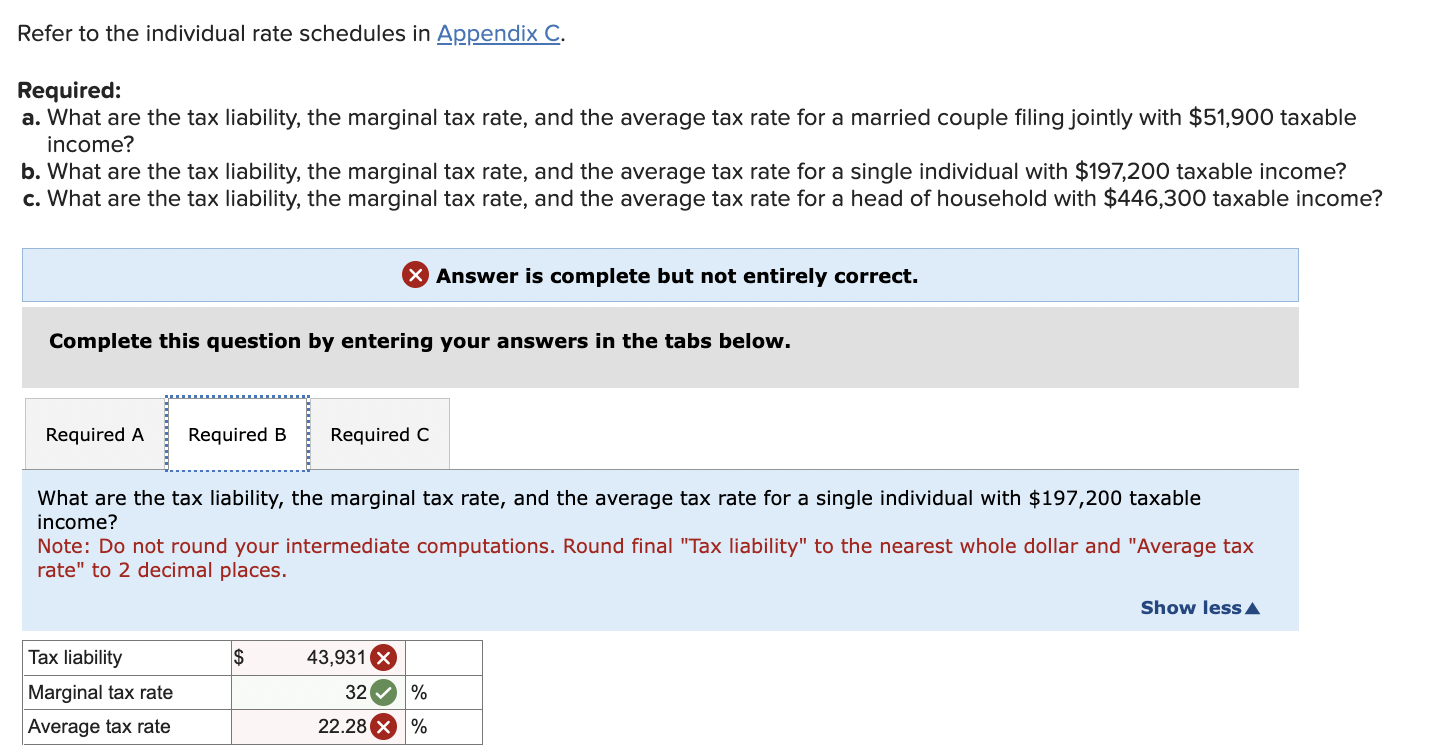

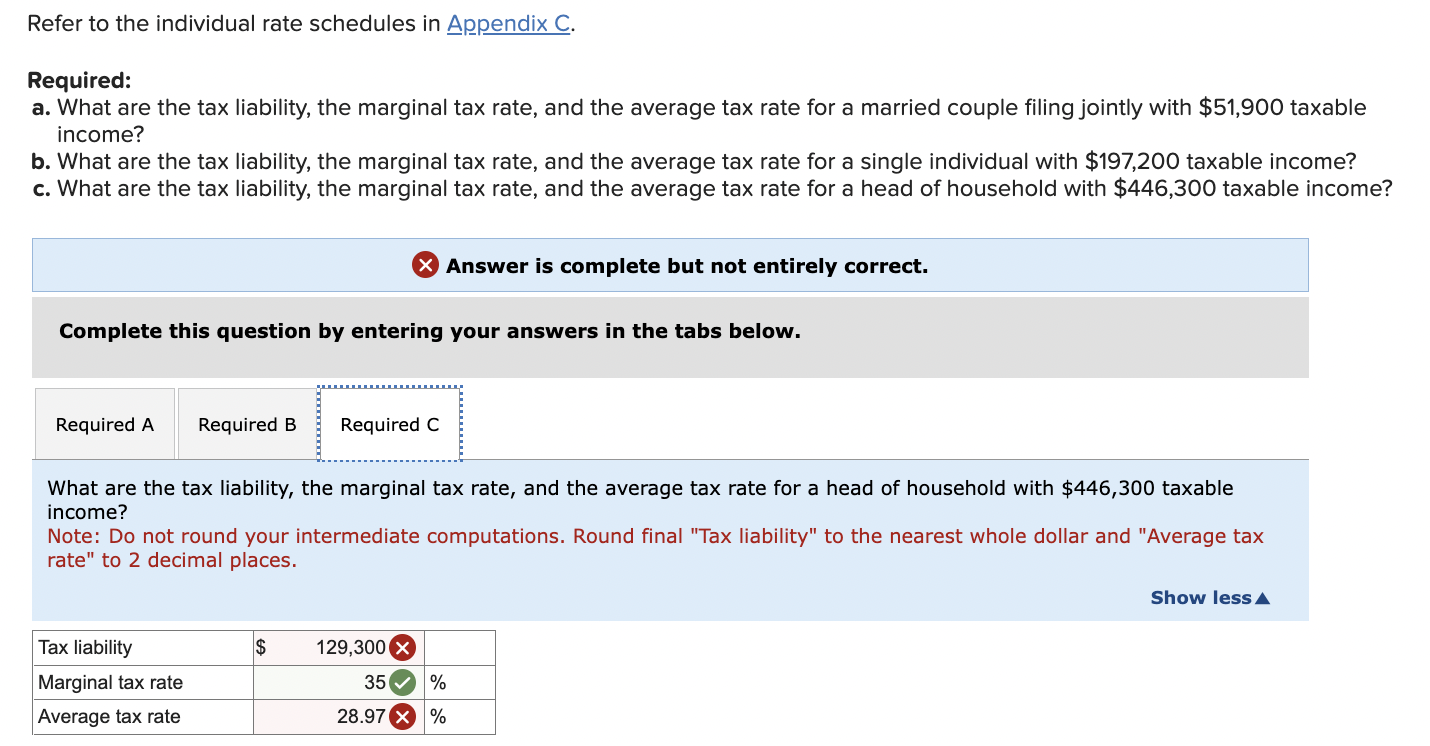

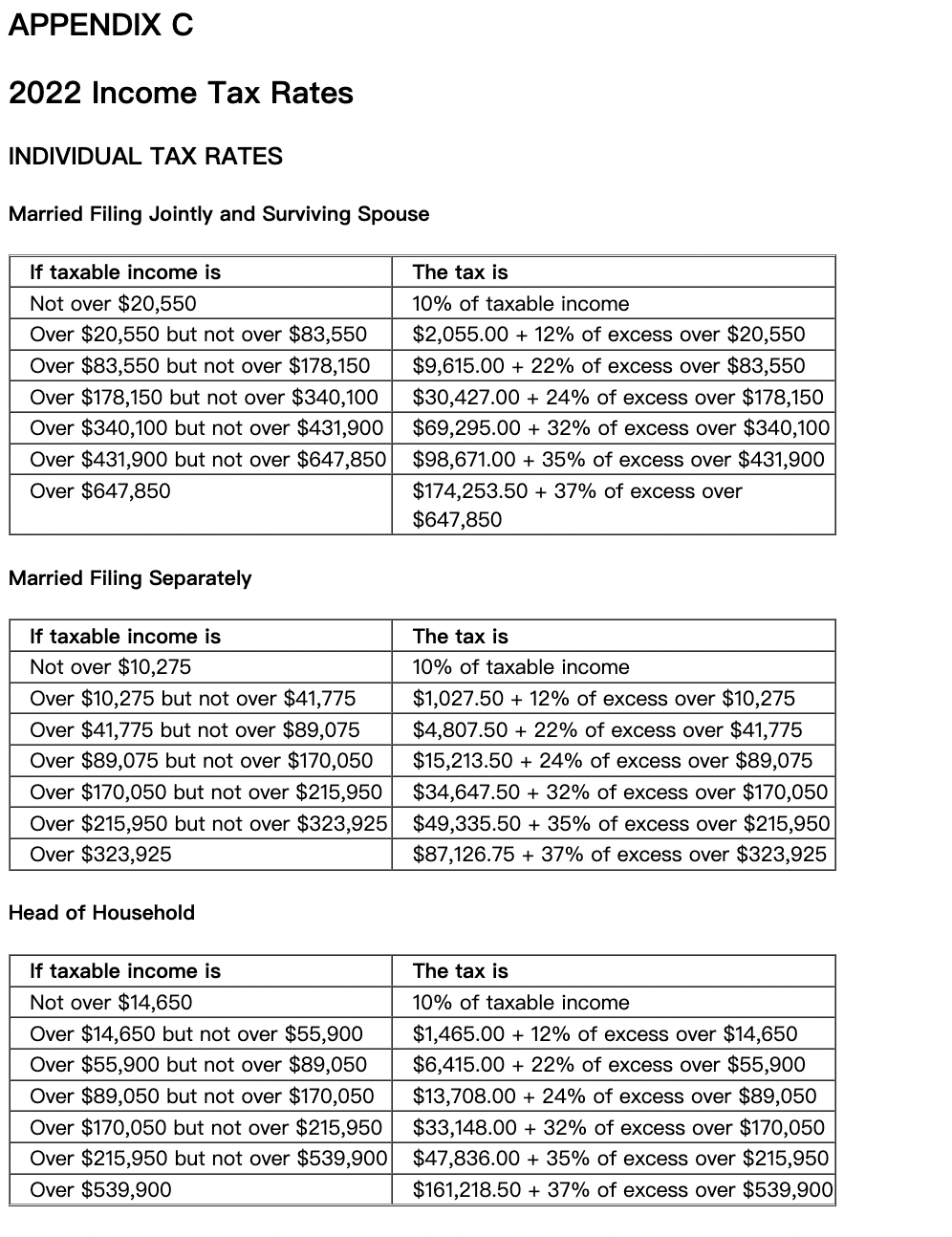

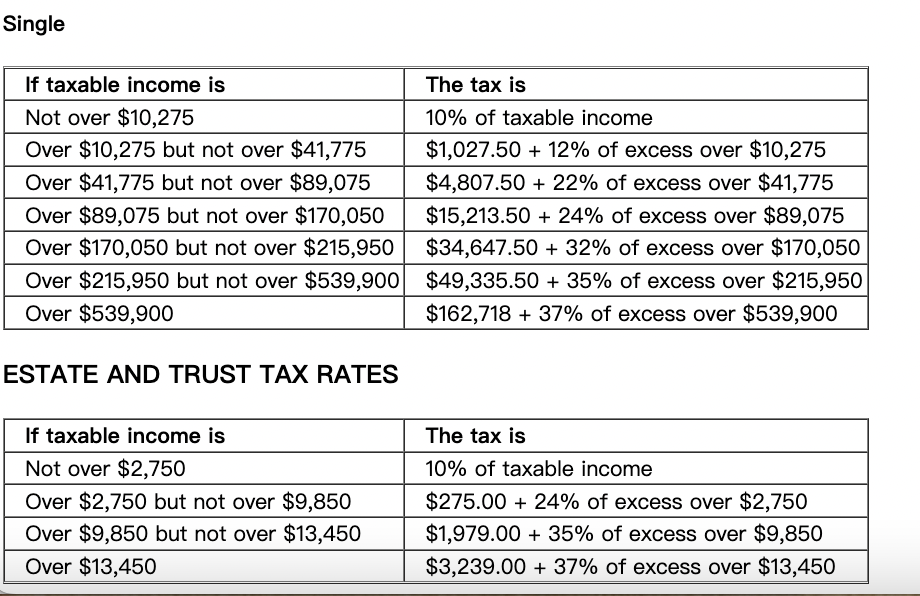

Refer to the individual rate schedules in Appendix C. Required: a. What are the tax liability, the marginal tax rate, and the average tax rate for a married couple filing jointly with $51,900 taxable income? b. What are the tax liability, the marginal tax rate, and the average tax rate for a single individual with $197,200 taxable income? c. What are the tax liability, the marginal tax rate, and the average tax rate for a head of household with $446,300 taxable income? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What are the tax liability, the marginal tax rate, and the average tax rate for a married couple filing jointly with $51,900 taxable income? Note: Round "Average tax rate" to 2 decimal places. Refer