Question

Refer to this case study for more information: THE DATA IS ON THIS LINK: http://sfmagazine.com/post-entry/august-2017-2018-student-case-competition-babyfreedom-stakeholders-and-strategy/ Question : Using the assumptions given to BabyFreedoms management team

Refer to this case study for more information: THE DATA IS ON THIS LINK: http://sfmagazine.com/post-entry/august-2017-2018-student-case-competition-babyfreedom-stakeholders-and-strategy/

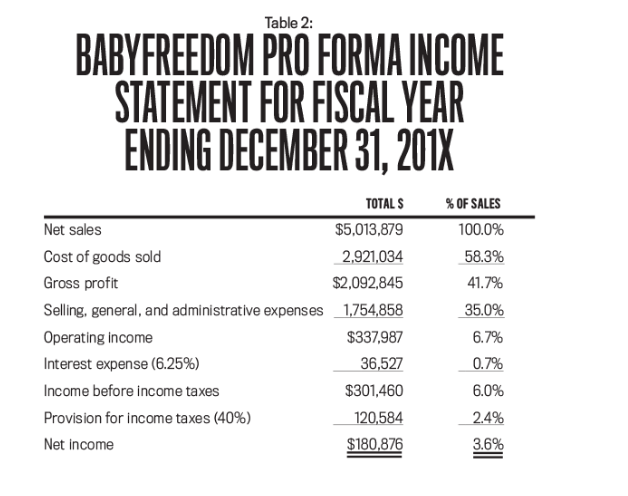

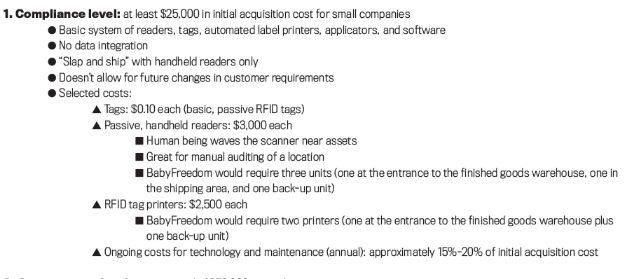

Question: Using the assumptions given to BabyFreedoms management team and an initial acquisition cost of $25,000, construct a pro forma income statement incorporating the effects of accepting the Walmart contract. Use the mandated Walmart gross margin of 29.8%, and assume that BabyFreedom must maintain the same gross margin percentage for all revenues (in other words, it cant charge a different, higher price to its medically necessary or natural clothing customers). Assumptions given: The management team is tasked with reviewing the current pro forma financials, the projected costs of RFID implementation, and the qualitative and ethical aspects of the Walmart opportunity over the next week. In addition to doubling sales volume, assumptions to be used in the analysis include a 15% across-the-board reduction in selling price; a reduction in selling, general, and administrative expenses to 25% of revenue; 80% financing of the compliance option of RFID implementation (the remaining 20% will come from cash on hand); and 20% of acquisition cost for ongoing support and maintenance of the RFID equipment and software.

MORE DATA ON THE LINK

Table 2: BABYFREEDOM PRO FORMA INCOME STATEMENT FOR FISCAL YEAR ENDING DECEMBER 31, 201X TOTAL S $5,013,879 2,921,034 $2,092,845 Net sales Cost of goods sold Gross profit Selling, general, and administrative expenses1754,858 Operating income Interest expense (6.25%) Income before income taxes Provision for income taxes (40%) Net income % OF SALES 100.0% 58.3% 41.7% 35.0% 6.7% 07% 6.0% , 24% $337987 36,527 $301,460 Table 2: BABYFREEDOM PRO FORMA INCOME STATEMENT FOR FISCAL YEAR ENDING DECEMBER 31, 201X TOTAL S $5,013,879 2,921,034 $2,092,845 Net sales Cost of goods sold Gross profit Selling, general, and administrative expenses1754,858 Operating income Interest expense (6.25%) Income before income taxes Provision for income taxes (40%) Net income % OF SALES 100.0% 58.3% 41.7% 35.0% 6.7% 07% 6.0% , 24% $337987 36,527 $301,460Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started