Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Regression PE A firm has a retention ratio of 4 0 percent of earnings and P / E ratio of 1 3 . Its earnings

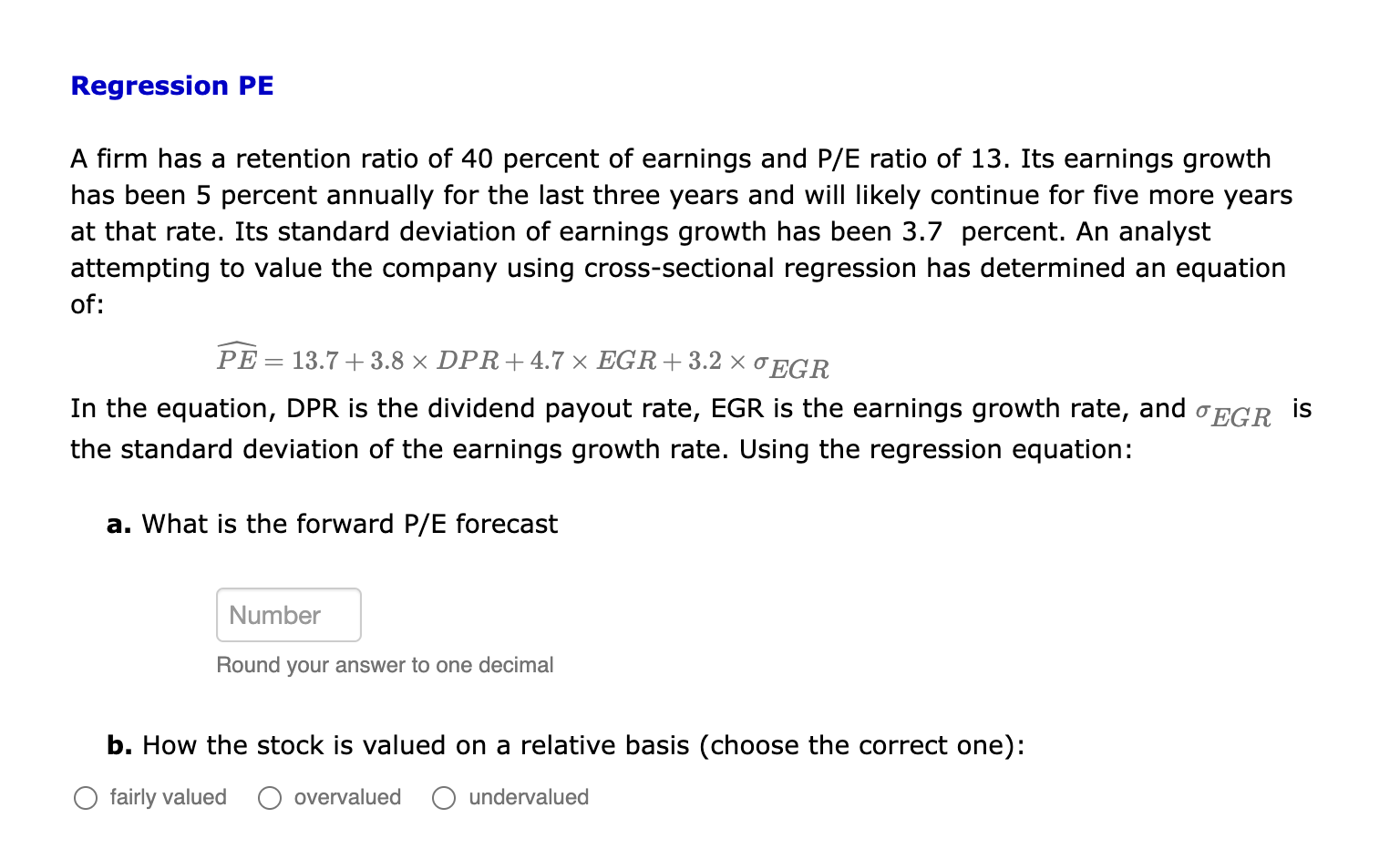

Regression PE

A firm has a retention ratio of percent of earnings and PE ratio of Its earnings growth

has been percent annually for the last three years and will likely continue for five more years

at that rate. Its standard deviation of earnings growth has been percent. An analyst

attempting to value the company using crosssectional regression has determined an equation

of:

widehatEGR

In the equation, DPR is the dividend payout rate, EGR is the earnings growth rate, and is

the standard deviation of the earnings growth rate. Using the regression equation:

a What is the forward forecast

Round your answer to one decimal

b How the stock is valued on a relative basis choose the correct one:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started