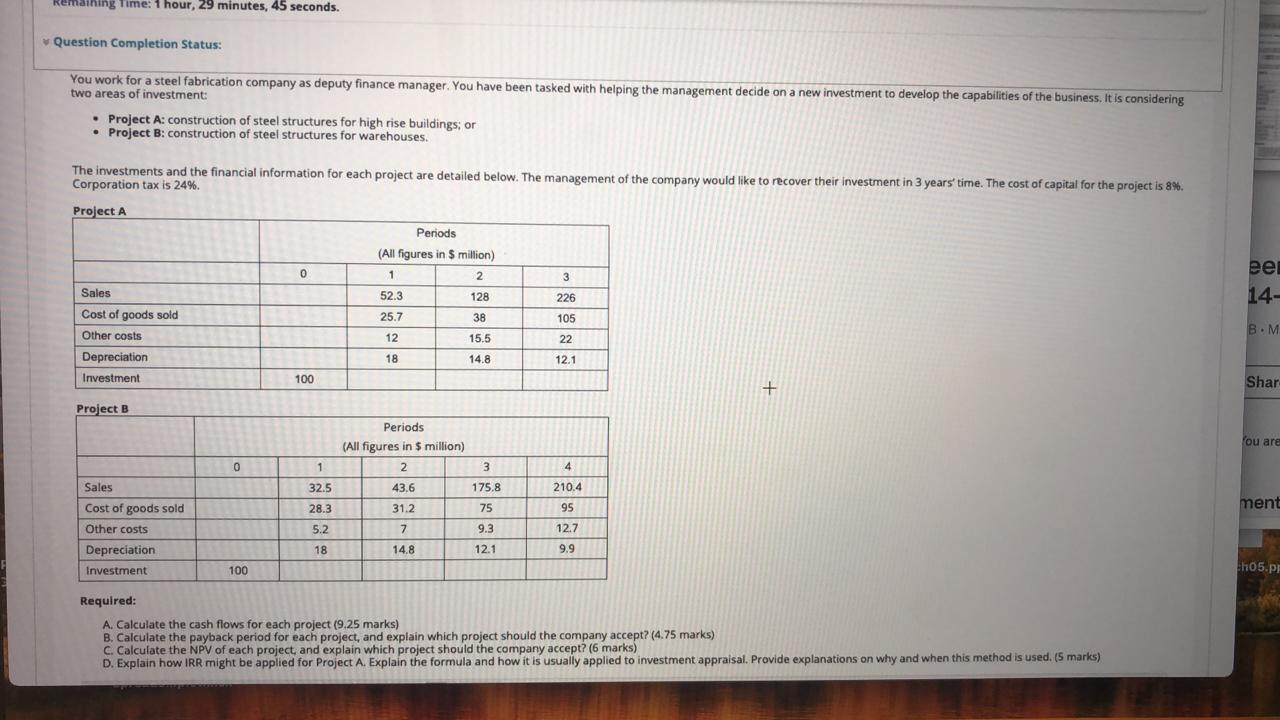

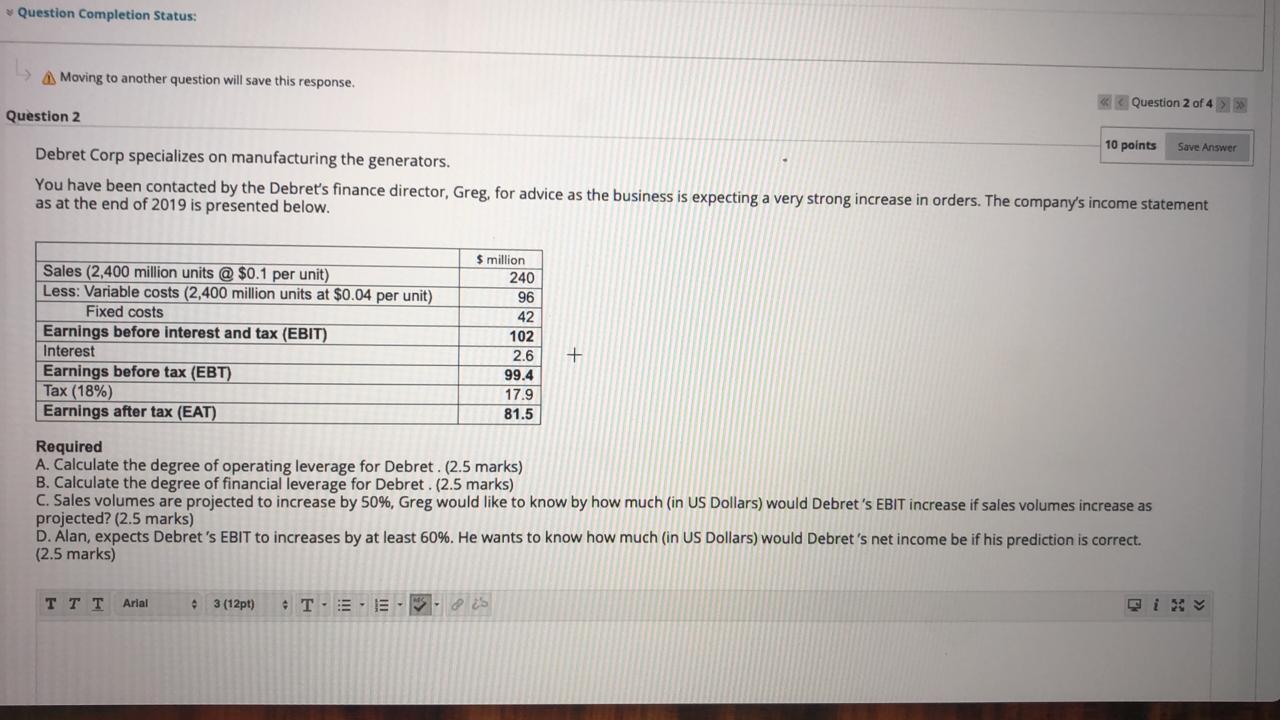

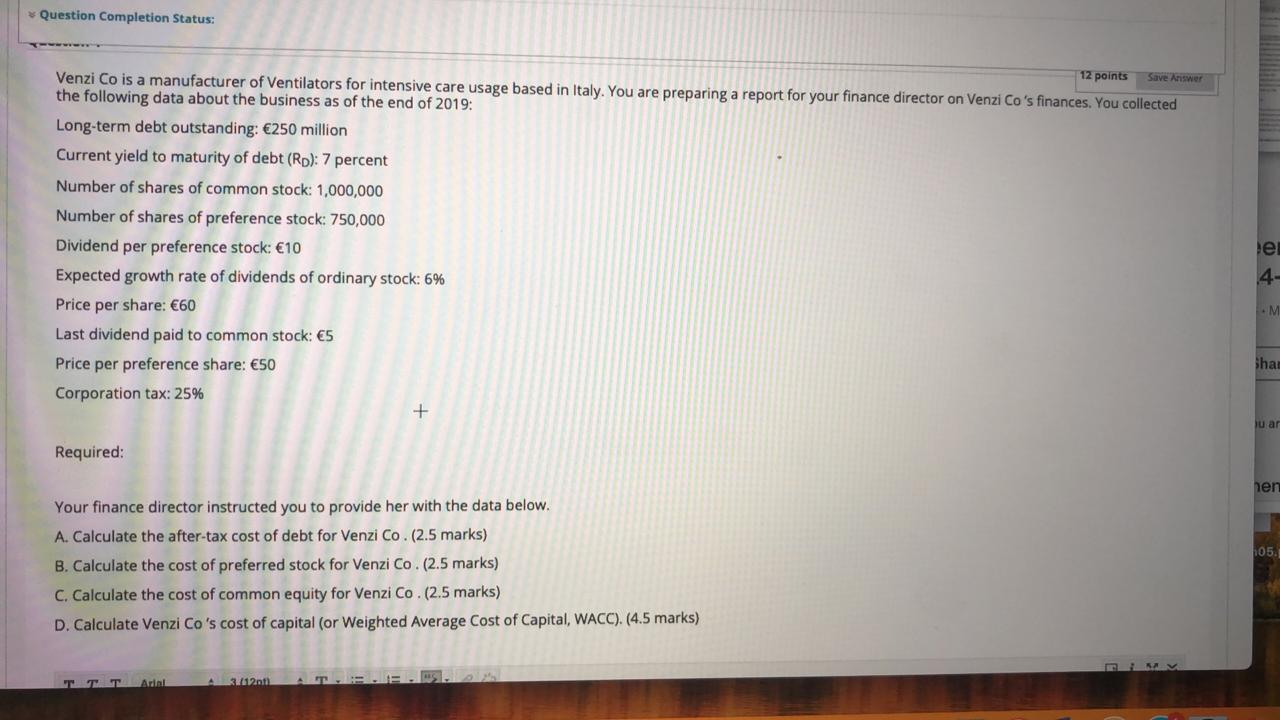

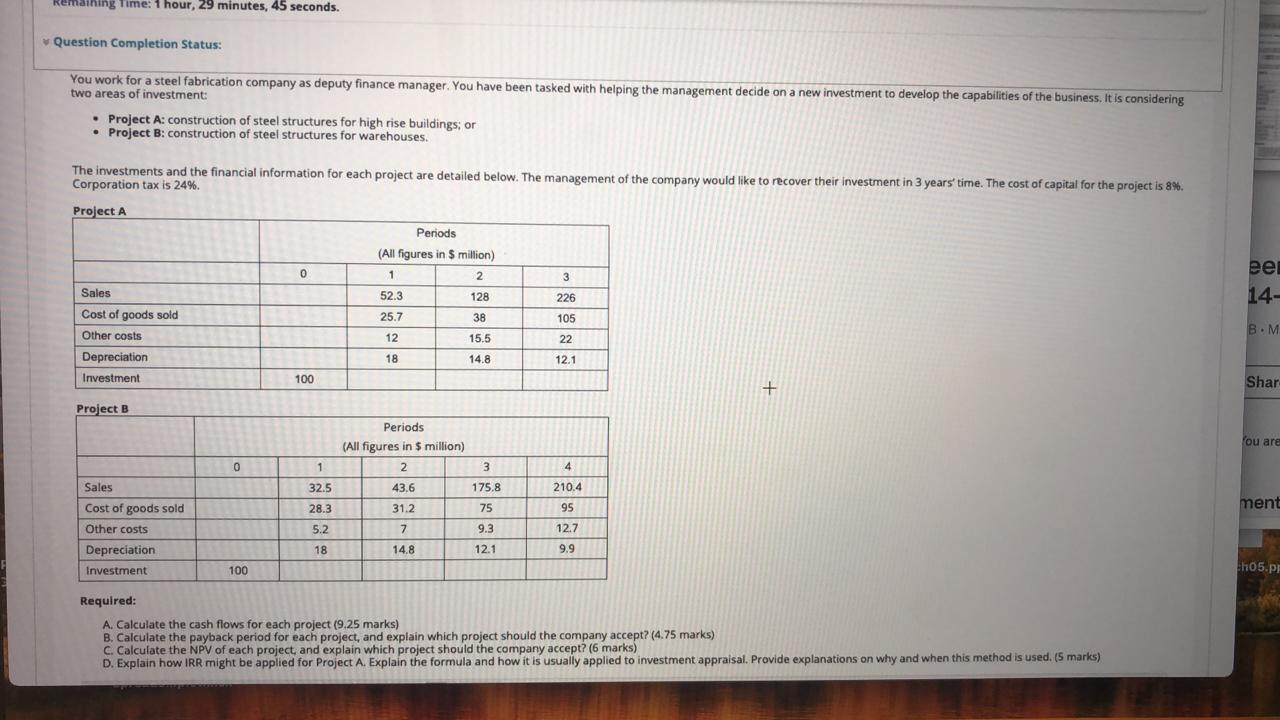

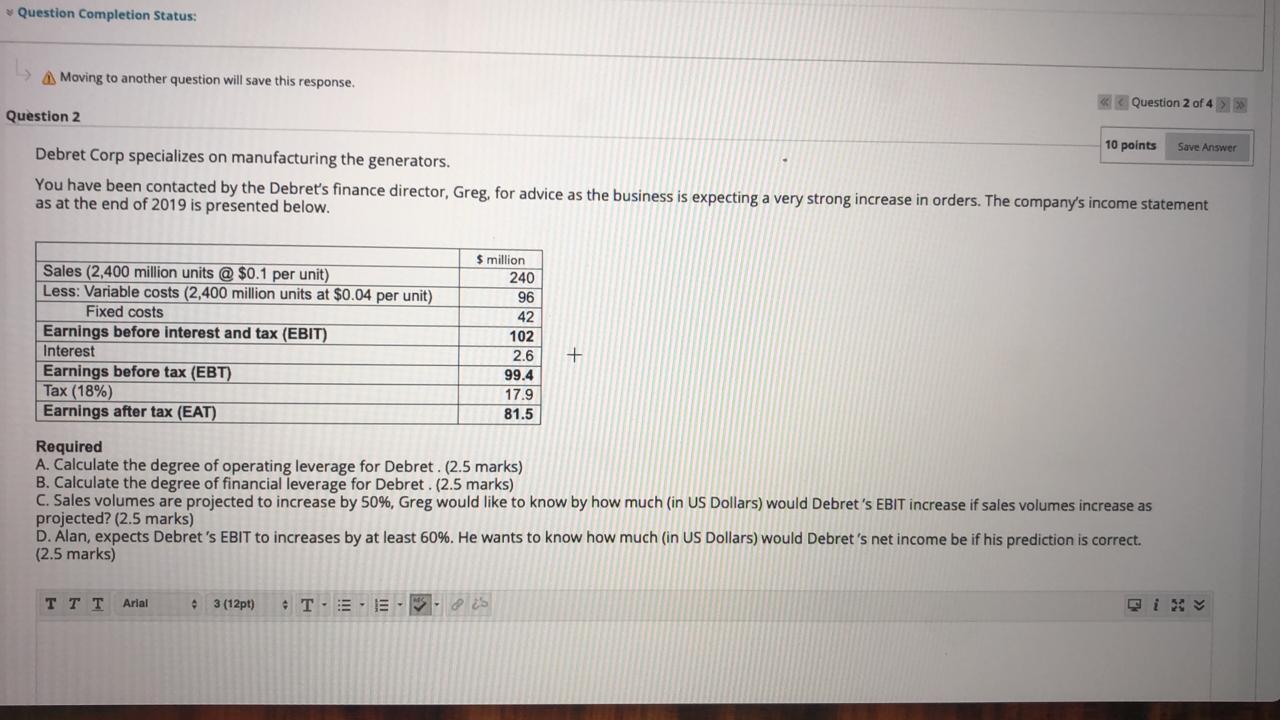

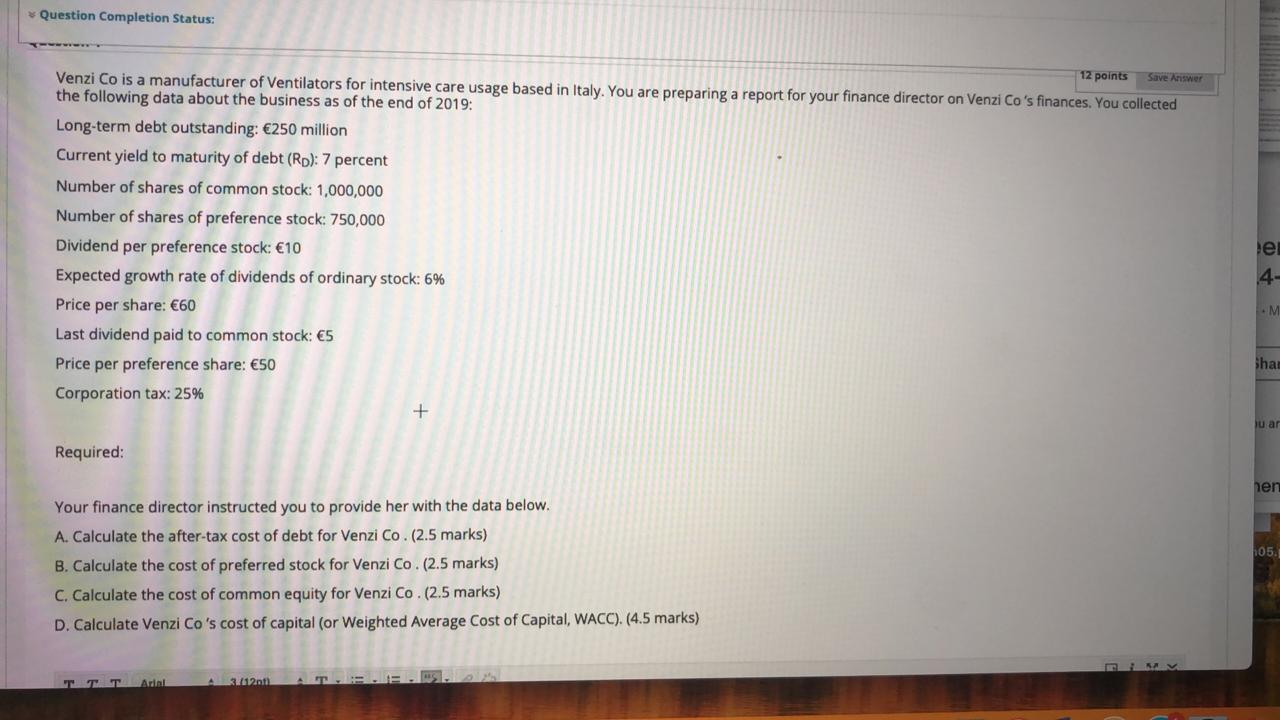

Remaining Time: 1 hour, 29 minutes, 45 seconds. Question Completion Status: You work for a steel fabrication company as deputy finance manager. You have been tasked with helping the management decide on a new investment to develop the capabilities of the business. It is considering two areas of investment: Project A: construction of steel structures for high rise buildings; or Project B: construction of steel structures for warehouses. The investments and the financial information for each project are detailed below. The management of the company would like to recover their investment in 3 years' time. The cost of capital for the project is 8%. Corporation tax is 24%. Project A Periods (All figures in 5 million) 1. 2 0 3 eer 14- 52.3 128 226 25.7 38 105 Sales Cost of goods sold Other costs Depreciation Investment B.M 12 15.5 22 18 14.8 12.1 100 + Shar Project B Periods (All figures in 5 million) 2 ou are 0 3 4 1 1 32.5 28.3 43.6 175.8 210.4 31.2 75 95 ment Sales Cost of goods sold Other costs Depreciation Investment 5.2 7 9.3 12.7 9.9 18 14.8 12.1 100 