Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Reliable Electric, a major Ruritanian producer of electrical products, is considering a proposal to manufacture a new type of industrial electric motor that would replace

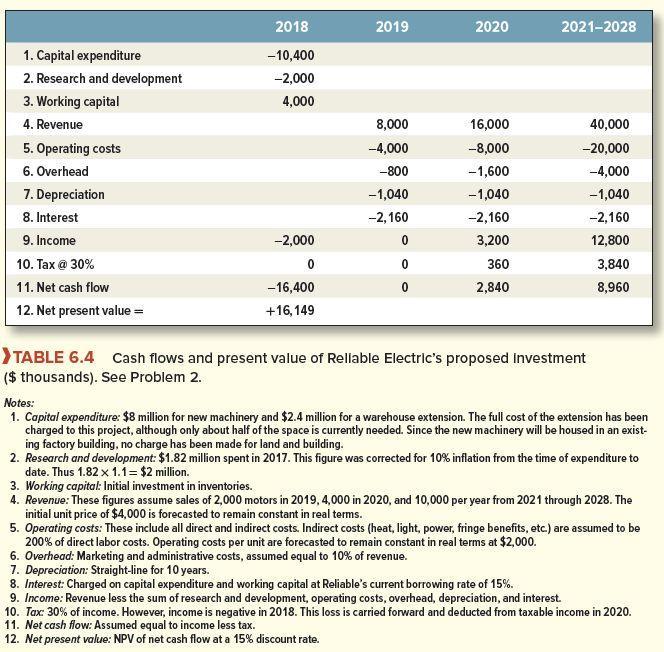

Reliable Electric, a major Ruritanian producer of electrical products, is considering a proposal to manufacture a new type of industrial electric motor that would replace most of its existing product line. A research breakthrough has given Reliable a two-year lead on its competitors. The project proposal is summarized in Table 6.4.

Question : Read the notes to the table carefully. Which entries make sense? Which do not? Why or why not? (need to find the entry that make sense and which do not not and why)

2018 2019 2020 2021-2028 1. Capital expenditure -10,400 2. Research and development -2,000 3. Working capital 4,000 4. Revenue 8,000 16,000 40,000 5. Operating costs 6. Overhead 7. Depreciation 8. Interest 9. Income 10. Tax @ 30% -4,000 -8,000 -20,000 -800 -1,600 -4,000 -1,040 -1,040 -1,040 -2,160 -2,160 -2,160 -2,000 0 3,200 12,800 0 0 360 3,840 11. Net cash flow 12. Net present value = -16,400 0 2,840 8,960 +16,149 >TABLE 6.4 Cash flows and present value of Rellable Electric's proposed Investment ($ thousands). See Problem 2. Notes: 1. Capital expenditure: $8 million for new machinery and $2.4 million for a warehouse extension. The full cost of the extension has been charged to this project, although only about half of the space is currently needed. Since the new machinery will be housed in an exist- ing factory building, no charge has been made for land and building. 2. Research and development: $1.82 million spent in 2017. This figure was corrected for 10% inflation from the time of expenditure to date. Thus 1.82 x 1.1 = $2 million. 3. Working capital: Initial investment in inventories. 4. Revenue: These figures assume sales of 2,000 motors in 2019, 4,000 in 2020, and 10,000 per year from 2021 through 2028. The initial unit price of $4,000 is forecasted to remain constant in real terms. 5. Operating costs: These include all direct and indirect costs. Indirect costs (heat, light, power, fringe benefits, etc.) are assumed to be 200% of direct labor costs. Operating costs per unit are forecasted to remain constant in real terms at $2,000. 6. Overhead: Marketing and administrative costs, assumed equal to 10% of revenue. 7. Depreciation: Straight-line for 10 years. 8. Interest: Charged on capital expenditure and working capital at Reliable's current borrowing rate of 15%. 9. Income: Revenue less the sum of research and development, operating costs, overhead, depreciation, and interest. 10. Tax: 30% of income. However, income is negative in 2018. This loss is carried forward and deducted from taxable income in 2020. 11. Net cash flow: Assumed equal to income less tax. 12. Net present value: NPV of net cash flow at a 15% discount rate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Table Entries Analysis 1 Capital Expenditure 10400 in 2018 Makes Sense The capital expenditure of 104 million in 2018 is explained by 8 million for machinery and 24 million for a warehouse extension I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started