Answered step by step

Verified Expert Solution

Question

1 Approved Answer

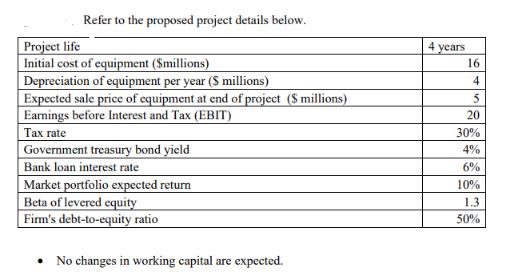

Refer to the proposed project details below. Project life Initial cost of equipment (Smillions) Depreciation of equipment per year ($ millions) Expected sale price

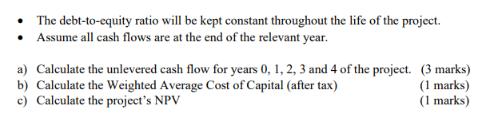

Refer to the proposed project details below. Project life Initial cost of equipment (Smillions) Depreciation of equipment per year ($ millions) Expected sale price of equipment at end of project ($ millions) Earnings before Interest and Tax (EBIT) Tax rate Government treasury bond yield Bank loan interest rate Market portfolio expected return Beta of levered equity Firm's debt-to-equity ratio No changes in working capital are expected. 4 years 16 4 5 20 30% 4% 6% 10% 1.3 50% The debt-to-equity ratio will be kept constant throughout the life of the project. Assume all cash flows are at the end of the relevant year. a) Calculate the unlevered cash flow for years 0, 1, 2, 3 and 4 of the project. (3 marks) b) Calculate the Weighted Average Cost of Capital (after tax) (1 marks) (1 marks) c) Calculate the project's NPV

Step by Step Solution

★★★★★

3.55 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the unlevered cash flows we need to find the earnings before interest and taxes EBIT and subtract the tax expense Year 0 Initial cost of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started