Answered step by step

Verified Expert Solution

Question

1 Approved Answer

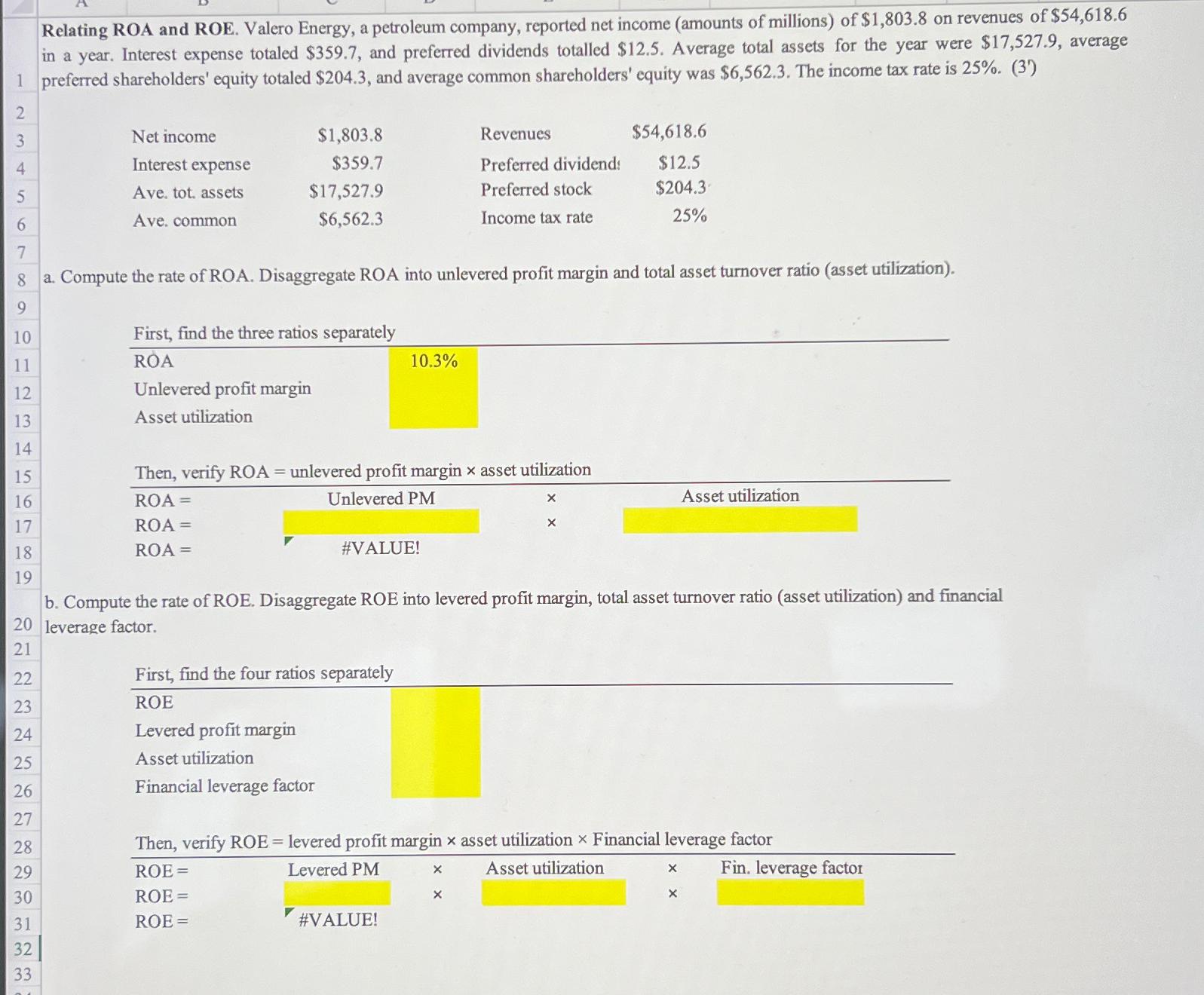

Relating ROA and ROE. Valero Energy, a petroleum company, reported net income (amounts of millions) of $1,803.8 on revenues of $54,618.6 in a year.

Relating ROA and ROE. Valero Energy, a petroleum company, reported net income (amounts of millions) of $1,803.8 on revenues of $54,618.6 in a year. Interest expense totaled $359.7, and preferred dividends totalled $12.5. Average total assets for the year were $17,527.9, average 1 preferred shareholders' equity totaled $204.3, and average common shareholders' equity was $6,562.3. The income tax rate is 25%. (3) 2 3 45 9 7 Net income Interest expense $1,803.8 Revenues Ave. tot. assets Ave. common $359.7 $17,527.9 $6,562.3 Preferred dividends $54,618.6 $12.5 Preferred stock Income tax rate $204.3 25% 9 10 8 a. Compute the rate of ROA. Disaggregate ROA into unlevered profit margin and total asset turnover ratio (asset utilization). First, find the three ratios separately 11 ROA 10.3% 12 Unlevered profit margin 13 Asset utilization 14 15 16 17 18 19 456789 Then, verify ROA = unlevered profit margin x asset utilization ROA = Unlevered PM x Asset utilization ROA = X #VALUE! ROA = b. Compute the rate of ROE. Disaggregate ROE into levered profit margin, total asset turnover ratio (asset utilization) and financial 20 leverage factor. First, find the four ratios separately 21 22 23 ROE 24 Levered profit margin 25 Asset utilization 26 27 28 Financial leverage factor Then, verify ROE = levered profit margin asset utilization x Financial leverage factor 29 ROE= 30 ROE= Levered PM Asset utilization x Fin. leverage factor 31 ROE= #VALUE! 32 33

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To compute the rate of ROA Return on Assets we can use the following formulas ROA Net Income Avera...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started