Question

(Related to Checkpoint 9.1)(Floating-rate loans)The Bensington Glass Company entered into a loan agreement with the firm's bank to finance the firm's working capital. The loan

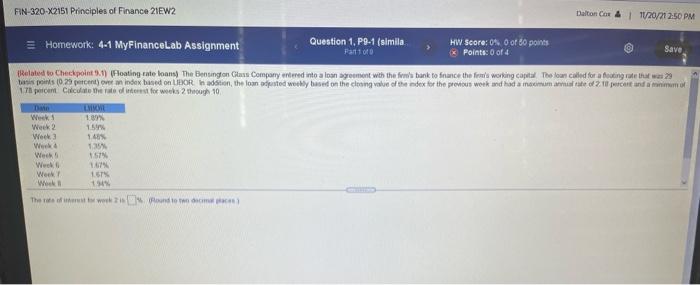

(Related to Checkpoint 9.1)(Floating-rate loans)The Bensington Glass Company entered into a loan agreement with the firm's bank to finance the firm's working capital. The loan called for a floating rate that was 29 basis points (0.29 percent) over an index based on LIBOR. In addition, the loan adjusted weekly based on the closing value of the index for the previous week and had a maximum annual rate of 2.18 percent and a minimum of 1.78 percent. Calculate the rate of interest for weeks 2 through 10.

| Date | LIBOR |

|---|---|

| Week 1 | 1.89% |

|

| |

| Week 2 | 1.59% |

|

| |

| Week 3 | 1.48% |

| Week 4 | 1.35% |

| Week 5 | 1.57% |

| Week 6 | 1.67% |

| Week 7 | 1.67% |

| Week 8 | 1.94% |

| Week 9 | 1.88% |

The rate of interest for week 2 is enter your response here%.(Round to two decimal places.)

FIN-320x2151 Principles of Finance 21EW2 Dalton Cor! 11/20/212:50 PM 3 Homework: 4-1 MyFinanceLab Assignment Question 1, P9-1 (simila HW Score: 0of do portes Falls Points: 0 of 4 Save Related to Checkpoint.1) Floating rate loans) The Bingon Glass Company entered into a loan sement wth the firm's bank to face the fre's working capital. The loan called for a footing rate that was is 10.23 percent of Index based on UBOR adition, the lo dested weekly based on the chong value of the index for the previous work and had a comum 2.0 percent and a minimum 17 pont Calculatorate of interest for weeks 2 through 10 CORE Weck 187% Week 2 15 Week 148 Week 13 Wech 157 Week Week 16 W 19 The story work and to comeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started