th05.PF Required: A. Calculate the cash flows for each project (9.25 marks) B. Calculate the payback period for each project, and explain which project should the company accept? (4.75 marks) C. Calculate the NPV of each project, and explain which project should the company accept? (6 marks) D. Explain how IRR might be applied for Project A. Explain the formula and how it is usually applied to investment appraisal. Provide explanations on why and when this method is used. (5 marks) Question Completion Status: Moving to another question will save this response. Question 2 of 4 >> Question 2 10 points Save Answer Debret Corp specializes on manufacturing the generators. You have been contacted by the Debret's finance director, Greg, for advice as the business is expecting a very strong increase in orders. The company's income statement as at the end of 2019 is presented below. Sales (2,400 million units @ $0.1 per unit) Less: Variable costs (2,400 million units at $0.04 per unit) Fixed costs Earnings before interest and tax (EBIT) Interest Earnings before tax (EBT) Tax (18%) Earnings after tax (EAT) $ million 240 96 42 102 2.6 99.4 17.9 81.5 + Required A. Calculate the degree of operating leverage for Debret . (2.5 marks) B. Calculate the degree of financial leverage for Debret. (2.5 marks) C. Sales volumes are projected to increase by 50%, Greg would like to know by how much (in US Dollars) would Debret's EBIT increase if sales volumes increase as projected? (2.5 marks) D. Alan, expects Debret's EBIT to increases by at least 60%. He wants to know how much (in US Dollars) would Debret's net income be if his prediction is correct. (2.5 marks) Arial . 3 (12pt) TE-ES-25 Question Completion Status: 12 points Save Answer Venzi Co is a manufacturer of Ventilators for intensive care usage based in Italy. You are preparing a report for your finance director on Venzi Co's finances. You collected the following data about the business as of the end of 2019: Long-term debt outstanding: 250 million Current yield to maturity of debt (Rp): 7 percent Number of shares of common stock: 1,000,000 Number of shares of preference stock: 750,000 Dividend per preference stock: 10 Expected growth rate of dividends of ordinary stock: 6% Price per share: 60 Last dividend paid to common stock: 5 Price per preference share: 50 Corporation tax: 25% + 4- .M sha juar Required: hen 105.1 Your finance director instructed you to provide her with the data below. A. Calculate the after-tax cost of debt for Venzi Co. (2.5 marks) B. Calculate the cost of preferred stock for Venzi Co. (2.5 marks) C. Calculate the cost of common equity for