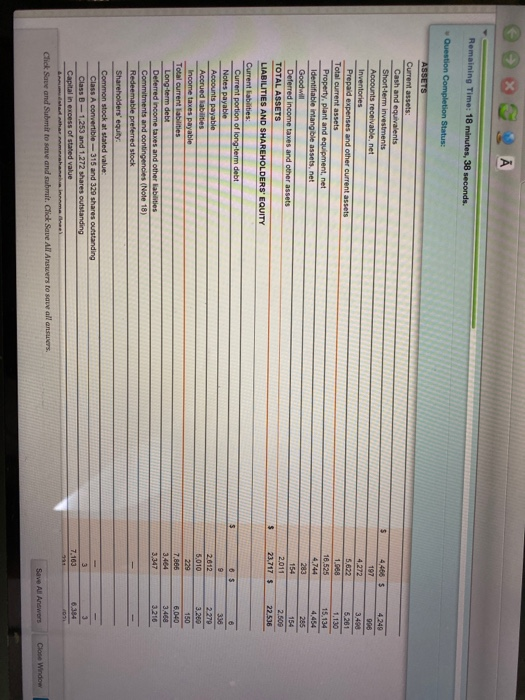

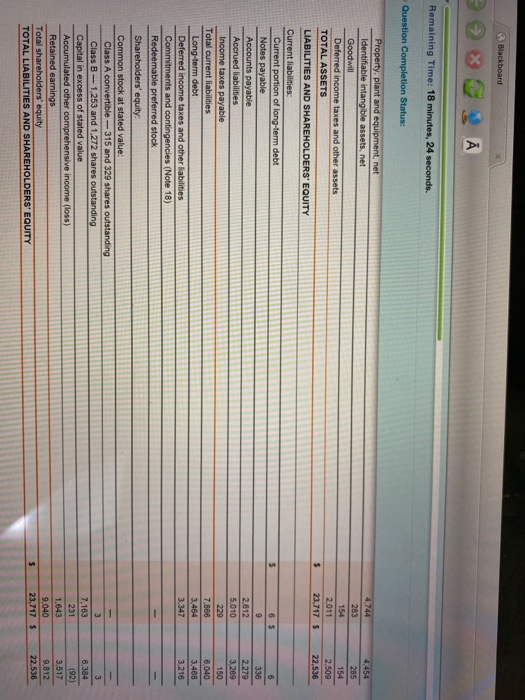

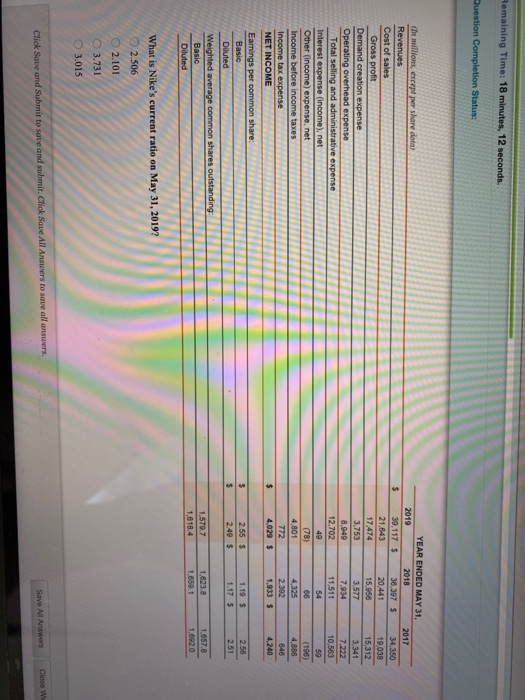

Remaining Time: 18 minutes, 38 seconds. Question Completion Status: $ 4249 998 4,466 S 197 4,272 5,822 1.968 16.525 4.744 283 154 2,011 23,717 $ 5.261 1.130 15,134 4.454 255 154 2,509 22,536 $ ASSETS Current assets: Cash and equivalents Short-term investments Accounts receivable, net Inventories Prepaid expenses and other current assets Total current assets Property, plant and equipment, net Identifiable intangible assets.net Goodwill Deferred income taxes and other assets TOTAL ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Current portion of long-term debt Notes payable Accounts payable Accrued abilities Income taxes payable Total current liabilities Long-term debt Deferred income taxes and other abilities Commitments and contingencies (Note 18) Redeemable preferred stock Shareholders' equity Common stock at stated value: Class A convertible 315 and 329 shares outstanding Class B-1.253 and 1.272 shares outstanding Capital in excess of stated value Acer har manchen im Click Save and Submit to se and submit. Click Save All Answers to swall answers. $ 05 9 2012 5,010 229 7,866 3,464 3,347 6 336 2.279 3,260 150 6040 3,468 3.216 3 7.103 6.384 Save All Antwors Close Window Blackboard Remaining Time: 18 minutes, 24 seconds. Question Completion Status: 4,744 283 154 2011 23.717 $ 4.454 285 154 2.509 22,536 $ $ Property, plant and equipment, net Identifiable intangible assets, net Goodwill Deferred income taxes and other assets TOTAL ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Current portion of long-term debt Notes payable Accounts payable Accrued liabilities Income taxes payable Total current liabilities Long-term debt Deferred income taxes and other liabilities Commitments and contingencies (Note 18) Redeemable preferred stock Shareholders' equity Common stock at stated value: Class A convertible-315 and 329 shares outstanding Class B - 1.253 and 1.272 shares outstanding Capital in excess of stated value Accumulated other comprehensive income (loss) Retained earnings Total shareholders' equity TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 6 $ 9 2.612 5,010 229 7.866 3,464 3,347 338 2.279 3.269 150 6,040 3,468 3.216 3 7,163 231 1.643 9,040 23,717 S 3 6,384 (92) 3,517 9,812 22,536 $ Remaining Time: 18 minutes, 12 seconds. Question Completion Status: $ in millions, except pur share data) Revenues Cost of sales Gross profit Demand creation expense Operating overhead expense Total selling and administrative expense Interest expense (income), net Other (income) expense, net Income before income taxes Income tax expense NET INCOME Earnings per common share: Basic Diluted YEAR ENDED MAY 31, 2019 2018 39,117 $ 36,397 S 21.643 20,441 17 474 15,956 3,753 3.577 8.949 7,934 12.702 11.511 49 54 (78) 66 4,801 4,325 772 2.392 4,029 $ 1,933 2017 34,350 19.038 15.312 3.341 7,222 10,583 59 4.886 846 4.240 $ $ 2.555 2.49 $ 1.19 $ 1.175 2.58 2.51 $ Weighted average common shares outstanding Basic Diluted 1.579.7 1,6184 1,623.8 1,6591 1.657.8 1.8920 What is Nike's current ratio on May 31, 2019? 2.506 2.101 3.731 3.015 Click Save and Submit to save and submit. Click Save All Answers to save all answers, Save All Answers Close w