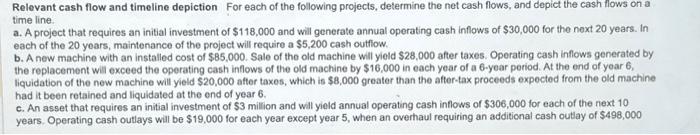

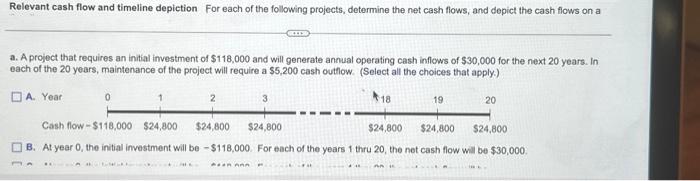

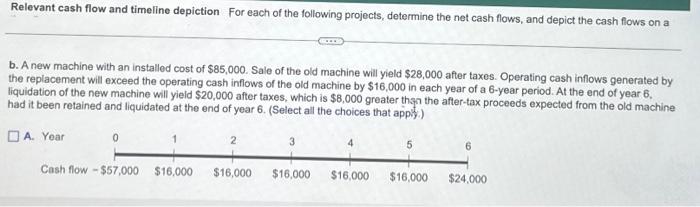

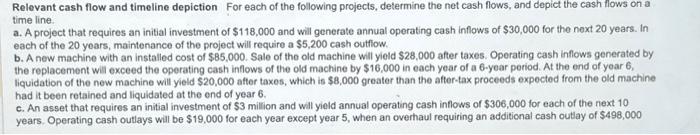

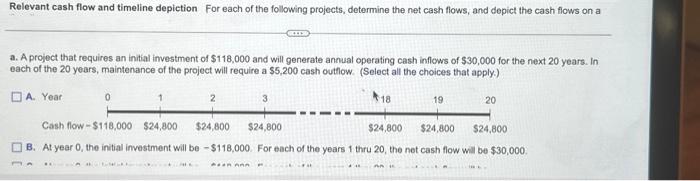

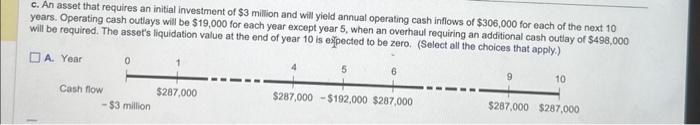

Relevant cash flow and timeline depiction For each of the following projects, determine the net cash flows, and depict the cash flows on a time line. a. A project that requires an initial investment of $118,000 and will generate annual operating cash inflows of $30,000 for the next 20 years. In each of the 20 years, maintenance of the project will require a $5,200 cash outflow. b. A new machine with an installed cost of $85,000. Sale of the old machine will yield $28,000 after taxes. Operating cash inflows generated by the replacement will exceed the operating cash inflows of the old machine by $16,000 in each year of a 6-year period. At the end of year 6, liquidation of the new machine will yield $20,000 after taxes, which is $8,000 greater than the after-tax proceeds expected from the old machine had it been retained and liquidated at the end of year 6. c. An asset that requires an initial investment of $3 million and will yield annual operating cash inflows of $306,000 for each of the next 10 years. Operating cash outlays will be $19,000 for each year except year 5, when an overhaul requiring an additional cash outlay of $498,000