Venzi Co. (2.5 marks) D. Calculate Venzi Co's cost of capital (or Weighted Average Cost of Capital, WACC). (4.5 marks) Admi 2012 Remaining Time: 1 hour, 29 minutes, 45 seconds. Question Completion Status: You work for a steel fabrication company as deputy finance manager. You have been tasked with helping the management decide on a new investment to develop the capabilities of the business. It is considering two areas of investment: Project A: construction of steel structures for high rise buildings; or Project B: construction of steel structures for warehouses. The investments and the financial information for each project are detailed below. The management of the company would like to recover their investment in 3 years' time. The cost of capital for the project is 8%. Corporation tax is 24%. Project A Periods (All figures in 5 million) 1. 2 0 3 eer 14- 52.3 128 226 25.7 38 105 Sales Cost of goods sold Other costs Depreciation Investment B.M 12 15.5 22 18 14.8 12.1 100 + Shar Project B Periods (All figures in 5 million) 2 ou are 0 3 4 1 1 32.5 28.3 43.6 175.8 210.4 31.2 75 95 ment Sales Cost of goods sold Other costs Depreciation Investment 5.2 7 9.3 12.7 9.9 18 14.8 12.1 100 th05.PF Required: A. Calculate the cash flows for each project (9.25 marks) B. Calculate the payback period for each project, and