Answered step by step

Verified Expert Solution

Question

1 Approved Answer

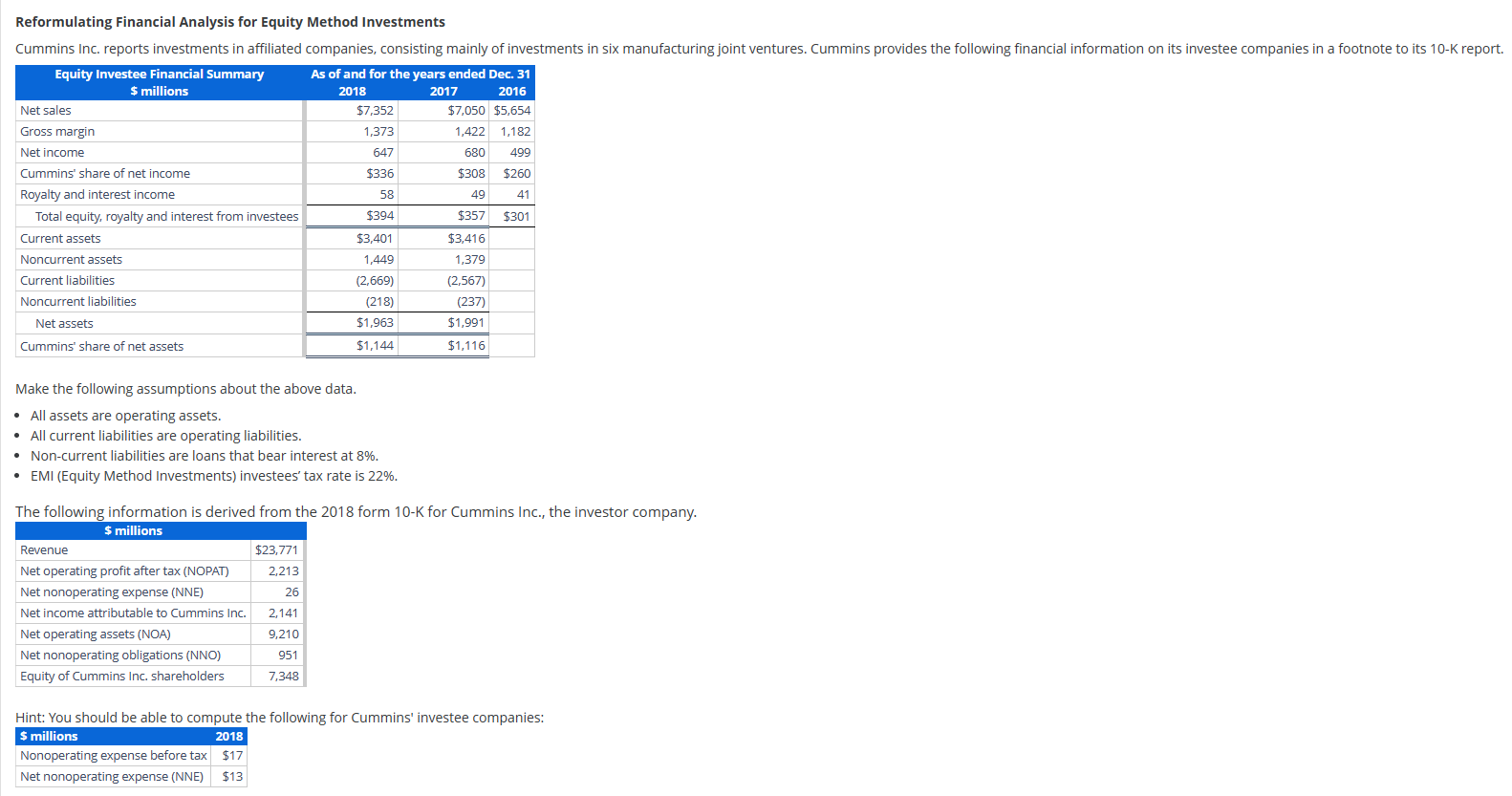

Reformulating Financial Analysis for Equity Method Investments Make the following assumptions about the above data. - All assets are operating assets. - All current liabilities

