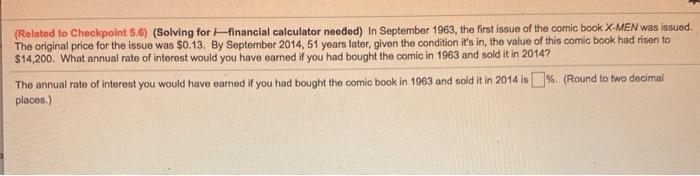

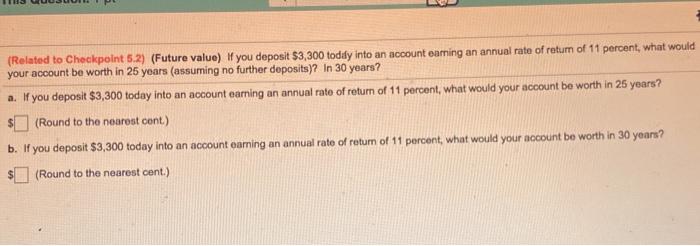

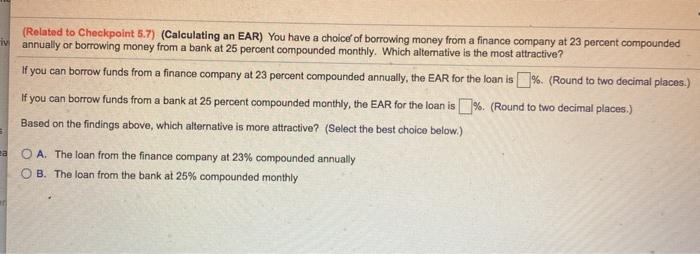

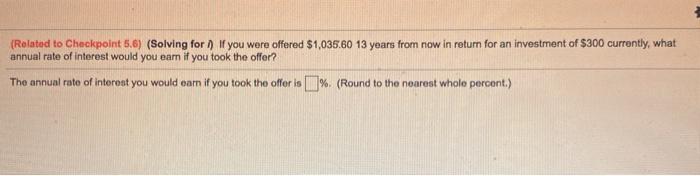

(Related to Checkpoint 5.6) (Solving for financial calculator needed) in September 1963, the first issue of the comic book X-MEN was issued. The original price for the issue was $0.13. By September 2014, 51 years later, given the condition it's in the value of this comic book had risen to $14,200. What annual rate of interest would you have earned if you had bought the comic in 1963 and sold it in 2014? The annual rate of interest you would have earned if you had bought the comic book in 1963 and sold it in 2014 is % (Round to two decimal places.) (Related to Checkpoint 5.2) (Future value) If you deposit $3,300 todily into an account earning an annual rate of return of 11 percent, what would your account be worth in 25 years (assuming no further deposits)? In 30 years? a. If you deposit $3,300 today into an account earning an annual rate of return of 11 percent, what would your account be worth in 25 years? (Round to the nearest cont.) b. If you deposit $3,300 today into an account earning an annual rate of return of 11 percent, what would your account be worth in 30 years? (Round to the nearest cent.) (Related to Checkpoint 5.7) (Calculating an EAR) You have a choice of borrowing money from a finance company at 23 percent compounded v annually or borrowing money from a bank at 25 percent compounded monthly. Which alternative is the most attractive? If you can borrow funds from a finance company at 23 percent compounded annually, the EAR for the loan is % (Round to two decimal places.) If you can borrow funds from a bank at 25 percent compounded monthly, the EAR for the loan is 1%. (Round to two decimal places.) Based on the findings above, which alternative is more attractive? (Select the best choice below.) O A. The loan from the finance company at 23% compounded annually OB. The loan from the bank at 25% compounded monthly (Related to Checkpoint 5.6) (Solving for ) If you were offered $1,035.60 13 years from now in return for an investment of $300 currently, what annual rate of interest would you eam if you took the offer? The annual rate of interest you would com if you took the offer is % (Round to the nearest wholo percent.)