Question

reference : Hopkins, P. E., & Halsey, R. F. (2023). Advanced accounting, 5e. page 118-120 a. AbbVie describes its assignment of fair value as being

reference : Hopkins, P. E., & Halsey, R. F. (2023). Advanced accounting, 5e. page 118-120

a. AbbVie describes its assignment of fair value as being “preliminary.” Briefly describe the procedure under GAAP for companies to use provisional amounts and the process by which those estimates can be adjusted.

b. Prepare the journal entry that AbbVie made for the acquisition of Allergan’s common stock.

c. Describe the process by which AbbVie determined the assignment of fair value to Goodwill in the amount of $27,044 million.

d. How much did AbbVie assign to identifiable intangible assets? Briefly describe the valuation approach used to determine the fair values of identifiable intangible assets. What significant assumptions are inherent in the estimation of intangible asset fair values?

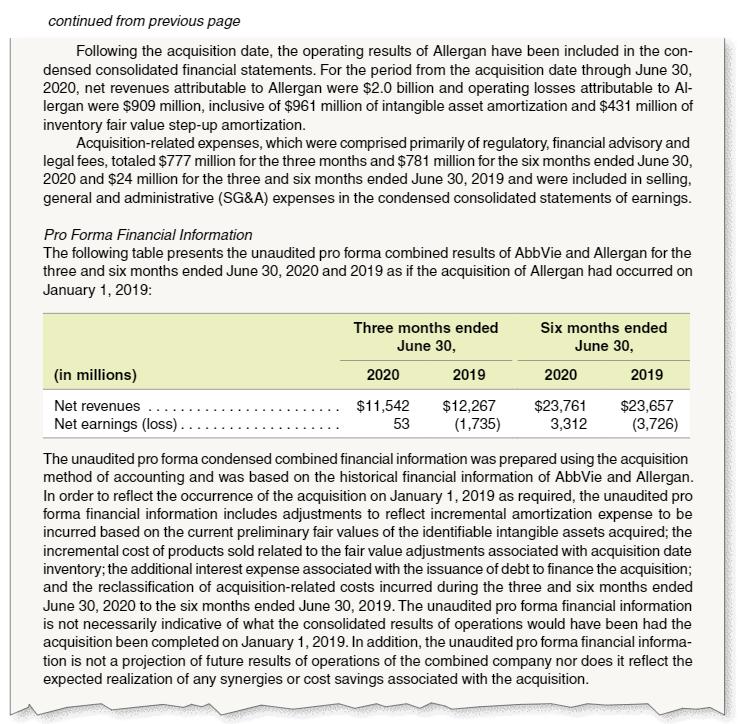

e. For the three months ended June 30, 2020 AbbVie reported consolidated revenues of $10,425 million and a net loss of $738 million. For what period of time is Allergan’s performance included in AbbVie’s revenues and expenses for the three months ending June 30, 2020? How much did Allergan contribute to AbbVie’s revenues and net losses for the three months ended June 30, 2020? What would AbbVie’s revenues and net income be without the effect of Allergan?

f. How much in acquisition-related costs did AbbVie incur during the three months that ended June 30, 2020. How were these costs recognized in the financial statements?

g. Describe the entry that AbbVie makes in the consolidation process to remove the Equity Investment account from the parent-company balance sheet in preparation of the consolidated balance sheet.

