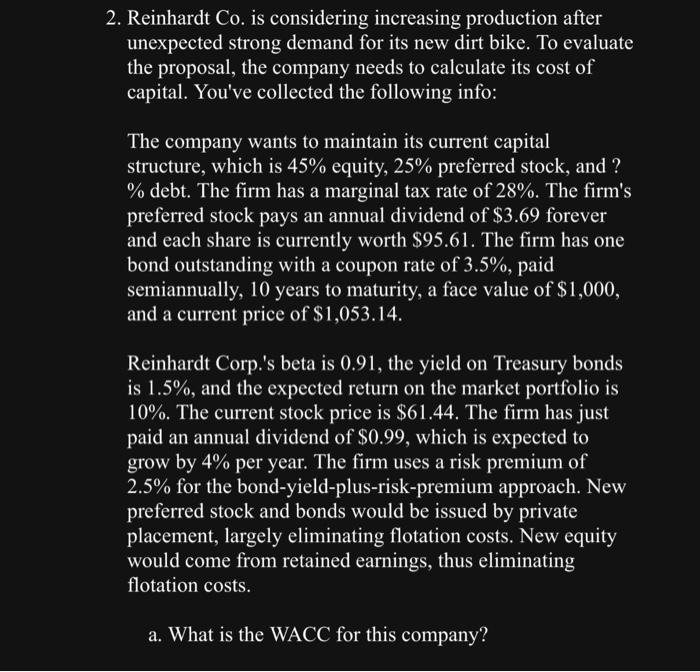

Reinhardt Co. is considering increasing production after unexpected strong demand for its new dirt bike. To evaluate the proposal, the company needs to calculate its cost of capital. You've collected the following info: The company wants to maintain its current capital structure, which is 45% equity, 25% preferred stock, and ? % debt. The firm has a marginal tax rate of 28%. The firm's preferred stock pays an annual dividend of $3.69 forever and each share is currently worth $95.61. The firm has one bond outstanding with a coupon rate of 3.5%, paid semiannually, 10 years to maturity, a face value of $1,000, and a current price of $1,053.14. Reinhardt Corp.'s beta is 0.91, the yield on Treasury bonds is 1.5%, and the expected return on the market portfolio is 10%. The current stock price is $61.44. The firm has just paid an annual dividend of $0.99, which is expected to grow by 4% per year. The firm uses a risk premium of 2.5% for the bond-yield-plus-risk-premium approach. New preferred stock and bonds would be issued by private placement, largely eliminating flotation costs. New equity would come from retained earnings, thus eliminating flotation costs. a. What is the WACC for this company? Reinhardt Co. is considering increasing production after unexpected strong demand for its new dirt bike. To evaluate the proposal, the company needs to calculate its cost of capital. You've collected the following info: The company wants to maintain its current capital structure, which is 45% equity, 25% preferred stock, and ? % debt. The firm has a marginal tax rate of 28%. The firm's preferred stock pays an annual dividend of $3.69 forever and each share is currently worth $95.61. The firm has one bond outstanding with a coupon rate of 3.5%, paid semiannually, 10 years to maturity, a face value of $1,000, and a current price of $1,053.14. Reinhardt Corp.'s beta is 0.91, the yield on Treasury bonds is 1.5%, and the expected return on the market portfolio is 10%. The current stock price is $61.44. The firm has just paid an annual dividend of $0.99, which is expected to grow by 4% per year. The firm uses a risk premium of 2.5% for the bond-yield-plus-risk-premium approach. New preferred stock and bonds would be issued by private placement, largely eliminating flotation costs. New equity would come from retained earnings, thus eliminating flotation costs. a. What is the WACC for this company