Answered step by step

Verified Expert Solution

Question

1 Approved Answer

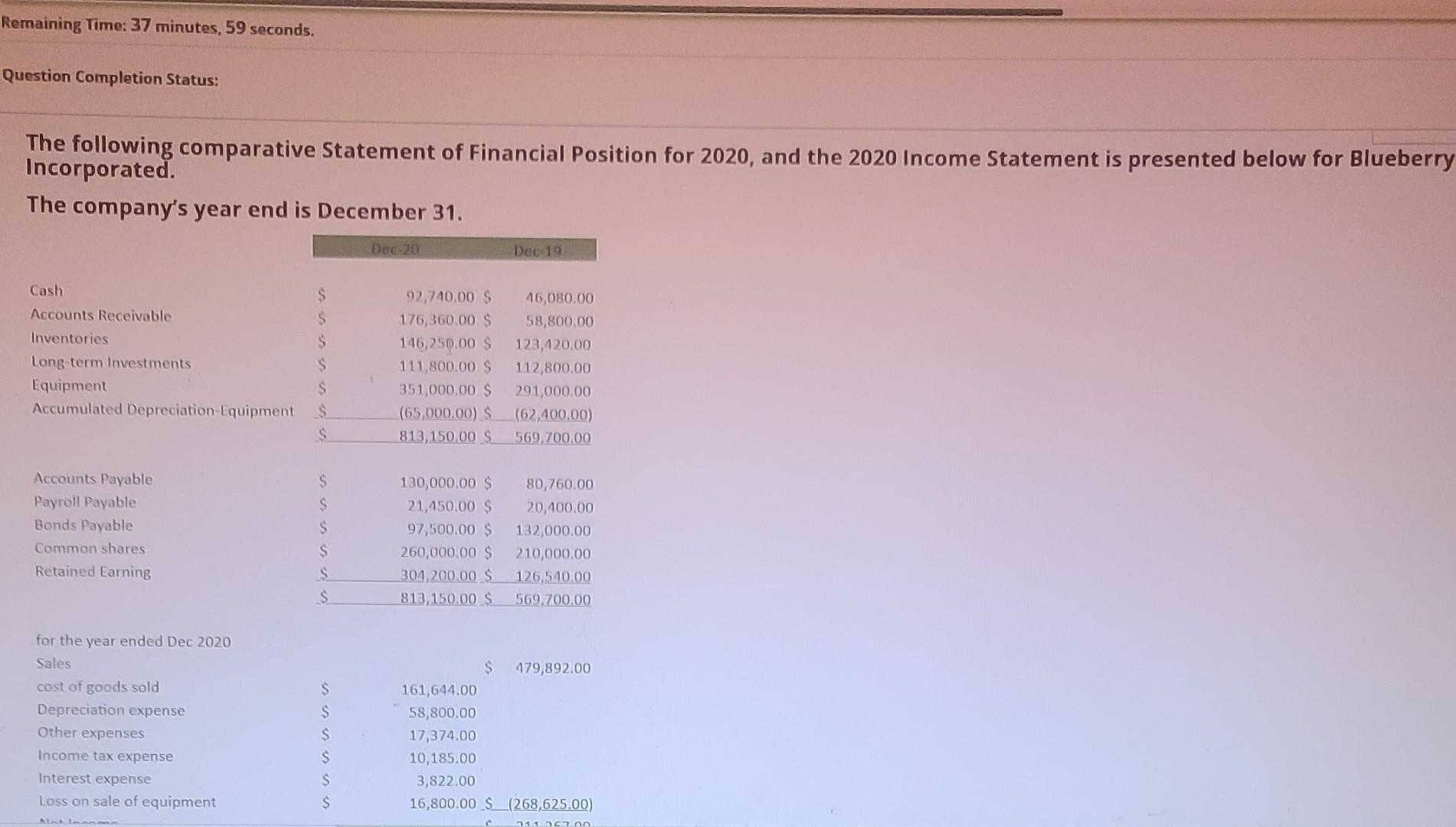

Remaining Time: 37 minutes, 59 seconds. Question Completion Status: The following comparative Statement of Financial Position for 2020, and the 2020 Income Statement is presented

