Answered step by step

Verified Expert Solution

Question

1 Approved Answer

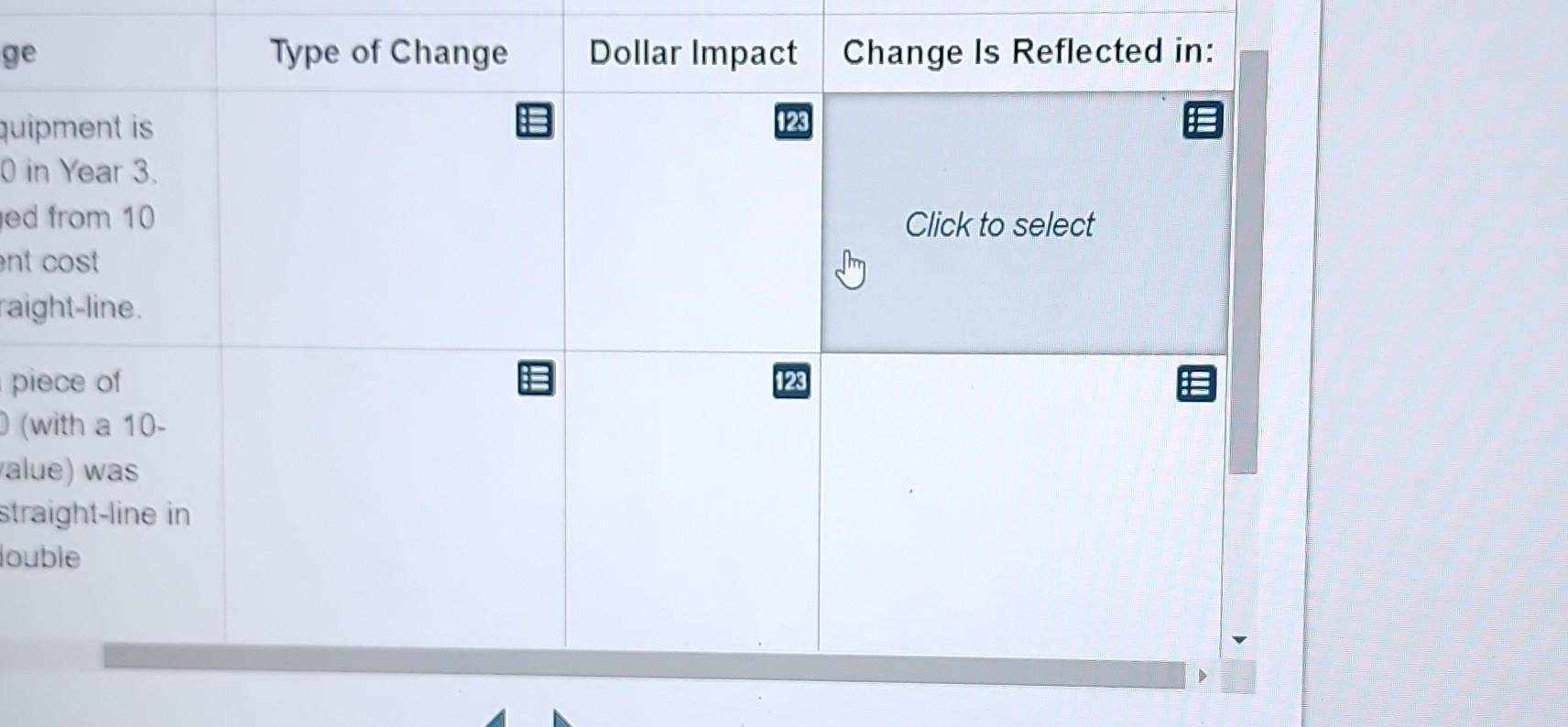

reflected in beginning retained earnings or current earnings Scroll down to complete all parts of this task. A company is assessing the impact that three

