Reformulating Balance Sheet and Income Statement for an Asset Disposal

In 2015, Winnebago Industries recorded an impairment loss of $462,000 on its corporate plane. We wish to reformulate the companys income statement and balance sheet under the assumption that the plane had been used for the prior five yearssee Analyst Adjustments 6.2 for guidance. The companys tax rate is 30%.

a. For the income statement, identify with numbers the adjustments for each of the five years 2011-2015 for:

Loss on disposal

Depreciation

Tax expense

Net income

Use a negative sign with your answer to indicate an adjustment decreases the account.

| Income Statement Adjustments | | | | 2011 | 2012 | 2013 | 2014 | 2015 |

| Loss on disposal (reversal) | | | | | | | | Answer |

| Tax Expense (reversal) | | | | | | | | Answer |

| Net Income (reversal) | | | | | | | | Answer |

| | | | | | | | | |

| Depreciation | | | | Answer | Answer | Answer | Answer | Answer |

| Tax Expense | | | | Answer | Answer | Answer | Answer | Answer |

| Net income (adjustment) | | | | Answer | Answer | Answer | Answer | Answer |

| | | | | | | | | |

| Total net income (reversal + adjustment) | | | | Answer | Answer | Answer | Answer | Answer |

b. For the balance sheet, identify with numbers the adjustments for each of the five years 2011-2015 for:

Accumulated depreciation

Deferred tax

Retained earnings

Use a negative sign with your answer to indicate an adjustment decreases the account.

