Answered step by step

Verified Expert Solution

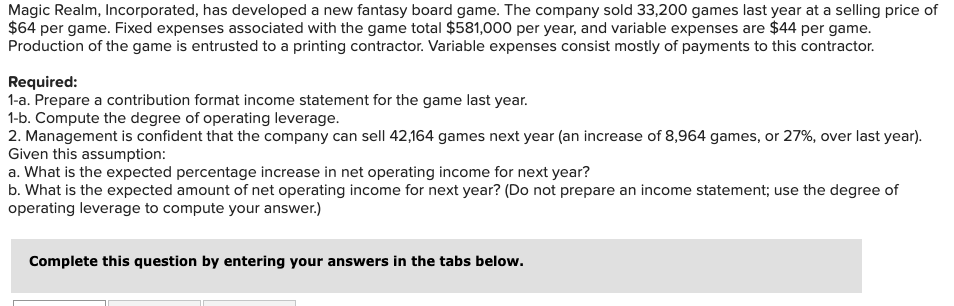

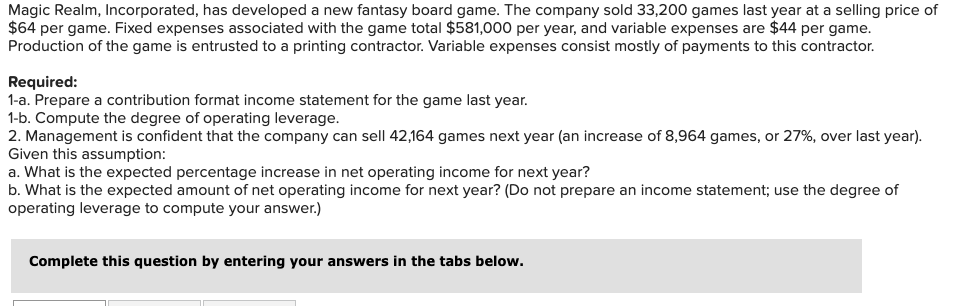

Question

1 Approved Answer

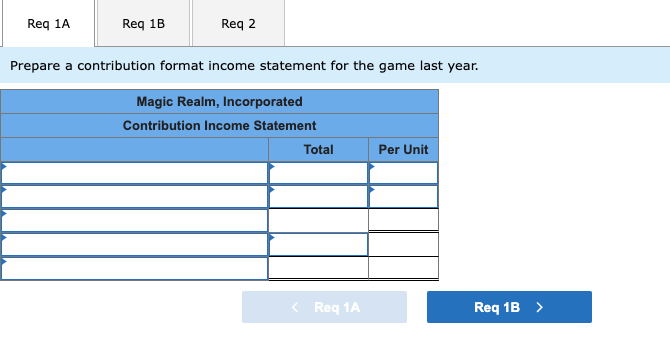

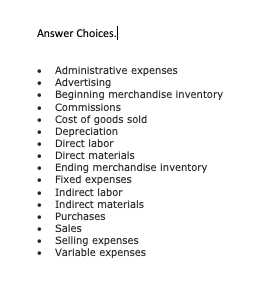

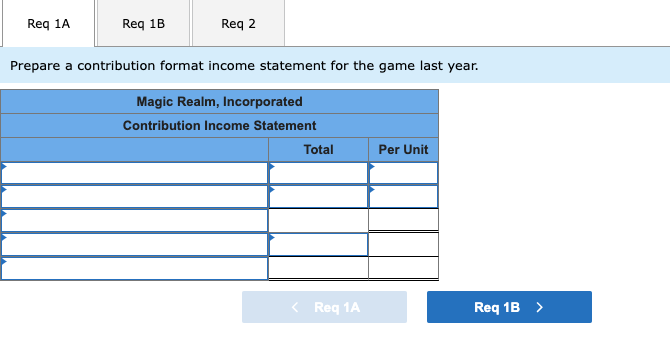

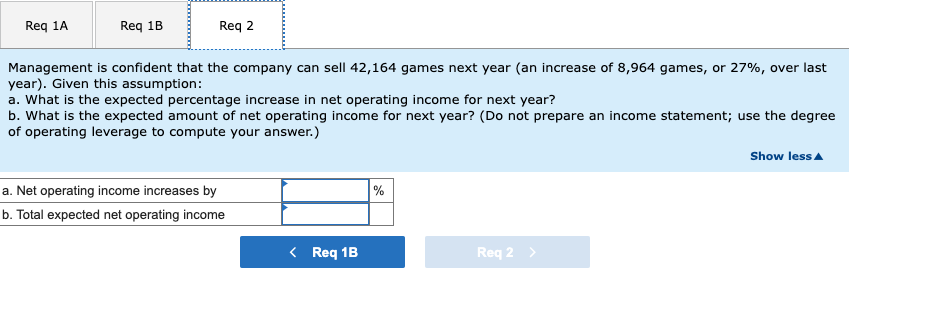

Reg 1A Req 1B Reg 2 Prepare a contribution format income statement for the game last year. Magic Realm, Incorporated Contribution Income Statement Total Per

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started