reflected in beginning retained earnings or current earnings

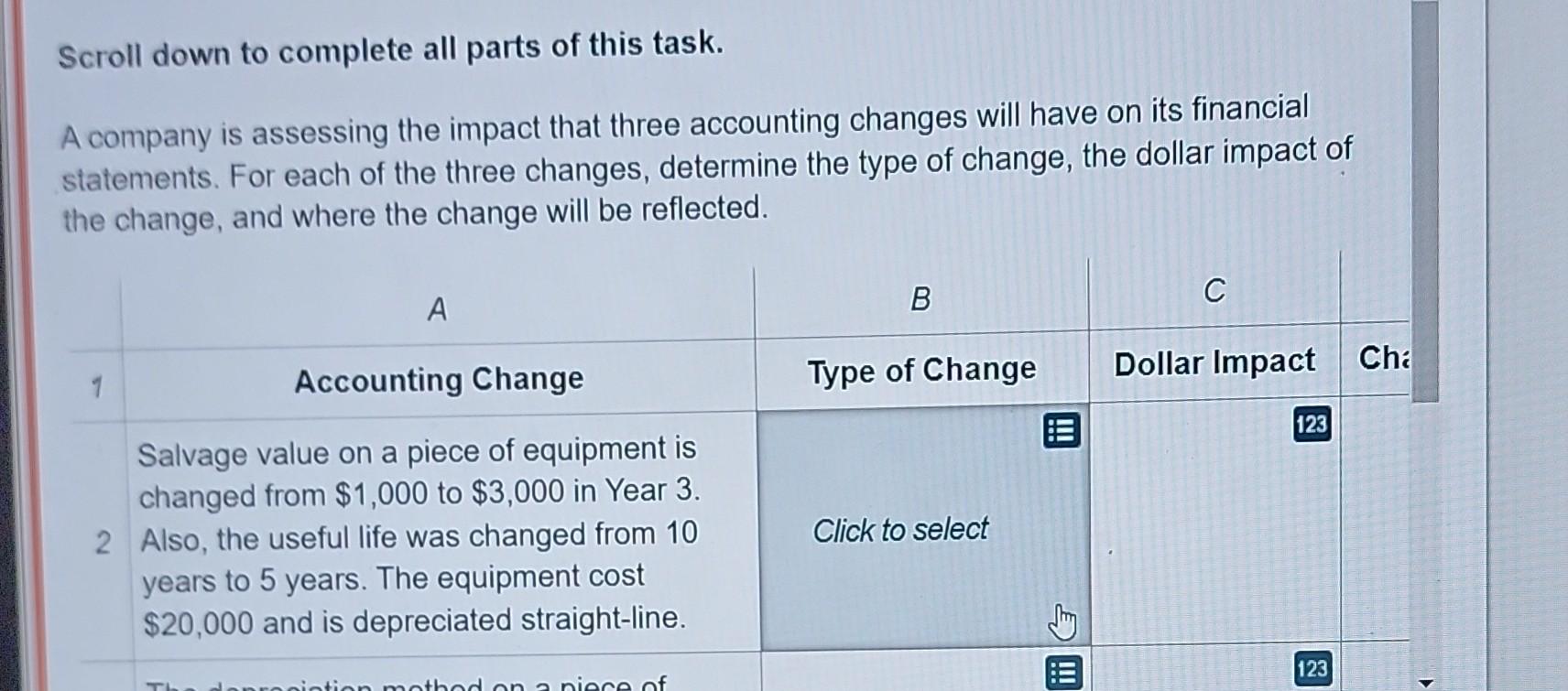

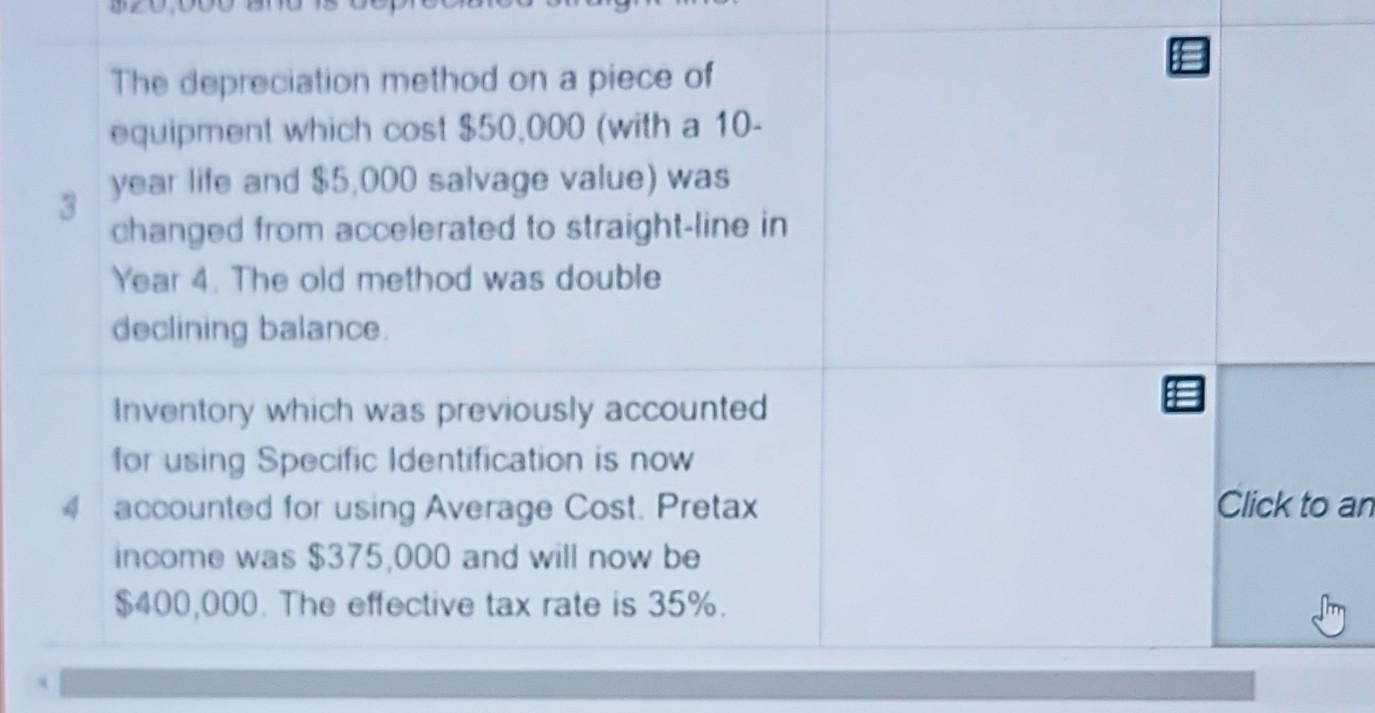

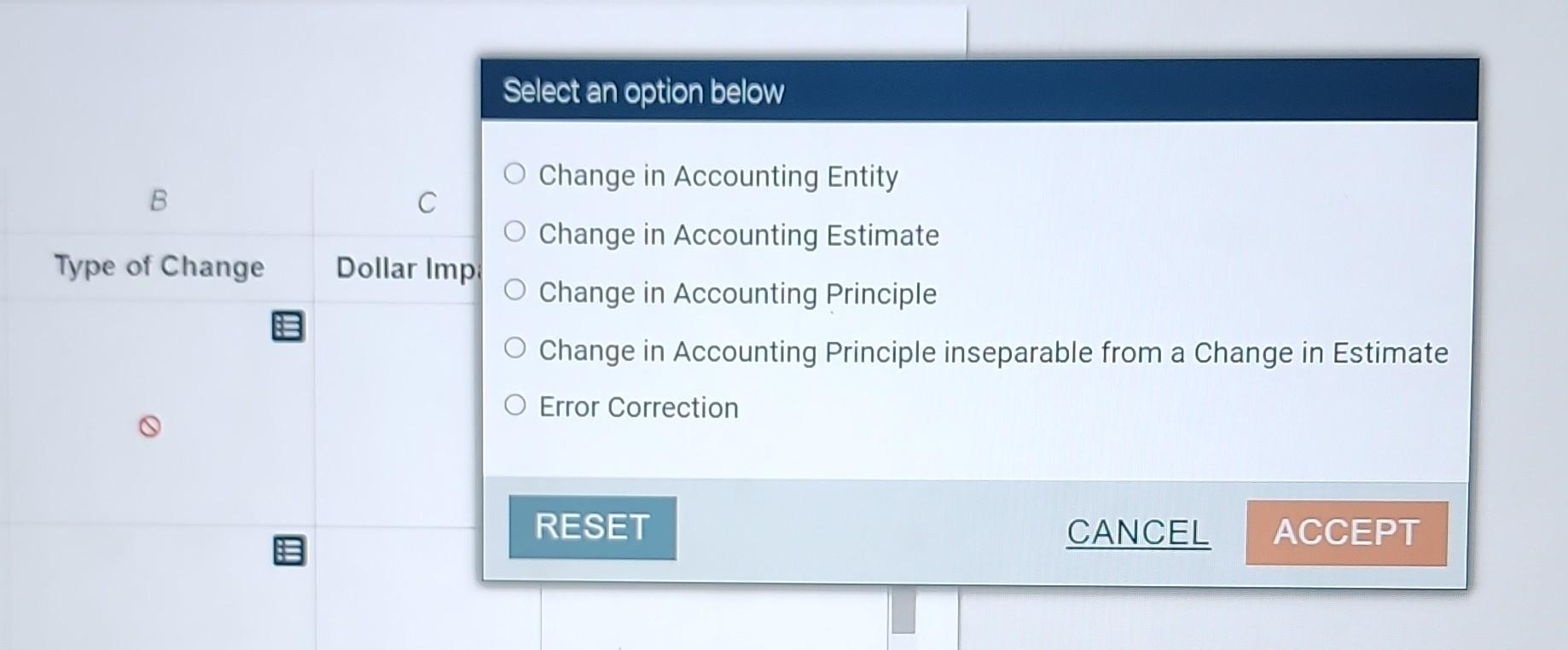

Scroll down to complete all parts of this task. A company is assessing the impact that three accounting changes will have on its financial statements. For each of the three changes, determine the type of change, the dollar impact of the change, and where the change will be reflected. The depreciation method on a piece of equipment which cost $50,000 (with a 10 year life and $5,000 salvage value) was changed from accelerated to straight-line in Year 4. The old method was double declining balance. Inventory which was previously accounted for using Specific Identification is now 4 acoounted for using Average Cost. Pretax income was $375,000 and will now be $400,000. The effective tax rate is 35%. Select an option below Change in Accounting Entity Change in Accounting Estimate Change in Accounting Principle Change in Accounting Principle inseparable from a Change in Estimate Error Correction Scroll down to complete all parts of this task. A company is assessing the impact that three accounting changes will have on its financial statements. For each of the three changes, determine the type of change, the dollar impact of the change, and where the change will be reflected. The depreciation method on a piece of equipment which cost $50,000 (with a 10 year life and $5,000 salvage value) was changed from accelerated to straight-line in Year 4. The old method was double declining balance. Inventory which was previously accounted for using Specific Identification is now 4 acoounted for using Average Cost. Pretax income was $375,000 and will now be $400,000. The effective tax rate is 35%. Select an option below Change in Accounting Entity Change in Accounting Estimate Change in Accounting Principle Change in Accounting Principle inseparable from a Change in Estimate Error Correction

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started