| Balance Sheet Adjustments | | | | 2011 | 2012 | 2013 | 2014 | 2015 |

| Accumulated depreciation | | | | Answer | Answer | Answer | Answer | Answer |

| Deferred tax liability | | | | Answer | Answer | Answer | Answer | Answer |

| Retained Earnings | | | | Answer | Answer | Answer | Answer | Answer |

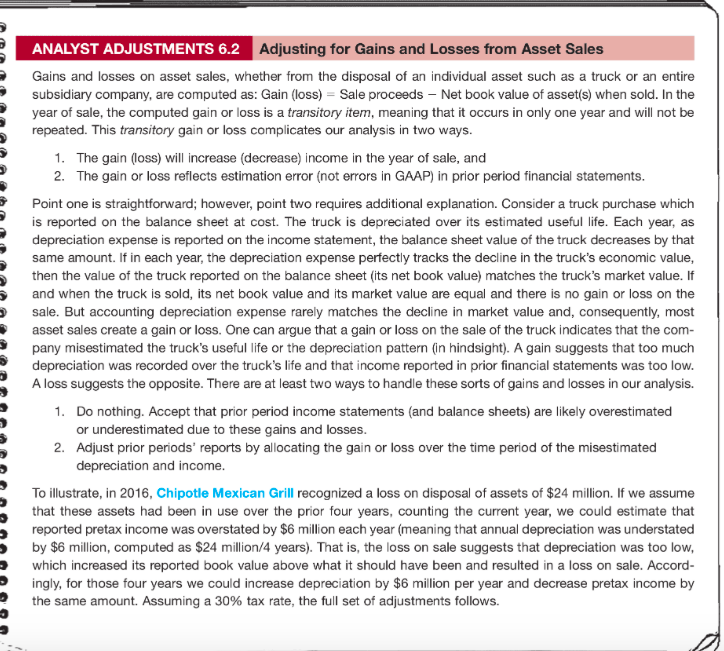

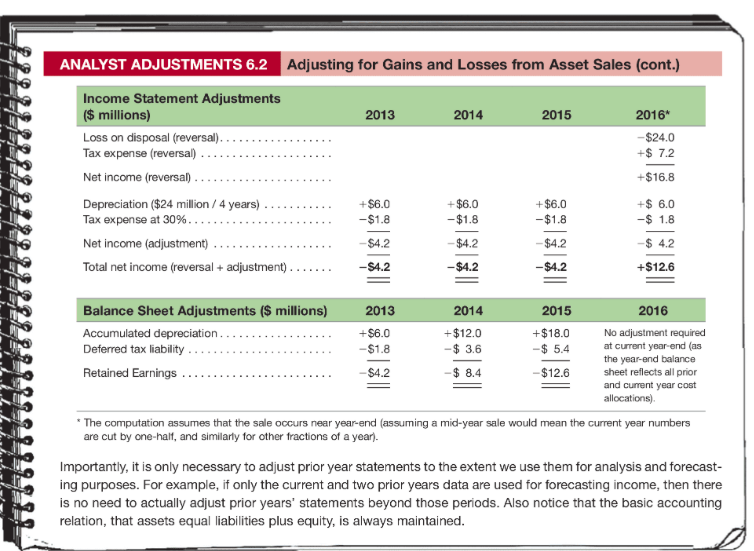

ANALYST ADJUSTMENTS 6.2 Adjusting for Gains and Losses from Asset Sales Gains and losses on asset sales, whether from the disposal of an individual asset such as a truck or an entire subsidiary company, are computed as: Gain (loss) Sale proceeds Net book value of asset(s) when sold. In the year of sale, the computed gain or loss is a transitory item, meaning that it occurs in only one year and will not be repeated. This transitory gain or loss complicates our analysis in two ways. 1. The gain (loss) will increase (decrease) income in the year of sale, and 2. The gain or loss reflects estimation error (not errors in GAAP) in prior period financial statements. Point one is straightforward; however, point two requires additional explanation. Consider a truck purchase which is reported on the balance sheet at cost. The truck is depreciated over its estimated useful life. Each year, as depreciation expense is reported on the income statement, the balance sheet value of the truck decreases by that same amount. If in each year, the depreciation expense perfectly tracks the decline in the truck's economic value then the value of the truck reported on the balance sheet (its net book value) matches the truck's market value. If and when the truck is sold, its net book value and its market value are equal and there is no gain or loss on the sale. But accounting depreciation expense rarely matches the decline in market value and, consequently, most asset sales create a gain or loss. One can argue that a gain or loss on the sale of the truck indicates that the com- pany misestimated the truck's useful life or the depreciation pattern (in hindsight). A gain suggests that too much depreciation was recorded over the truck's life and that income reported in prior financial statements was too low. A loss suggests the opposite. There are at least two ways to handle these sorts of gains and losses in our analysis. 1. Do nothing. Accept that prior period income statements (and balance sheets) are likely overestimated or underestimated due to these gains and losses 2. Adjust prior periods' reports by allocating the gain or loss over the time period of the misestimated depreciation and income To illustrate, in 2016, Chipotle Mexican Grill recognized a loss on disposal of assets of $24 million. If we assume that these assets had been in use over the prior four years, counting the current year, we could estimate that reported pretax income was overstated by $6 million each year (meaning that annual depreciation was understated by $6 million, computed as $24 million/4 years). That is, the loss on sale suggests that depreciation was too low which increased its reported book value above what it should have been and resulted in a loss on sale. Accord ingly, for those four years we could increase depreciation by $6 million per year and decrease pretax income by the same amount. Assuming a 30% tax rate, the full set of adjustments follows. 2 ANALYST ADJUSTMENTS 6.2Adjusting for Gains and Losses from Asset Sales (cont.) Income Statement Adjustments $ millions) 2013 2014 2015 2016* -$24.0 +$7.2 +$16.8 $6.0 -4.2 +$12.6 Tax expense (reversal). . +$6.0 +$6.0 Tax expense at 30% $4.2 $4.2 $4.2 Total net income (reversal +adjustment). $4.2 $4.2 -$4.2 Balance Sheet Adjustments ($ millions) Accumulated depreciation.... Deferred tax liability 2013 2014 +$12.0 $ 3.6 -8.4 2015 2016 +$18.0 -$5.4 +$6.0 No adjustment required at current year-end (as the year-end balance sheet reflects all prior and cument year cost allocations) -$4.2 -$12.6 The computation assumes that the sale occurs near year-end (assuming a mid-year sale would mean the current year numbers are cut by one-halt, and similarly for other fractions of a year). Importantly, it is only necessary to adjust prior year statements to the extent we use them for analysis and forecast- ing purposes. For example, if only the current and two prior years data are used for forecasting income, then there is no need to actually adjust prior