Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Related to Checkpoint 6.1) (Loan amortization) On December 31, Beth Klamkosky bought a yacht for $110.000 She paid $10,000 down and agreed to pay the

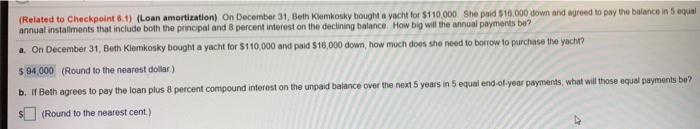

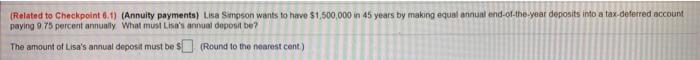

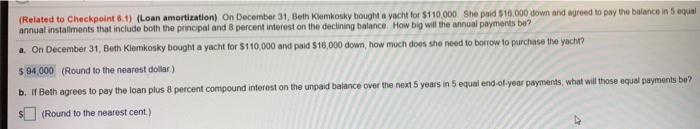

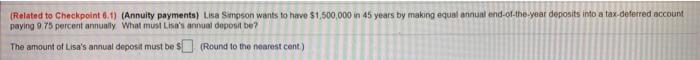

(Related to Checkpoint 6.1) (Loan amortization) On December 31, Beth Klamkosky bought a yacht for $110.000 She paid $10,000 down and agreed to pay the balance in 5 equal annual installments that include both the principal and 8 percent interest on the declining balance How big wil the annual payments be? a. On December 31, Both Klemkosky bought a yacht for $110,000 and paid $10,000 down, how much does she need to borrow to purchase the yacht? 5 94,000 (Round to the nearest dollar) b. If Beth agrees to pay the loan plus 8 percent compound interest on the unpaid balance over the next 5 years in 5 equal end of year payments, what will those equal payments be? (Round to the nearest cent.) (Related to Checkpoint 6.1) (Annuity payments) Lisa Simpson wants to have $1,500,000 in 45 years by making equal annual end-of-the-year deposits into a tax-deferred account paying 9 75 percent annually What must Lisa's annual deposit be? The amount of Lisa's annual deposit must be $ (Round to the nearest cent)

(Related to Checkpoint 6.1) (Loan amortization) On December 31, Beth Klamkosky bought a yacht for $110.000 She paid $10,000 down and agreed to pay the balance in 5 equal annual installments that include both the principal and 8 percent interest on the declining balance How big wil the annual payments be? a. On December 31, Both Klemkosky bought a yacht for $110,000 and paid $10,000 down, how much does she need to borrow to purchase the yacht? 5 94,000 (Round to the nearest dollar) b. If Beth agrees to pay the loan plus 8 percent compound interest on the unpaid balance over the next 5 years in 5 equal end of year payments, what will those equal payments be? (Round to the nearest cent.) (Related to Checkpoint 6.1) (Annuity payments) Lisa Simpson wants to have $1,500,000 in 45 years by making equal annual end-of-the-year deposits into a tax-deferred account paying 9 75 percent annually What must Lisa's annual deposit be? The amount of Lisa's annual deposit must be $ (Round to the nearest cent)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started