Answered step by step

Verified Expert Solution

Question

1 Approved Answer

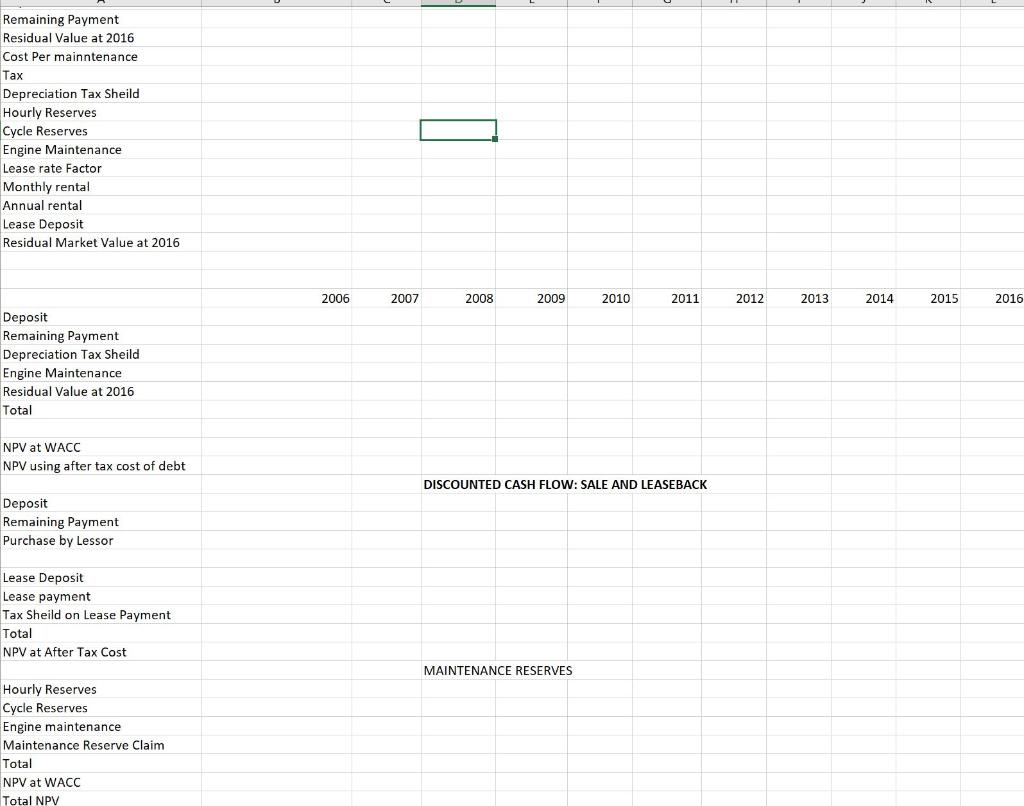

Remaining Payment Residual Value at 2016 Cost Per mainntenance Tax Depreciation Tax Sheild Hourly Reserves Cycle Reserves Engine Maintenance Lease rate Factor Monthly rental Annual

