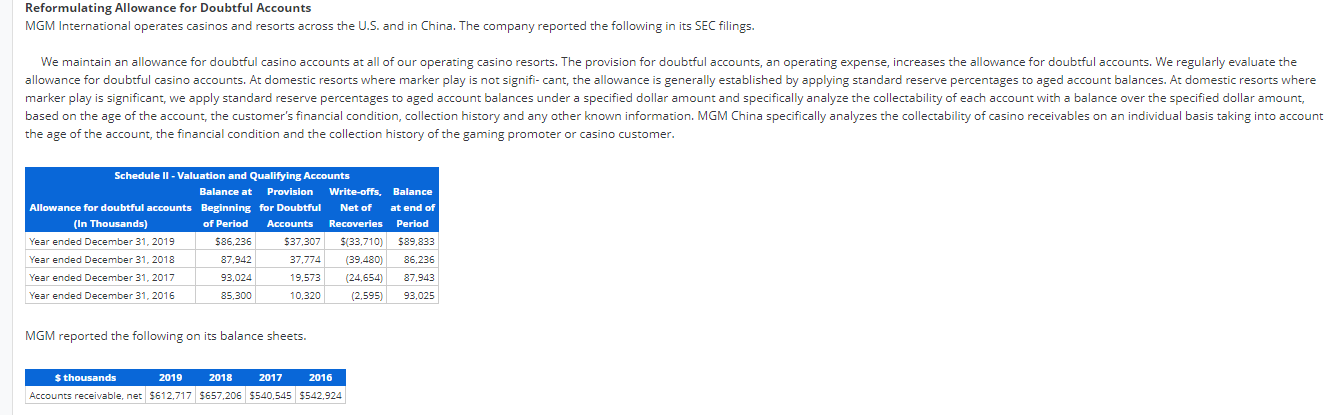

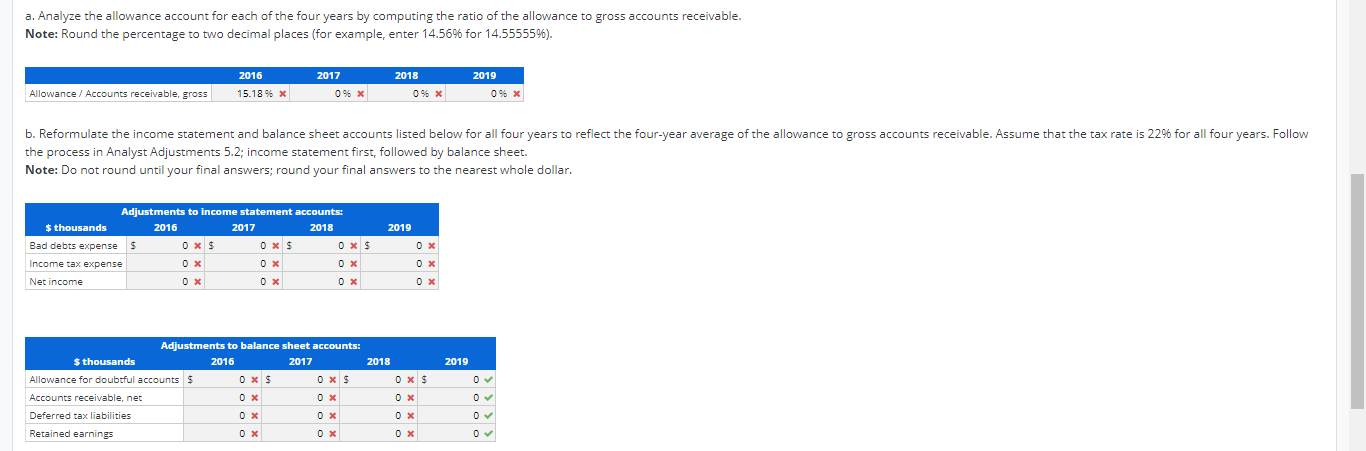

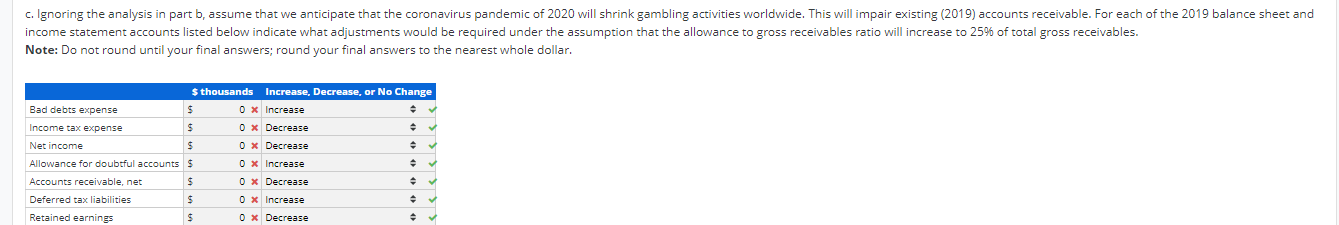

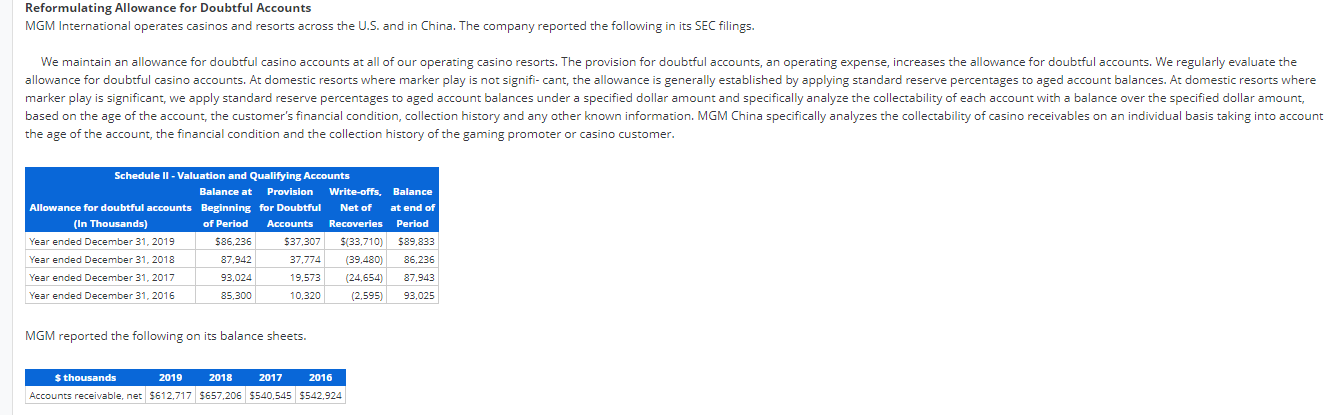

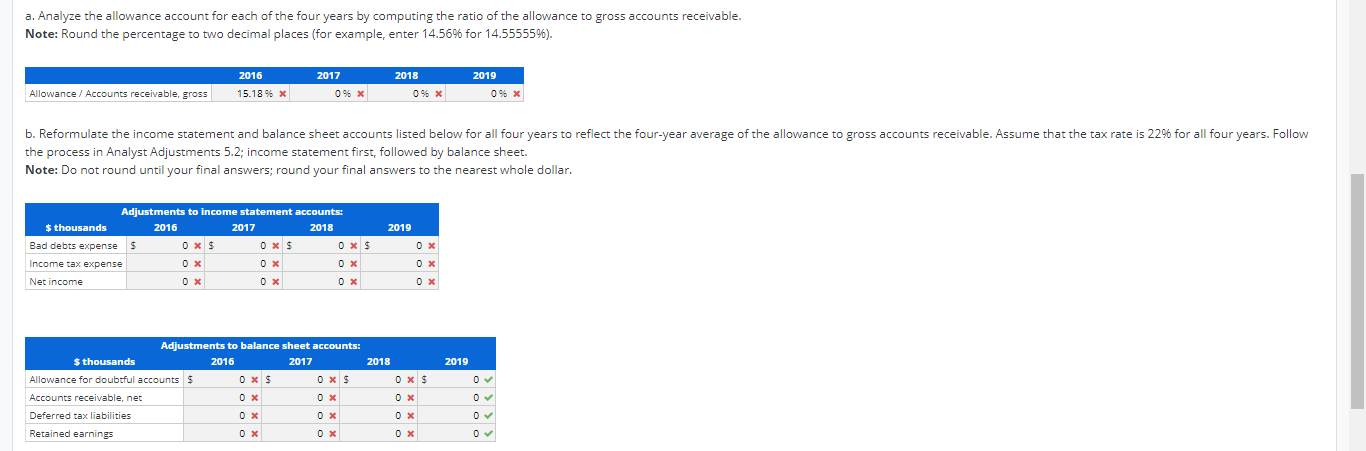

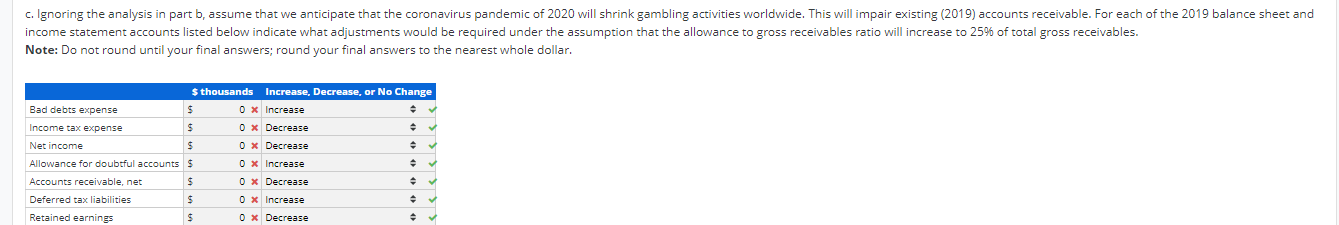

Reformulating Allowance for Doubtful Accounts MGM International operates casinos and resorts across the U.S. and in China. The company reported the following in its SEC filings. We maintain an allowance for doubtful casino accounts at all of our operating casino resorts. The provision for doubtful accounts, an operating expense, increases the allowance for doubtful accounts. We regularly evaluate the allowance for doubtful casino accounts. At domestic resorts where marker play is not signifi-cant, the allowance is generally established by applying standard reserve percentages to aged account balances. At domestic resorts where marker play is significant, we apply standard reserve percentages to aged account balances under a specified dollar amount and specifically analyze the collectability of each account with a balance over the specified dollar amount, based on the age of the account, the customer's financial condition, collection history and any other known information. MGM China specifically analyzes the collectability of casino receivables on an individual basis taking into account the age of the account, the financial condition and the collection history of the gaming promoter or casino customer. Schedule II - Valuation and Qualifying Accounts Balance at Provision Write-offs, Balance Allowance for doubtful accounts Beginning for Doubtful Net of at end of (In Thousands) of Period Accounts Recoveries Period Year ended December 31, 2019 $86,236 $37,307 $(33,710) $89,833 Year ended December 31, 2018 87,942 37,774 (39,480) 86.236 Year ended December 31, 2017 93.024 19.573 (24,654) 87.943 Year ended December 31, 2016 85,300 10,320 (2.595 93.025 MGM reported