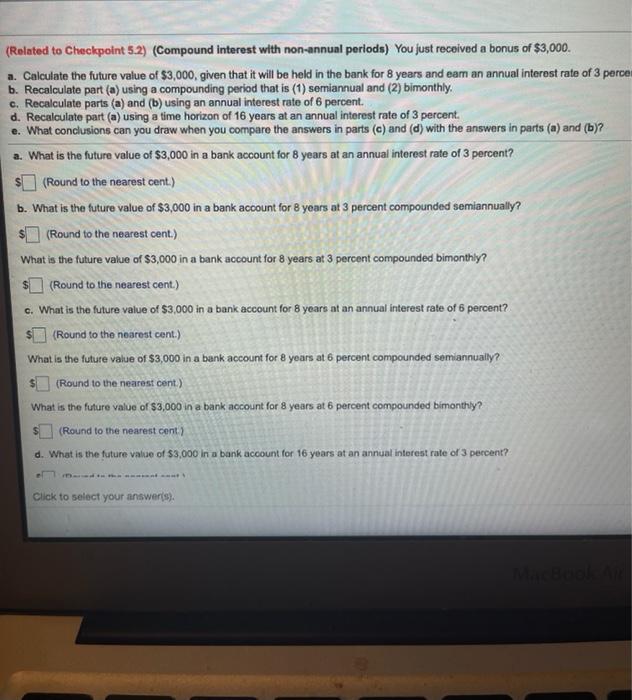

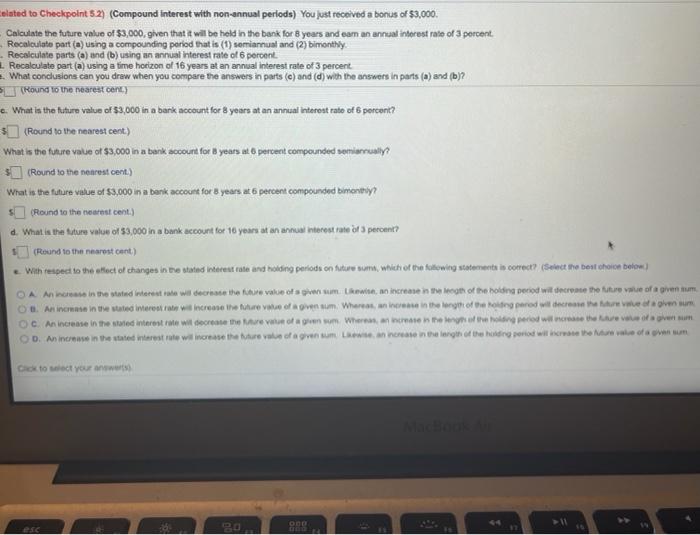

(Related to Checkpoint 5.2) (Compound interest with non-annual periods) You just received a bonus of $3,000. a. Calculate the future value of $3,000, given that it will be held in the bank for 8 years and eam an annual interest rate of 3 perce b. Recalculate part (a) using a compounding period that is (1) semiannual and (2) bimonthly c. Recalculate parts (a) and (b) using an annual interest rate of 6 percent. d. Recalculate part (a) using a time horizon of 16 years at an annual interest rate of 3 percent e. What conclusions can you draw when you compare the answers in parts (e) and (d) with the answers in parts (a) and (b)? a. What is the future value of $3,000 in a bank account for 8 years at an annual interest rate of 3 percent? (Round to the nearest cent.) b. What is the future value of $3,000 in a bank account for 8 years at 3 percent compounded semiannually? (Round to the nearest cent.) What is the future value of $3,000 in a bank account for 8 years at 3 percent compounded bimonthly? (Round to the nearest cent.) c. What is the future value of $3,000 in a bank account for 8 years at an annual interest rate of 6 percent? (Round to the nearest cent.) What is the future value of $3,000 in a bank account for 8 years at 6 percent compounded semiannually? (Round to the nearest cent.) What is the future value of $3,000 in a bank account for 8 years at 6 percent compounded bmonthly? (Round to the nearest cent) d. What is the future value of $3,000 in a bank account for 16 years at an annual interest rate of 3 peccent? Click to select your answers). olated to Checkpoint 5 2) (Compound interest with non-annual perlods) You just received a bonus of $3,000. Calculate the future value of $3,000, given that it will be held in the bank for years and eam an annual interest rate of 3 percent Recalculate part (a) using a compounding period that is (1) semiannual and (2) bimonthly Recalculate parts (a) and (b) using an annual interest rate of 6 percent. Recalculate part (a) using a time horizon of 16 years at an annual interest rate of 3 percent What conclusions can you draw when you compare the answers in parts (e) and (d) with the answers in parts (a) and (b)? PL Round to the nearest Cont) 6. What is the future value of $3,000 in a bank account for 8 years at an annual interest rate of 6 percent? $(Round to the nearest cent) What is the future vnue of 3,000 in a bank account for B re for years at 6 percent compounded semisrally? $(Round to the nearest on.) What is the future value of $3,000 in a bank account for B years at 6 percent compounded bimonty? (Round to the nearest cent.) d. What is the future value of $3,000 in a bank account for 16 years at an annual interest rate of a percent? (Round to the nearest cant) With respect to the effect of changes in the stated test rate and holding periods on future sur, which of the following statements is correct? (Select the best choice below) DA Ances in the state interest rate will be the future value of a num twise, an increase in the oth of the holding period will decrease the future of a given tum Aninoase in the stated interest rate increase the future of a given sum. Whereas in the length of the holding predilecrease there was OC. An increase in the state interest rate will create the rate of Where anche le of the holding period was there OD. An increase in the state interest rate will increase the value of a given som en restength of the holding period with a sum Click to ect your awes 998