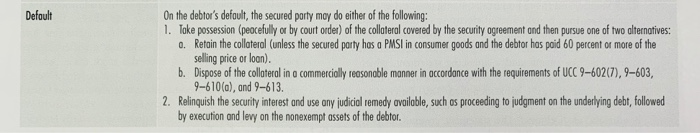

REFLECTION QUESTIONS FOR CHAPTER # 19 SECURED TRANSACTIONS Read chapter 19 in the textbook and answer the following reflection questions. The answers are to be submitted for grading. A. At the end of the chapter in Business Scenarios and Case Problems, read, reflect on, answer, and submit a response to Question 19-5 (Disposition of Collateral) on page 376. B. At the end of the chapter in Business Scenarios and Case Problems, read, reflect on, answer, and submit a response to Question 19-6 (Perfecting a Security Interest) on page 376. 19-5 Disposition of Collateral. PRA Aviation, LLC, borrowed $3 million from Center Capital Corp. to buy a Gates Learjet 55B. Center perfected a security interest in the plane. Later, PRA defaulted on the loan, and Center obtained possession of the jet. The market, design, and mechanical condition of 19-6 similar aircraft were reviewed to estimate the jet's value at $1.45 million. The jet was marketed in trade publications, on the Internet, and by direct advertising to select customers for $1.595 million. There were three offers. Center sold the jet to the high bidder for $1.3 million. Was the sale commercially reasonable? Explain. [Center Capital Corp. v. PRA Aviation, LLC, 2011 WL 867516 (E.D.Pa. 2011)] (See Default.) Perfecting a Security Interest. Thomas Tille owned M.A.T.T. Equipment Co. To operate the business, Tille borrowed funds from Union Bank. For each loan, Union filed a financing state- ment that included Tille's signature and address, the bank's address, and a description of the collateral. The first loan covered all of Tilles equipment, including "any after-acquired property. The second loan covered a truck crane "whether owned now or acquired later." The third loan covered a "Bobcat mini-excavator." Did these financing statements perfect Union's security interests? Explain. (Union Bank Co. v. Heban, 2012 WL 32102 (Ohio App. 2012) (See Perfection of a Security Interest.) Perfection of a Security Interest The classification of collateral determines how and where a security interest is perfected (see Exhibit 19.2). 1. Perfection by filing--The most common method of perfection is by filing a financing statement containing the names of the secured porty and the debtor ond indicating the collateral covered by the financing statement. The financing statement must be filed under the nome of the debtor. Fictitious (trade) names normally are not sufficient. 2. Perfection without filing- 0. By transfer of collateral --The debtor con fransfer possession of the collateral to the secured party. A pledge is an example of this type of transfer. b. By offochment, such as the attachment of a purchase money security interest (PMSD) in consumer goods. If the secured party has a PMSI in consumer goods, the secured party's security interest is perfected automatically. In all, fourteen types of security interests con be perfected by ottochment. Default On the debtor's default, the secured party may do either of the following: 1. Take possession (peacefully or by court order of the collateral covered by the security agreement and then pursue one of two alternatives: 0. Retain the collateral (unless the secured party has a PMSI in consumer goods and the debtor has paid 60 percent of more of the selling price or loon). b. Dispose of the collateral in a commercially reasonable manner in accordance with the requirements of UCC 9-602(7), 9-603, 9-610(a), and 9-613. 2. Relinquish the security interest and use ony judicial remedy available, such as proceeding to judgment on the underlying debt, followed by execution and levy on the nonexempt assets of the debtor. REFLECTION QUESTIONS FOR CHAPTER # 19 SECURED TRANSACTIONS Read chapter 19 in the textbook and answer the following reflection questions. The answers are to be submitted for grading. A. At the end of the chapter in Business Scenarios and Case Problems, read, reflect on, answer, and submit a response to Question 19-5 (Disposition of Collateral) on page 376. B. At the end of the chapter in Business Scenarios and Case Problems, read, reflect on, answer, and submit a response to Question 19-6 (Perfecting a Security Interest) on page 376. 19-5 Disposition of Collateral. PRA Aviation, LLC, borrowed $3 million from Center Capital Corp. to buy a Gates Learjet 55B. Center perfected a security interest in the plane. Later, PRA defaulted on the loan, and Center obtained possession of the jet. The market, design, and mechanical condition of 19-6 similar aircraft were reviewed to estimate the jet's value at $1.45 million. The jet was marketed in trade publications, on the Internet, and by direct advertising to select customers for $1.595 million. There were three offers. Center sold the jet to the high bidder for $1.3 million. Was the sale commercially reasonable? Explain. [Center Capital Corp. v. PRA Aviation, LLC, 2011 WL 867516 (E.D.Pa. 2011)] (See Default.) Perfecting a Security Interest. Thomas Tille owned M.A.T.T. Equipment Co. To operate the business, Tille borrowed funds from Union Bank. For each loan, Union filed a financing state- ment that included Tille's signature and address, the bank's address, and a description of the collateral. The first loan covered all of Tilles equipment, including "any after-acquired property. The second loan covered a truck crane "whether owned now or acquired later." The third loan covered a "Bobcat mini-excavator." Did these financing statements perfect Union's security interests? Explain. (Union Bank Co. v. Heban, 2012 WL 32102 (Ohio App. 2012) (See Perfection of a Security Interest.) Perfection of a Security Interest The classification of collateral determines how and where a security interest is perfected (see Exhibit 19.2). 1. Perfection by filing--The most common method of perfection is by filing a financing statement containing the names of the secured porty and the debtor ond indicating the collateral covered by the financing statement. The financing statement must be filed under the nome of the debtor. Fictitious (trade) names normally are not sufficient. 2. Perfection without filing- 0. By transfer of collateral --The debtor con fransfer possession of the collateral to the secured party. A pledge is an example of this type of transfer. b. By offochment, such as the attachment of a purchase money security interest (PMSD) in consumer goods. If the secured party has a PMSI in consumer goods, the secured party's security interest is perfected automatically. In all, fourteen types of security interests con be perfected by ottochment. Default On the debtor's default, the secured party may do either of the following: 1. Take possession (peacefully or by court order of the collateral covered by the security agreement and then pursue one of two alternatives: 0. Retain the collateral (unless the secured party has a PMSI in consumer goods and the debtor has paid 60 percent of more of the selling price or loon). b. Dispose of the collateral in a commercially reasonable manner in accordance with the requirements of UCC 9-602(7), 9-603, 9-610(a), and 9-613. 2. Relinquish the security interest and use ony judicial remedy available, such as proceeding to judgment on the underlying debt, followed by execution and levy on the nonexempt assets of the debtor