the following on its balance sheets. $thousands 2019 2018 2017 2016 Accounts receivable, net $612,717 $657,206 $540,545 $542,924 a. Analyze the allowance account for each of the four years by computing the ratio of the allowance to gross accounts receivable. Note: Round the percentage to two decimal places (for example, enter 14.56% for 14.5555596). 2016 2018 2017 0% X 2019 096 x Allowance / Accounts receivable, gross 15.1896 x 0 % X b. Reformulate the income statement and balance sheet accounts listed below for all four years to reflect the four-year average of the allowance to gross accounts receivable. Assume that the tax rate is 22% for all four years. Follow the process in Analyst Adjustments 5.2; income statement first, followed by balance sheet. Note: Do not round until your final answers, round your final answers to the nearest whole dollar. 2019 Adjustments to income statement accounts: $ thousands $ 2016 2017 2018 Bad debts expense $ Ox $ Ox $ 0 x $ Income tax expense OX Net income OX OX OX x Ox 2018 2019 0 Adjustments to balance sheet accounts: $ thousands $ 2016 2017 Allowance for doubtful accounts $ Ox $ Ox $ Accounts receivable, net OX OX Deferred tax liabilities OX Retained earnings 0 x Ox $ OX 0 0 c. Ignoring the analysis in part b, assume that we anticipate that the coronavirus pandemic of 2020 will shrink gambling activities worldwide. This will impair existing (2019) accounts receivable. For each of the 2019 balance sheet and income statement accounts listed below indicate what adjustments would be required under the assumption that the allowance to gross receivables ratio will increase to 25% of total gross receivables. Note: Do not round until your final answers; round your final answers to the nearest whole dollar. $thousands Increase, Decrease, or No Change Bad debts expense $ 0x Increase Income tax expense $ 0x Decrease Net income $ 0X Decrease Allowance for doubtful accounts $ 0x Increase Accounts receivable, net S 0X Decrease Deferred tax liabilities $ 0 x Increase Retained earnings $ 0x Decrease Reformulating Allowance for Doubtful Accounts MGM International operates casinos and resorts across the U.S. and in China. The company reported the following in its SEC filings. We maintain an allowance for doubtful casino accounts at all of our operating casino resorts. The provision for doubtful accounts, an operating expense, increases the allowance for doubtful accounts. We regularly evaluate the allowance for doubtful casino accounts. At domestic resorts where marker play is not signifi-cant, the allowance is generally established by applying standard reserve percentages to aged account balances. At domestic resorts where marker play is significant, we apply standard reserve percentages to aged account balances under a specified dollar amount and specifically analyze the collectability of each account with a balance over the specified dollar amount, based on the age of the account, the customer's financial condition, collection history and any other known information. MGM China specifically analyzes the collectability of casino receivables on an individual basis taking into account the age of the account, the financial condition and the collection history of the gaming promoter or casino customer. Schedule II - Valuation and Qualifying Accounts Balance at Provision Write-offs, Balance Allowance for doubtful accounts Beginning for Doubtful Net of at end of (In Thousands) of Period Accounts Recoveries Period Year ended December 31, 2019 $86,236 $37,307 $(33,710) $89,833 Year ended December 31, 2018 87,942 37,774 (39,480) 86.236 Year ended December 31, 2017 93.024 19.573 (24,654) 87.943 Year ended December 31, 2016 85,300 10,320 (2.595 93.025 MGM reported the following on its balance sheets. $thousands 2019 2018 2017 2016 Accounts receivable, net $612,717 $657,206 $540,545 $542,924 a. Analyze the allowance account for each of the four years by computing the ratio of the allowance to gross accounts receivable. Note: Round the percentage to two decimal places (for example, enter 14.56% for 14.5555596). 