explain which project should the company accept? (4.75 marks) C. Calculate the NPV of each project, and explain which project should the company accept? (6 marks) D. Explain how IRR might be applied for Project A. Explain the formula and how it is usually applied to investment appraisal. Provide explanations on why and when this method is used. (5 marks) Question Completion Status: Moving to another question will save this response. Question 2 of 4 >> Question 2 10 points Save Answer Debret Corp specializes on manufacturing the generators. You have been contacted by the Debret's finance director, Greg, for advice as the business is expecting a very strong increase in orders. The company's income statement as at the end of 2019 is presented below. Sales (2,400 million units @ $0.1 per unit) Less: Variable costs (2,400 million units at $0.04 per unit) Fixed costs Earnings before interest and tax (EBIT) Interest Earnings before tax (EBT) Tax (18%) Earnings after tax (EAT) $ million 240 96 42 102 2.6 99.4 17.9 81.5 + Required A. Calculate the degree of operating leverage for Debret . (2.5 marks) B. Calculate the degree of financial leverage for Debret. (2.5 marks) C. Sales volumes are projected to increase by 50%, Greg would like to know by how much (in US Dollars) would Debret's EBIT increase if sales volumes increase as projected? (2.5 marks) D. Alan, expects Debret's EBIT to increases by at least 60%. He wants to know how much (in US Dollars) would Debret's net income be if his prediction is correct. (2.5 marks) Arial . 3 (12pt) TE-ES-25 Question Completion Status: 12 points Save Answer Venzi Co is a manufacturer of Ventilators for intensive care usage based in Italy. You are preparing a report for your finance director on Venzi Co's finances. You collected the following data about the business as of the end of 2019: Long-term debt outstanding: 250 million Current yield to maturity of debt (Rp): 7 percent Number of shares of common stock: 1,000,000 Number of shares of preference stock: 750,000 Dividend per preference stock: 10 Expected growth rate of dividends of ordinary stock: 6% Price per share: 60 Last dividend paid to common stock: 5 Price per preference share: 50 Corporation tax: 25% + 4- .M sha juar Required: hen 105.1 Your finance director instructed you to provide her with the data below. A. Calculate the after-tax cost of debt for Venzi Co. (2.5 marks) B. Calculate the cost of preferred stock for Venzi Co. (2.5 marks) C. Calculate the cost of common equity for Venzi Co. (2.5 marks) D. Calculate Venzi Co's cost of capital (or Weighted Average Cost of Capital, WACC). (4.5 marks) Admi 2012