Answered step by step

Verified Expert Solution

Question

1 Approved Answer

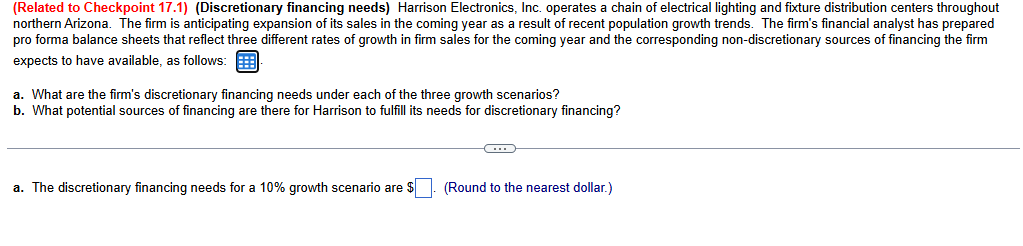

( Related to Checkpoint 1 7 . 1 ) ( Discretionary financing needs ) Harrison Electronics, Inc. operates a chain of electrical lighting and fixture

Related to Checkpoint Discretionary financing needs Harrison Electronics, Inc. operates a chain of electrical lighting and fixture distribution centers throughout Data table Related to Checkpoint Discretionary financing needs Harrison Electronics, Inc. operates a chain of

electrical lighting and fixture distribution centers throughout northern Arizona. The firm is anticipating expansion

of its sales in the coming year as a result of recent population growth trends. The firm's financial analyst has

prepared pro forma balance sheets that reflect three different rates of growth in firm sales for the coming year

and the corresponding nondiscretionary sources of financing the firm expects to have available, as follows:

a What are the firm's discretionary financing needs under each of the three growth scenarios?

b What potential sources of financing are there for Harrison to fulfill its needs for discretionary financing?

a The discretionary financing needs for a growth scenario are $Round to the nearest dollar.

The discretionary financing needs for a growth scenario are $ Round to the nearest dollar.

The discretionary financing needs for a growth scenario are $ Round to the nearest dollar.

b What potential sources of financing are there for Harrison to fulfill its needs for discretionary financing?

Select all the choices that apply below.

A Common stock.

B Longterm debt.

C Notes payable.

D Retained earnings.

E Sale of fixed assets. SSole:

C Mrotess panat:

III

northern Arizona. The firm is anticipating expansion of its sales in the coming year as a result of recent population growth trends. The firm's financial analyst has prepared

pro forma balance sheets that reflect three different rates of growth in firm sales for the coming year and the corresponding nondiscretionary sources of financing the firm

expects to have available, as follows:

a What are the firm's discretionary financing needs under each of the three growth scenarios?

b What potential sources of financing are there for Harrison to fulfill its needs for discretionary financing?

a The discretionary financing needs for a growth scenario are $

Round to the nearest dollar.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started