Relevant cash flow and timeline depiction For each of the following projects, determine the net cash flows, and depict the cash flows on a time line. a. A project that requires an initial investment of $118,000 and will generate annual operating cash inflows of $30,000 for the next 20 years. In each of the 20 years, maintenance of the project will require a $5,200 cash outflow. b. A new machine with an installed cost of $85,000. Sale of the old machine will yield $28,000 after taxes. Operating cash inflows generated by the replacement will exceed the operating cash inflows of the old machine by $16,000 in each year of a 6-year poriod. At the end of yoar 6 , liquidation of the new machine will yield $20,000 after taxes, which is $8,000 greater than the after-taxproceeds expected from the old machine had it been retained and liquidated at the end of year 6 . c. An asset that requires an initial investment of $3 million and will yield annual operating cash inflows of $306,000 for each of the next 10 years. Operating cash outlays will be $19,000 for each year except year 5 , when an overhaul requiring an additional cash outlay of $498,000 Relevant cash flow and timeline depiction For each of the following projects, determine the net cash flows, and depict the cash flows on a a. A project that requires an initial investment of $118,000 and will generate annual operating cash inflows of $30,000 for the next 20 years. In each of the 20 years, maintenance of the project will require a $5,200 cash outflow. (Select all the choices that apply.) A. ) B. At year 0 , the initial investment will be $118,000. For each of the years 1 thru 20 , the net cash flow will be $30,000. Relevant cash flow and timeline depiction For each of the following projects, determine the net cash flows, and depict the cash flows on a b. A new machine with an installed cost of $85,000. Sale of the old machine will yield $28,000 after taxes. Operating cash inflows generated by the replacement will exceed the operating cash inflows of the old machine by $16,000 in each year of a 6-year period. At the end of year 6 . liquidation of the new machine will yield $20,000 after taxes, which is $8,000 greater thon the after-tax proceeds expected from the old machine had it been retained and liquidated at the end of year 6 . (Select all the choices that appit.) c. An asset that requires an initial investment of $3 million and will yield annual operating cash inflows of $306,000 for each of the next 10 years. Operating cash outlays will be $19,000 for each year except year $, when an overhaul requiring an additional cash outlay of $498,000. will be required. The asset's liquidation value at the end of year 10 is ef.pected to be zero. (Select all the choices that apply.) A. Year Cash flow Relevant cash flow and timeline depiction For each of the following projects, determine the net cash flows, and depict the cash flows on a time line. a. A project that requires an initial investment of $118,000 and will generate annual operating cash inflows of $30,000 for the next 20 years. In each of the 20 years, maintenance of the project will require a $5,200 cash outflow. b. A new machine with an installed cost of $85,000. Sale of the old machine will yield $28,000 after taxes. Operating cash inflows generated by the replacement will exceed the operating cash inflows of the old machine by $16,000 in each year of a 6-year poriod. At the end of yoar 6 , liquidation of the new machine will yield $20,000 after taxes, which is $8,000 greater than the after-taxproceeds expected from the old machine had it been retained and liquidated at the end of year 6 . c. An asset that requires an initial investment of $3 million and will yield annual operating cash inflows of $306,000 for each of the next 10 years. Operating cash outlays will be $19,000 for each year except year 5 , when an overhaul requiring an additional cash outlay of $498,000 Relevant cash flow and timeline depiction For each of the following projects, determine the net cash flows, and depict the cash flows on a a. A project that requires an initial investment of $118,000 and will generate annual operating cash inflows of $30,000 for the next 20 years. In each of the 20 years, maintenance of the project will require a $5,200 cash outflow. (Select all the choices that apply.) A. ) B. At year 0 , the initial investment will be $118,000. For each of the years 1 thru 20 , the net cash flow will be $30,000. Relevant cash flow and timeline depiction For each of the following projects, determine the net cash flows, and depict the cash flows on a b. A new machine with an installed cost of $85,000. Sale of the old machine will yield $28,000 after taxes. Operating cash inflows generated by the replacement will exceed the operating cash inflows of the old machine by $16,000 in each year of a 6-year period. At the end of year 6 . liquidation of the new machine will yield $20,000 after taxes, which is $8,000 greater thon the after-tax proceeds expected from the old machine had it been retained and liquidated at the end of year 6 . (Select all the choices that appit.) c. An asset that requires an initial investment of $3 million and will yield annual operating cash inflows of $306,000 for each of the next 10 years. Operating cash outlays will be $19,000 for each year except year $, when an overhaul requiring an additional cash outlay of $498,000. will be required. The asset's liquidation value at the end of year 10 is ef.pected to be zero. (Select all the choices that apply.) A. Year Cash flow