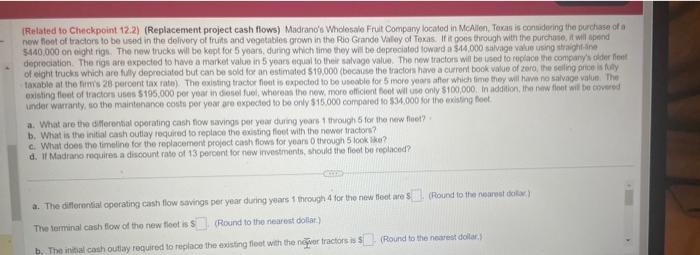

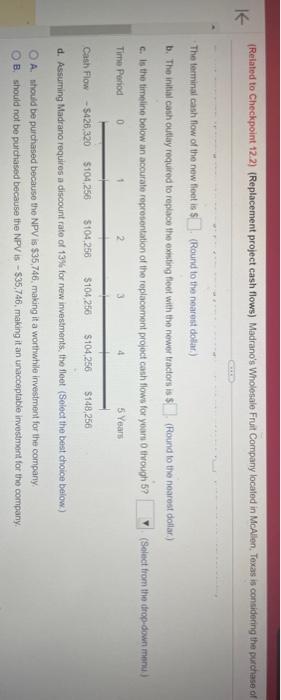

Related to Checkpoint 12.2) (Replacement project cash flows) Madrano's Wholesahe Frul Compary localed in McAlien. Texas is contidering the burchase of a inder wistarity, wo the maintenanen coste per year are expextest to bo only $15.000 compaied to $34,000 for the exisking foet a. What are tion diflerental operating cash fion savings per year duning yoars 1 through 5 for the new fleet? b. What is the initial cash outay required to replace the existing floet with the newer tractors? c. What does the timeline for the replacemont project cash flows for yoare 0 through 5 look hke? d. If Madraye requifes a discount rase of 13 percent for new irvestments, should the fleot be regliced? a. The diflemntial operation cash flow sawings per year during years t throwgh 4 for the new fieet are (Round to the nuarest sotik) Thie teiminal cash flow of the new fioet is ? (Roound to the nearest opliat.) b. The ithial cash outiay required to recloco the existing fieot with the ngwor tractors is 5 (Round to the newest dollari) (Related to Checkpoint 12.2) (Replacement project cash flows) Madrano's Wholesale Frut Company located in McAlen, Texas is considering the purchase of The terminal cash flow of the new fleet is 5 (Round to the nearest dollar.) b. The initial cash outlay required to replace the exesing fleot with the newer tractoss is: (Round to the niearest dollar.) c. Is the timelina below an accurate representation of the replacement project cash flows for yeart 0 thisough 5 ? (Select from the thop-down menie) d. Assuming Madrano requires a discount rate of 133 for new investments, the fleet (Select the best choice beliow.) A. nhould be purchased because the NPV is $35,746, making it a worthwhile investment for the company. B; should not be purchased because the NPV is $35,746, making it an unacceptable irvestrxent for the company. Related to Checkpoint 12.2) (Replacement project cash flows) Madrano's Wholesahe Frul Compary localed in McAlien. Texas is contidering the burchase of a inder wistarity, wo the maintenanen coste per year are expextest to bo only $15.000 compaied to $34,000 for the exisking foet a. What are tion diflerental operating cash fion savings per year duning yoars 1 through 5 for the new fleet? b. What is the initial cash outay required to replace the existing floet with the newer tractors? c. What does the timeline for the replacemont project cash flows for yoare 0 through 5 look hke? d. If Madraye requifes a discount rase of 13 percent for new irvestments, should the fleot be regliced? a. The diflemntial operation cash flow sawings per year during years t throwgh 4 for the new fieet are (Round to the nuarest sotik) Thie teiminal cash flow of the new fioet is ? (Roound to the nearest opliat.) b. The ithial cash outiay required to recloco the existing fieot with the ngwor tractors is 5 (Round to the newest dollari) (Related to Checkpoint 12.2) (Replacement project cash flows) Madrano's Wholesale Frut Company located in McAlen, Texas is considering the purchase of The terminal cash flow of the new fleet is 5 (Round to the nearest dollar.) b. The initial cash outlay required to replace the exesing fleot with the newer tractoss is: (Round to the niearest dollar.) c. Is the timelina below an accurate representation of the replacement project cash flows for yeart 0 thisough 5 ? (Select from the thop-down menie) d. Assuming Madrano requires a discount rate of 133 for new investments, the fleet (Select the best choice beliow.) A. nhould be purchased because the NPV is $35,746, making it a worthwhile investment for the company. B; should not be purchased because the NPV is $35,746, making it an unacceptable irvestrxent for the company