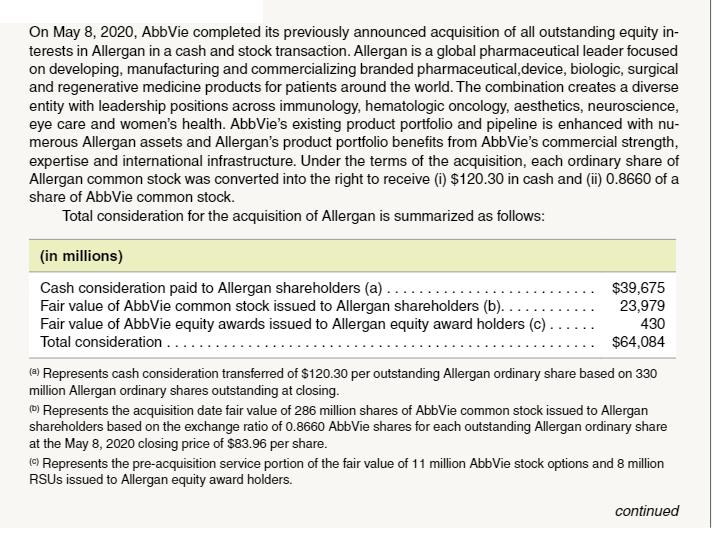

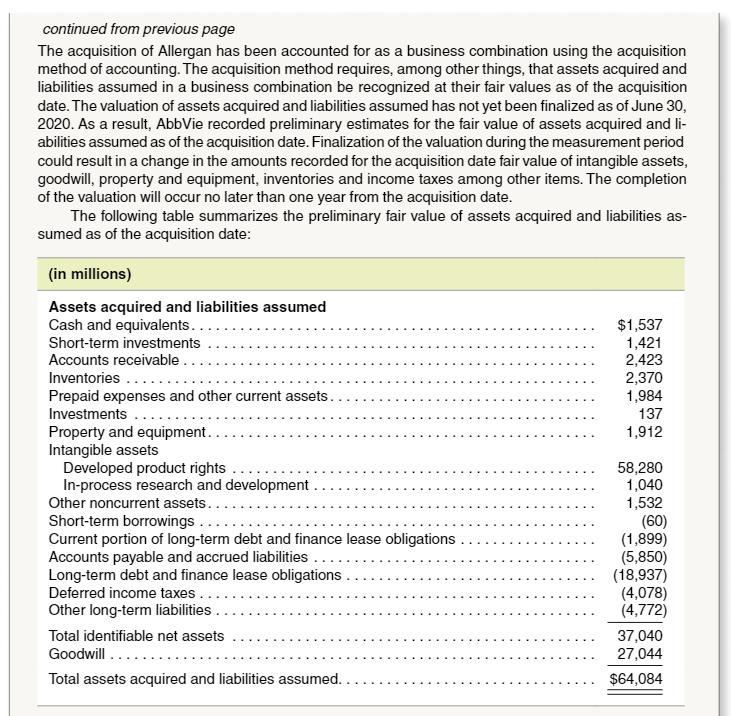

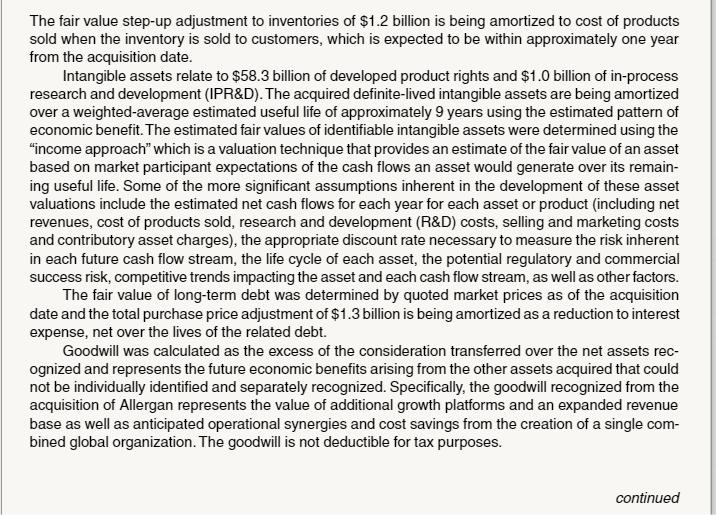

On May 8, 2020, AbbVie completed its previously announced acquisition of all outstanding equity in- terests in Allergan in a cash and stock transaction. Allergan is a global pharmaceutical leader focused on developing, manufacturing and commercializing branded pharmaceutical, device, biologic, surgical and regenerative medicine products for patients around the world. The combination creates a diverse entity with leadership positions across immunology, hematologic oncology, aesthetics, neuroscience, eye care and women's health. AbbVie's existing product portfolio and pipeline is enhanced with nu- merous Allergan assets and Allergan's product portfolio benefits from AbbVie's commercial strength, expertise and international infrastructure. Under the terms of the acquisition, each ordinary share of Allergan common stock was converted into the right to receive (i) $120.30 in cash and (ii) 0.8660 of a share of AbbVie common stock. Total consideration for the acquisition of Allergan is summarized as follows: (in millions) Cash consideration paid to Allergan shareholders (a). Fair value of AbbVie common stock issued to Allergan shareholders (b). Fair value of AbbVie equity awards issued to Allergan equity award holders (c). Total consideration.. $39,675 23,979 430 $64,084 (a) Represents cash consideration transferred of $120.30 per outstanding Allergan ordinary share based on 330 million Allergan ordinary shares outstanding at closing. (D) Represents the acquisition date fair value of 286 million shares of AbbVie common stock issued to Allergan shareholders based on the exchange ratio of 0.8660 AbbVie shares for each outstanding Allergan ordinary share at the May 8, 2020 closing price of $83.96 per share. (c) Represents the pre-acquisition service portion of the fair value of 11 million AbbVie stock options and 8 million RSUS issued to Allergan equity award holders. continued

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER a GAAP requires companies to use provisional amounts when recording assets and liabilities in a business combination These provisional amounts are based on estimates of the fair value of the as...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started