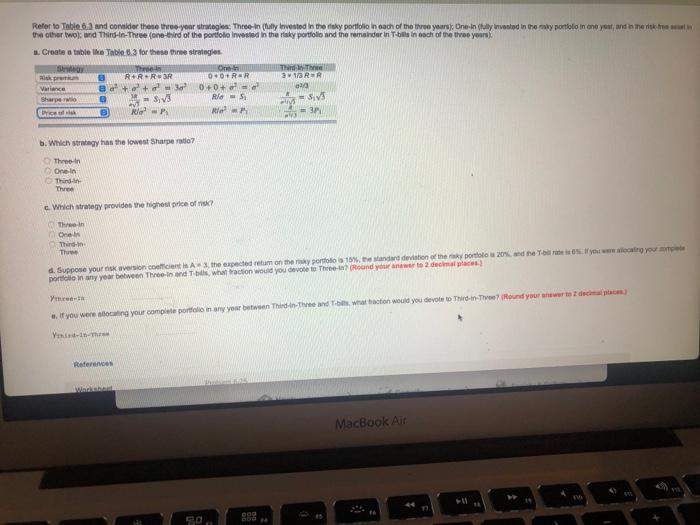

Refer to Tobie 63 and consider these three year strategies. Three-In (huynvested in the sky portfolio in each of the three years One In (fully invested in the sportolo in one year and is the other two and Third-In-Three (one-third of the portfolio invested in the risky portfolio and the remainder in Tbilis in each of the three years 1. Create a table the Table 6.3 for these three strategies SO Thea Tha The RRRR 0 ORSR RR B. +3 0+0+ Sharpe Ro- B News News WS SV b. Which strategy has the lowest Sharpe rato? Three in Onein Thing Three c. Which strategy provides the highest price of ? Then O Third- Tu d. Suppose your skversion cooo, the expected return on the mayor 19 and the port 20%, we Ya Swing you portfolio in any year between Threel and Tbil, Whatraction would you devote to Three-Round your answer 2 decimal places! Yr if you were locating your complete portfolio in any your between Third in three and attraction would you devolle to Thes-in-The Round your new tode Reference MacBook Ait SO Bode Refer to Tobie 63 and consider these three year strategies. Three-In (huynvested in the sky portfolio in each of the three years One In (fully invested in the sportolo in one year and is the other two and Third-In-Three (one-third of the portfolio invested in the risky portfolio and the remainder in Tbilis in each of the three years 1. Create a table the Table 6.3 for these three strategies SO Thea Tha The RRRR 0 ORSR RR B. +3 0+0+ Sharpe Ro- B News News WS SV b. Which strategy has the lowest Sharpe rato? Three in Onein Thing Three c. Which strategy provides the highest price of ? Then O Third- Tu d. Suppose your skversion cooo, the expected return on the mayor 19 and the port 20%, we Ya Swing you portfolio in any year between Threel and Tbil, Whatraction would you devote to Three-Round your answer 2 decimal places! Yr if you were locating your complete portfolio in any your between Third in three and attraction would you devolle to Thes-in-The Round your new tode Reference MacBook Ait SO Bode