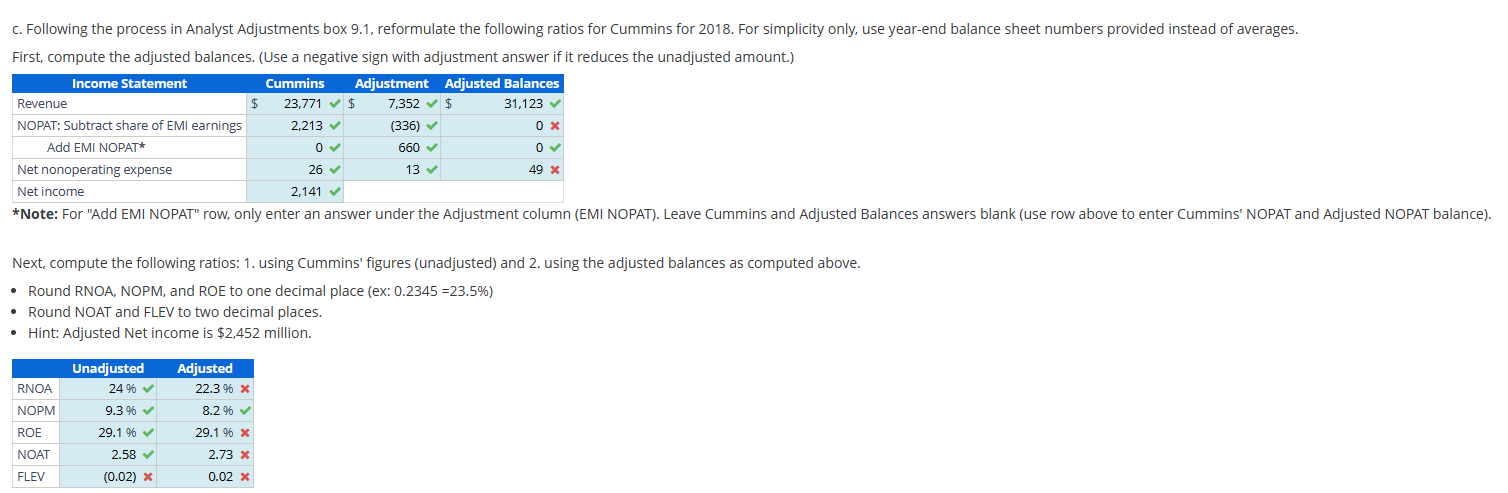

Reformulating Financial Analysis for Equity Method Investments Make the following assumptions about the above data. - All assets are operating assets. - All current liabilities are operating liabilities. - Non-current liabilities are loans that bear interest at 8%. - EMI (Equity Method Investments) investees' tax rate is 22%. The following information is derived from the 2018 form 10-K for Cummins Inc., the investor company. Hint: You should be able to compute the following for Cummins' investee companies: First, compute the adjusted balances. (Use a negative sign with adjustment answer if it reduces the unadjusted amount.) Next, compute the following ratios: 1. using Cummins' figures (unadjusted) and 2. using the adjusted balances as computed above. - Round RNOA, NOPM, and ROE to one decimal place (ex: 0.2345=23.5% ) - Round NOAT and FLEV to two decimal places. - Hint: Adjusted Net income is $2,452 million

Reformulating Financial Analysis for Equity Method Investments Make the following assumptions about the above data. - All assets are operating assets. - All current liabilities are operating liabilities. - Non-current liabilities are loans that bear interest at 8%. - EMI (Equity Method Investments) investees' tax rate is 22%. The following information is derived from the 2018 form 10-K for Cummins Inc., the investor company. Hint: You should be able to compute the following for Cummins' investee companies: First, compute the adjusted balances. (Use a negative sign with adjustment answer if it reduces the unadjusted amount.) Next, compute the following ratios: 1. using Cummins' figures (unadjusted) and 2. using the adjusted balances as computed above. - Round RNOA, NOPM, and ROE to one decimal place (ex: 0.2345=23.5% ) - Round NOAT and FLEV to two decimal places. - Hint: Adjusted Net income is $2,452 million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started