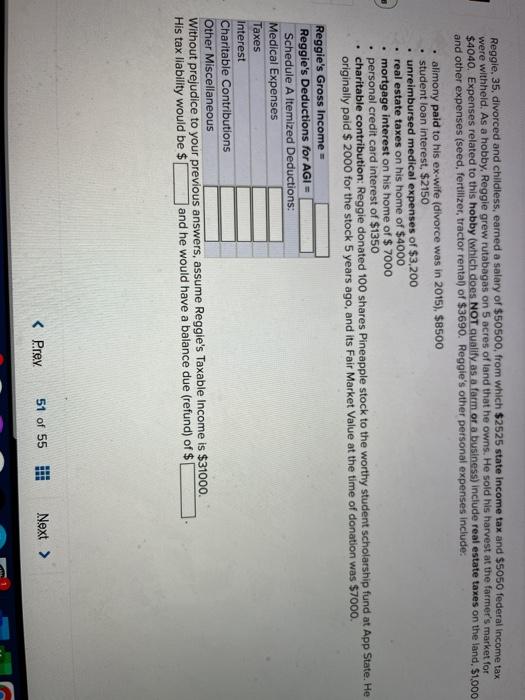

Reggle, 35, divorced and childless, earned a salary of $50500, from which $2525 state income tax and $5050 federal income tax were withheld. As a hobby, Reggie grew rutabagas on 5 acres of land that he owns. He sold his harvest at the farmer's market for $4040. Expenses related to this hobby (which does NOT qualify as a form or a business) include real estate taxes on the land, $1,000 and other expenses (seed, fertilizer, tractor rental) of $3690. Reggie's other personal expenses include: alimony paid to his ex-wife (divorce was in 2015), $8500 student loan interest, $2150 unreimbursed medical expenses of $3,200 real estate taxes on his home of $4000 mortgage interest on his home of $ 7000 personal credit card interest of $1350 . charitable contribution: Reggie donated 100 shares Pineapple stock to the worthy student scholarship fund at App State. He originally paid $ 2000 for the stock 5 years ago, and its Fair Market Value at the time of donation was $7000 Reggie's Gross Income Reggie's Deductions for AGI = Schedule A Itemized Deductions: Medical Expenses Taxes Interest Charitable Contributions Other Miscellaneous Without prejudice to your previous answers, assume Reggie's Taxable income is $31000 His tax liability would be $ and he would have a balance due (refund) of $ Reggle, 35, divorced and childless, earned a salary of $50500, from which $2525 state income tax and $5050 federal income tax were withheld. As a hobby, Reggie grew rutabagas on 5 acres of land that he owns. He sold his harvest at the farmer's market for $4040. Expenses related to this hobby (which does NOT qualify as a form or a business) include real estate taxes on the land, $1,000 and other expenses (seed, fertilizer, tractor rental) of $3690. Reggie's other personal expenses include: alimony paid to his ex-wife (divorce was in 2015), $8500 student loan interest, $2150 unreimbursed medical expenses of $3,200 real estate taxes on his home of $4000 mortgage interest on his home of $ 7000 personal credit card interest of $1350 . charitable contribution: Reggie donated 100 shares Pineapple stock to the worthy student scholarship fund at App State. He originally paid $ 2000 for the stock 5 years ago, and its Fair Market Value at the time of donation was $7000 Reggie's Gross Income Reggie's Deductions for AGI = Schedule A Itemized Deductions: Medical Expenses Taxes Interest Charitable Contributions Other Miscellaneous Without prejudice to your previous answers, assume Reggie's Taxable income is $31000 His tax liability would be $ and he would have a balance due (refund) of $