2016 2018 2017 0% X 2019 096 x Allowance / Accounts receivable, gross 15.1896 x 0 % X b. Reformulate the income statement and balance sheet accounts listed below for all four years to reflect the four-year average of the allowance to gross accounts receivable. Assume that the tax rate is 22% for all four years. Follow the process in Analyst Adjustments 5.2; income statement first, followed by balance sheet. Note: Do not round until your final answers, round your final answers to the nearest whole dollar. 2019 Adjustments to income statement accounts: $ thousands $ 2016 2017 2018 Bad debts expense $ Ox $ Ox $ 0 x $ Income tax expense OX Net income OX OX OX x Ox 2018 2019 0 Adjustments to balance sheet accounts: $ thousands $ 2016 2017 Allowance for doubtful accounts $ Ox $ Ox $ Accounts receivable, net OX OX Deferred tax liabilities OX Retained earnings 0 x Ox $ OX 0 0 c. Ignoring the analysis in part b, assume that we anticipate that the coronavirus pandemic of 2020 will shrink gambling activities worldwide. This will impair existing (2019) accounts receivable. For each of the 2019 balance sheet and income statement accounts listed below indicate what adjustments would be required under the assumption that the allowance to gross receivables ratio will increase to 25% of total gross receivables. Note: Do not round until your final answers; round your final answers to the nearest whole dollar. $thousands Increase, Decrease, or No Change Bad debts expense $ 0x Increase Income tax expense $ 0x Decrease Net income $ 0X Decrease Allowance for doubtful accounts $ 0x Increase Accounts receivable, net S 0X Decrease Deferred tax liabilities $ 0 x Increase Retained earnings $ 0x Decrease