Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Reference BOOK: Fundamental of Financial Management 15th edition by Eugene F. Brigham and Joel F. Houston 1. Set up an amortization schedule for a 5-year,

Reference BOOK: Fundamental of Financial Management 15th edition by Eugene F. Brigham and Joel F. Houston

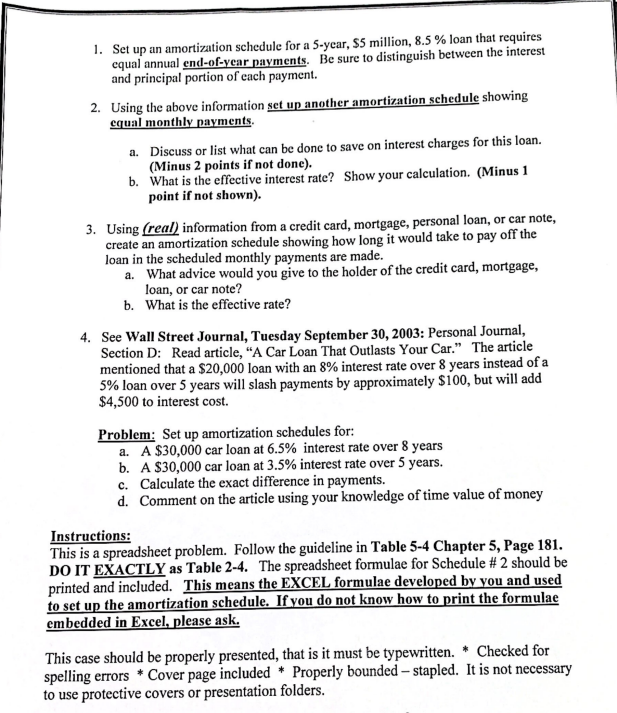

1. Set up an amortization schedule for a 5-year, $5 million, 8.5 % loan that requires equal annual end-of-year payments. Be sure to distinguish between the interest and principal portion of each payment. 2. Using the above information set up another amortization schedule showing cqual monthly payments. a. Discuss or list what can be done to save on interest charges for this loan. (Minus 2 points if not done). b. What is the effective interest rate? Show your calculation. (Minus 1 point if not shown). 3. Using (real) information from a credit card, mortgage, personal loan, or car note, create an amortization schedule showing how long it would take to pay off the loan in the scheduled monthly payments are made. a. What advice would you give to the holder of the credit card, mortgage, loan, or car note? b. What is the effective rate? 4. See Wall Street Journal, Tuesday September 30, 2003: Personal Journal, Section D: Read article, "A Car Loan That Outlasts Your Car." The article mentioned that a $20,000 loan with an 8% interest rate over 8 years instead of a 5% loan over 5 years will slash payments by approximately $100, but will add $4,500 to interest cost. Problem: Set up amortization schedules for: a. A $30,000 car loan at 6.5% interest rate over 8 years b. A $30,000 car loan at 3.5% interest rate over 5 years. c. Calculate the exact difference in payments. d. Comment on the article using your knowledge of time value of money Instructions: This is a spreadsheet problem. Follow the guideline in Table 5-4 Chapter 5, Page 181. DO IT EXACTLY as Table 2-4. The spreadsheet formulae for Schedule # 2 should be printed and included. This means the EXCEL formulae developed by you and used to set up the amortization schedule. If you do not know how to print the formulae embedded in Excel, please ask. This case should be properly presented, that is it must be typewritten. Checked for spelling errors * Cover page included * Properly bounded stapled. It is not necessary to use protective covers or presentation folders. 1. Set up an amortization schedule for a 5-year, $5 million, 8.5 % loan that requires equal annual end-of-year payments. Be sure to distinguish between the interest and principal portion of each payment. 2. Using the above information set up another amortization schedule showing cqual monthly payments. a. Discuss or list what can be done to save on interest charges for this loan. (Minus 2 points if not done). b. What is the effective interest rate? Show your calculation. (Minus 1 point if not shown). 3. Using (real) information from a credit card, mortgage, personal loan, or car note, create an amortization schedule showing how long it would take to pay off the loan in the scheduled monthly payments are made. a. What advice would you give to the holder of the credit card, mortgage, loan, or car note? b. What is the effective rate? 4. See Wall Street Journal, Tuesday September 30, 2003: Personal Journal, Section D: Read article, "A Car Loan That Outlasts Your Car." The article mentioned that a $20,000 loan with an 8% interest rate over 8 years instead of a 5% loan over 5 years will slash payments by approximately $100, but will add $4,500 to interest cost. Problem: Set up amortization schedules for: a. A $30,000 car loan at 6.5% interest rate over 8 years b. A $30,000 car loan at 3.5% interest rate over 5 years. c. Calculate the exact difference in payments. d. Comment on the article using your knowledge of time value of money Instructions: This is a spreadsheet problem. Follow the guideline in Table 5-4 Chapter 5, Page 181. DO IT EXACTLY as Table 2-4. The spreadsheet formulae for Schedule # 2 should be printed and included. This means the EXCEL formulae developed by you and used to set up the amortization schedule. If you do not know how to print the formulae embedded in Excel, please ask. This case should be properly presented, that is it must be typewritten. Checked for spelling errors * Cover page included * Properly bounded stapled. It is not necessary to use protective covers or presentation foldersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started