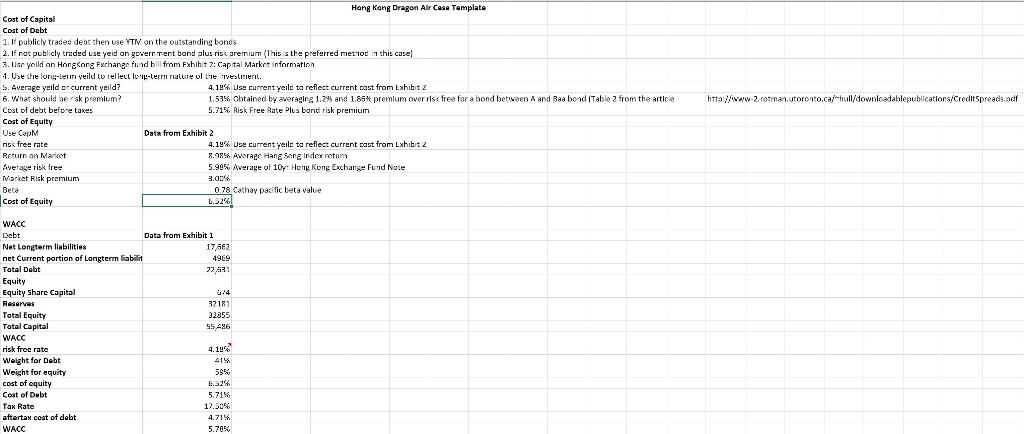

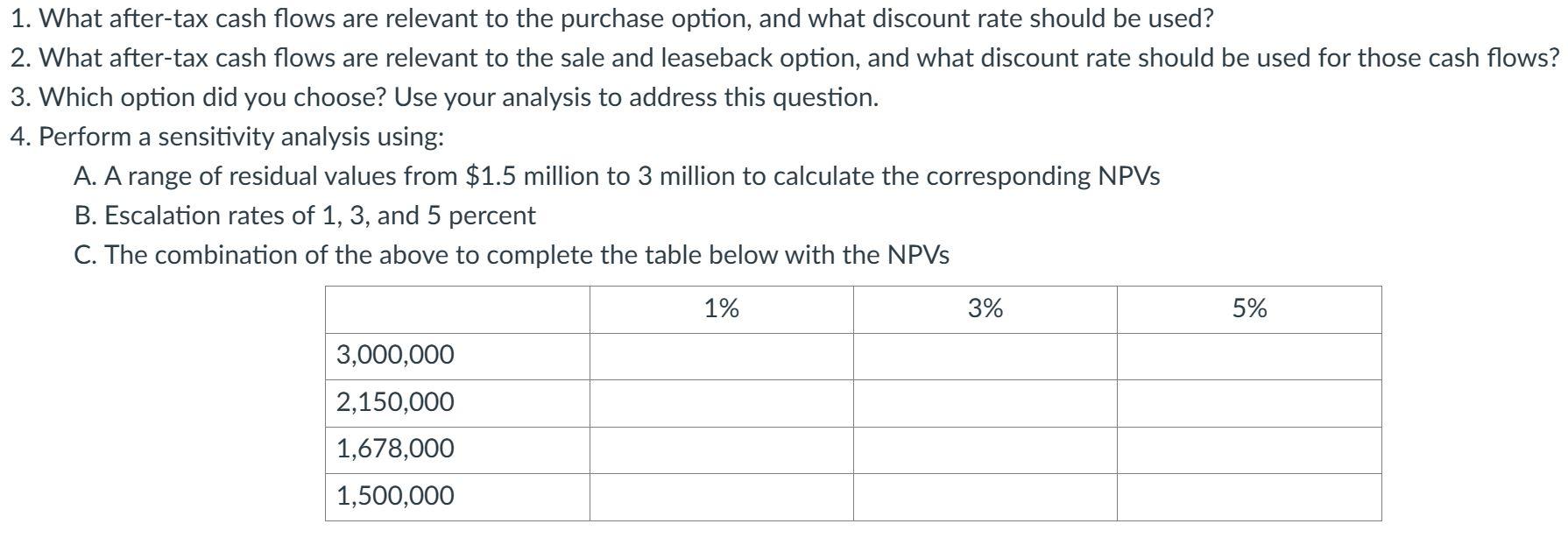

Remaining Payment Residual Value at 2016 Cost Per mainntenance Tax Depreciation Tax Sheild Hourly Reserves Cycle Reserves Engine Maintenance Lease rate Factor Monthly rental Annual rental Lease Deposit Residual Market Value at 2016 Deposit Remaining Payment Depreciation Tax Sheild Engine Maintenance Residual Value at 2016 Total NPV at WACC NPV using after tax cost of debt DISCOUNTED CASH FLOW: SALE AND LEASEBACK Deposit Remaining Payment Purchase by Lessor Lease Deposit Lease payment Tax Sheild on Lease Payment Total NPV at After Tax Cost Hourly Reserves Cycle Reserves Engine maintenance Maintenance Reserve Claim Total NPV at WACC Total NPV 1. What after-tax cash flows are relevant to the purchase option, and what discount rate should be used? 2. What after-tax cash flows are relevant to the sale and leaseback option, and what discount rate should be used for those cash flows? 3. Which option did you choose? Use your analysis to address this question. 4. Perform a sensitivity analysis using: A. A range of residual values from $1.5 million to 3 million to calculate the corresponding NPVs B. Escalation rates of 1,3 , and 5 percent C. The combination of the above to complete the table below with the NPVs Remaining Payment Residual Value at 2016 Cost Per mainntenance Tax Depreciation Tax Sheild Hourly Reserves Cycle Reserves Engine Maintenance Lease rate Factor Monthly rental Annual rental Lease Deposit Residual Market Value at 2016 Deposit Remaining Payment Depreciation Tax Sheild Engine Maintenance Residual Value at 2016 Total NPV at WACC NPV using after tax cost of debt DISCOUNTED CASH FLOW: SALE AND LEASEBACK Deposit Remaining Payment Purchase by Lessor Lease Deposit Lease payment Tax Sheild on Lease Payment Total NPV at After Tax Cost Hourly Reserves Cycle Reserves Engine maintenance Maintenance Reserve Claim Total NPV at WACC Total NPV 1. What after-tax cash flows are relevant to the purchase option, and what discount rate should be used? 2. What after-tax cash flows are relevant to the sale and leaseback option, and what discount rate should be used for those cash flows? 3. Which option did you choose? Use your analysis to address this question. 4. Perform a sensitivity analysis using: A. A range of residual values from $1.5 million to 3 million to calculate the corresponding NPVs B. Escalation rates of 1,3 , and 5 percent C. The combination of the above to complete the table below with the NPVs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started