to the individual rate schedules in AppendixC. Required: a. What are the tax liability, the marginal tax rate, and the average tax rate for a married couple filing jointly with $51,900 taxable income? b. What are the tax liability, the marginal tax rate, and the average tax rate for a single individual with $197,200 taxable income? c. What are the tax liability, the marginal tax rate, and the average tax rate for a head of household with $446,300 taxable income Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What are the tax liability, the marginal tax rate, and the average tax rate for a single individual with $197,200 taxable income? Note: Do not round your intermediate computations. Round final "Tax liability" to the nearest whole dollar and "Average tax rate" to 2 decimal places. Refer to the individual rate schedules in Appendix C. Required: a. What are the tax liability, the marginal tax rate, and the average tax rate for a married couple filing jointly with $51,900 taxable income? b. What are the tax liability, the marginal tax rate, and the average tax rate for a single individual with $197,200 taxable income? c. What are the tax liability, the marginal tax rate, and the average tax rate for a head of household with $446,300 taxable income Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What are the tax liability, the marginal tax rate, and the average tax rate for a head of household with $446,300 taxable income? Note: Do not round your intermediate computations. Round final "Tax liability" to the nearest whole dollar and "Average tax rate" to 2 decimal places. APPENDIX C 2022 Income Tax Rates INDIVIDUAL TAX RATES Married Filing Jointly and Surviving Spouse Married Filing Separately Head of Household Single ESTATE AND TRUST TAX RATES