years' statements beyond those periods. Also notice that the basic accounting relation, that assets equal liabilities plus equity, is always maintained the urenanpyseperods. Also notice that the bas ANALYST ADJUSTMENTS 6.2 Adjusting for Gains and Losses from Asset Sales Gains and losses on asset sales, whether from the disposal of an individual asset such as a truck or an entire subsidiary company, are computed as: Gain (loss) Sale proceeds Net book value of asset(s) when sold. In the year of sale, the computed gain or loss is a transitory item, meaning that it occurs in only one year and will not be repeated. This transitory gain or loss complicates our analysis in two ways. 1. The gain (loss) will increase (decrease) income in the year of sale, and 2. The gain or loss reflects estimation error (not errors in GAAP) in prior period financial statements. Point one is straightforward; however, point two requires additional explanation. Consider a truck purchase which is reported on the balance sheet at cost. The truck is depreciated over its estimated useful life. Each year, as depreciation expense is reported on the income statement, the balance sheet value of the truck decreases by that same amount. If in each year, the depreciation expense perfectly tracks the decline in the truck's economic value then the value of the truck reported on the balance sheet (its net book value) matches the truck's market value. If and when the truck is sold, its net book value and its market value are equal and there is no gain or loss on the sale. But accounting depreciation expense rarely matches the decline in market value and, consequently, most asset sales create a gain or loss. One can argue that a gain or loss on the sale of the truck indicates that the com- pany misestimated the truck's useful life or the depreciation pattern (in hindsight). A gain suggests that too much depreciation was recorded over the truck's life and that income reported in prior financial statements was too low. A loss suggests the opposite. There are at least two ways to handle these sorts of gains and losses in our analysis. 1. Do nothing. Accept that prior period income statements (and balance sheets) are likely overestimated or underestimated due to these gains and losses 2. Adjust prior periods' reports by allocating the gain or loss over the time period of the misestimated depreciation and income To illustrate, in 2016, Chipotle Mexican Grill recognized a loss on disposal of assets of $24 million. If we assume that these assets had been in use over the prior four years, counting the current year, we could estimate that reported pretax income was overstated by $6 million each year (meaning that annual depreciation was understated by $6 million, computed as $24 million/4 years). That is, the loss on sale suggests that depreciation was too low which increased its reported book value above what it should have been and resulted in a loss on sale. Accord ingly, for those four years we could increase depreciation by $6 million per year and decrease pretax income by the same amount. Assuming a 30% tax rate, the full set of adjustments follows. 2 ANALYST ADJUSTMENTS 6.2Adjusting for Gains and Losses from Asset Sales (cont.) Income Statement Adjustments $ millions) 2013 2014 2015 2016* -$24.0 +$7.2 +$16.8 $6.0 -4.2 +$12.6 Tax expense (reversal). . +$6.0 +$6.0 Tax expense at 30% $4.2 $4.2 $4.2 Total net income (reversal +adjustment). $4.2 $4.2 -$4.2 Balance Sheet Adjustments ($ millions) Accumulated depreciation.... Deferred tax liability 2013 2014 +$12.0 $ 3.6 -8.4 2015 2016 +$18.0 -$5.4 +$6.0 No adjustment required at current year-end (as the year-end balance sheet reflects all prior and cument year cost allocations) -$4.2 -$12.6 The computation assumes that the sale occurs near year-end (assuming a mid-year sale would mean the current year numbers are cut by one-halt, and similarly for other fractions of a year). Importantly, it is only necessary to adjust prior year statements to the extent we use them for analysis and forecast- ing purposes. For example, if only the current and two prior years data are used for forecasting income, then there is no need to actually adjust prior years' statements beyond those periods. Also notice that the basic accounting relation, that assets equal liabilities plus equity, is always maintained the urenanpyseperods. Also notice that the bas