Question

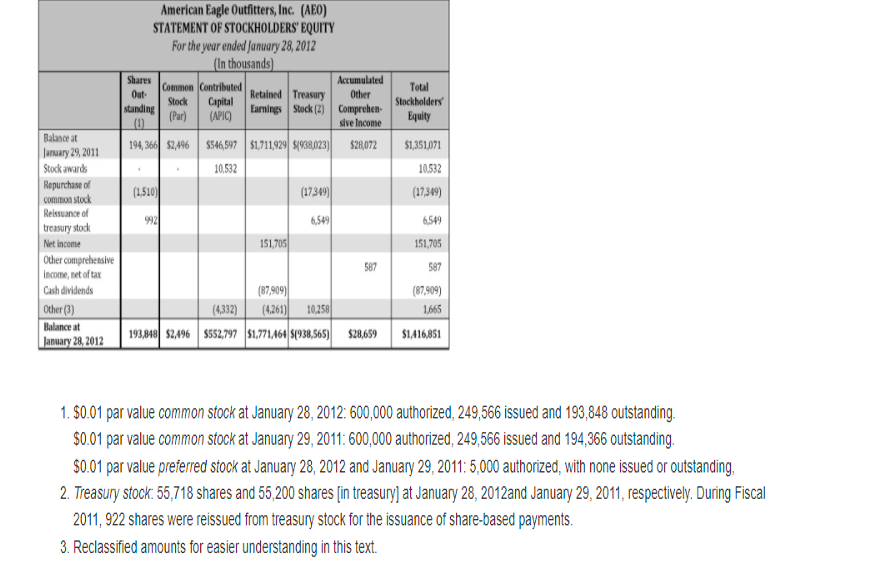

Refer to the Statement of Stockholders Equity for American Eagle Outfitters (AEO), Inc. and accompanying notes presented on page 107 to answer the following questions

Refer to the Statement of Stockholders Equity for American Eagle Outfitters (AEO), Inc. and accompanying notes presented on page 107 to answer the following questions.

Q1 For fiscal year ended on January 28, 2012 for AEO:

Beginning Retained Earnings, (January 29/ January 28), 2011 ____________ thousand

+ Net income ____________ thousand

- Dividends ____________ thousand

- Other (4,261) thousand

= Ending Retained Earnings, January 28, 2012 ____________ thousand

Q2 On January 28, 2012 stockholders equity totaled ______________ thousand, which is the amount of business assets owned by shareholders.

Q3 Assume that AEO issued 1 million shares of preferred stock with a dividend rate of $5 per share.

a. Preferred shareholders would expect to receive ______ million in dividends each year.

b. (Preferred / Common) shareholders always receive their dividends first; this is part of the preferred treatment. Therefore, if the Board of Directors declared an $80 million dividend, preferred shareholders would receive ____ million in dividends and common shareholders would receive _____ million in dividends.

c. (Preferred / Common) stock usually has a stated dividend rate.

Q4 a. A company has 170 million common shares outstanding. Assume there is a two-for-one stock split, after the stock split there would be (113 / 170 / 255 / 340 / 510) million common shares outstanding.

Assume there is a three-for-two stock split, after the stock split there would be (113 / 170 / 255 / 340 / 510) million common shares outstanding.

b. Because shareholders maintain the same proportionate share of a companys wealth before and after a stock split, the stock split (increases / decreases / has no effect) on shareholder wealth.

c. Under International Financial Reporting Standards (IFRS), preferred stock would be classified as (a liability / stockholders equity) and the preferred dividend reported as (interest / dividends) on the income statement.

Q5 For each of the following events, identify the effect on stockholders equity.

a. Net income (increases / decreases / has no effect on) stockholders equity.

b. Cash dividends (increase / decrease / have no effect on) stockholders equity.

c. Repurchase of treasury stock (increases / decreases / has no effect on) stockholders equity.

d. Reissue of treasury stock (increases / decreases / has no effect on) stockholders equity.

Q6 (Common / Preferred / Treasury) stock is publicly traded, meaning the shares are bought and sold on public stock exchanges such as the New York Stock Exchange and NASDAQ.

American Eagle Outfitters, Inc. (AEO) STATEMENT OF STOCKHOLDERS' EQUITY For the year ended January 28, 2012 (In thousands) Shares Common Contributed Accumulated Out Other Retained Treasury Stock Capital standing (Par) (APIC Earnings Stock (2) Comprehen 0 sive Income 194, 366 $2,496 $546,597 $1,711929 1938,023) $28,072 10,532 (1,510) (17309) Total Stockholders Equity $1,351,071 10532 (17,309) Balance at January 29, 2011 Stock awards Repurchase of common stock Reissuance of treasury stock Net income Other comprehensive income, net of tax Cash dividends 992 6,549 6.549 151705 151,705 587 587 Other (3) (87,909 (87,909) (4,332) (4,261) 10258 1665 193,848 $2,496 $552,797 $1,771464 1938,565) $28,659 $1,416,851 Balance at January 28, 2012 1. $0.01 par value common stock at January 28, 2012: 600,000 authorized, 249,566 issued and 193,848 outstanding. $0.01 par value common stock at January 29, 2011: 600,000 authorized, 249,566 issued and 194,366 outstanding. $0.01 par value preferred stock at January 28, 2012 and January 29, 2011: 5,000 authorized, with none issued or outstanding, 2. Treasury stock: 55,718 shares and 55,200 shares [in treasury] at January 28, 2012and January 29, 2011, respectively. During Fiscal 2011, 922 shares were reissued from treasury stock for the issuance of share-based payments. 3. Reclassified amounts for easier understanding in this text. American Eagle Outfitters, Inc. (AEO) STATEMENT OF STOCKHOLDERS' EQUITY For the year ended January 28, 2012 (In thousands) Shares Common Contributed Accumulated Out Other Retained Treasury Stock Capital standing (Par) (APIC Earnings Stock (2) Comprehen 0 sive Income 194, 366 $2,496 $546,597 $1,711929 1938,023) $28,072 10,532 (1,510) (17309) Total Stockholders Equity $1,351,071 10532 (17,309) Balance at January 29, 2011 Stock awards Repurchase of common stock Reissuance of treasury stock Net income Other comprehensive income, net of tax Cash dividends 992 6,549 6.549 151705 151,705 587 587 Other (3) (87,909 (87,909) (4,332) (4,261) 10258 1665 193,848 $2,496 $552,797 $1,771464 1938,565) $28,659 $1,416,851 Balance at January 28, 2012 1. $0.01 par value common stock at January 28, 2012: 600,000 authorized, 249,566 issued and 193,848 outstanding. $0.01 par value common stock at January 29, 2011: 600,000 authorized, 249,566 issued and 194,366 outstanding. $0.01 par value preferred stock at January 28, 2012 and January 29, 2011: 5,000 authorized, with none issued or outstanding, 2. Treasury stock: 55,718 shares and 55,200 shares [in treasury] at January 28, 2012and January 29, 2011, respectively. During Fiscal 2011, 922 shares were reissued from treasury stock for the issuance of share-based payments. 3. Reclassified amounts for easier understanding in this textStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started