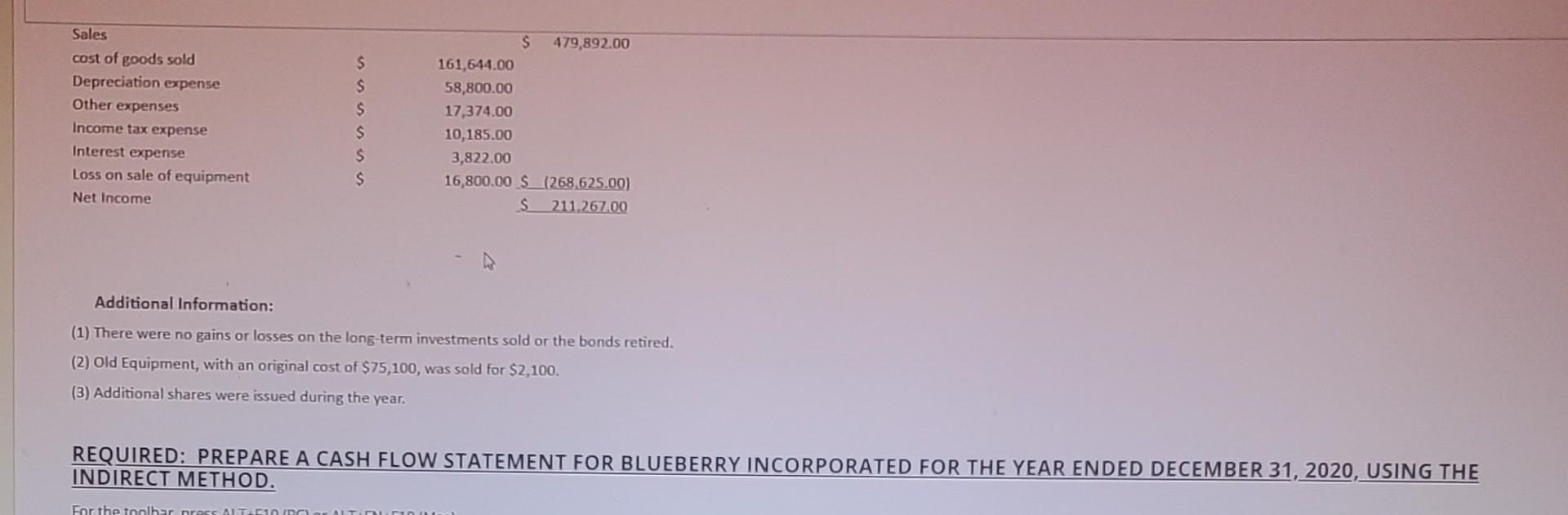

Remaining Time: 37 minutes, 59 seconds. Question Completion Status: The following comparative Statement of Financial Position for 2020, and the 2020 Income Statement is presented below for Blueberry Incorporated. The company's year end is December 31. Dec-20 Dec-19 $ $ S Cash Accounts Receivable Inventories Long-term Investments Equipment Accumulated Depreciation Equipment S S S S 92,740.00 $ 176,360.00 $ 146,250.00 $ 111,800.00 $ 351,000.00 $ (65,000.00) 813,150.00 $ 16,080.00 58,800.00 123,420.00 112,800.00 291,000.00 (62,400.00) 569,700.00 Accounts Payable Payroll Payable Bonds Payable Common shares Retained Earning $ S $ S s S 130,000.00 $ 21,450.00 $ 97,500.00 $ 260,000.00 $ 304,200.00 $ 813,150.00 $ 80,760.00 20,400.00 132,000.00 210,000.00 126,540.00 569,700.00 $ for the year ended Dec 2020 Sales cost of goods sold Depreciation expense Other expenses Income tax expense Interest expense Loss on sale of equipment S S 479,892.00 161,644.00 58,800.00 17,374.00 10,185.00 3,822.00 16,800.00 $_(268,625.00) $ $ $ 11 DA Sales cost of goods sold Depreciation expense Other expenses Income tax expense Interest expense Loss on sale of equipment Net Income $ $ $ s $ s 479,892.00 161,644.00 58,800.00 17,374.00 10,185.00 3,822.00 16,800.00 S_(268,625.00) S 211,267.00 Additional Information: (1) There were no gains or losses on the long-term investments sold or the bonds retired. (2) Old Equipment, with an original cost of $75,100, was sold for $2,100. (3) Additional shares were issued during the year. REQUIRED: PREPARE A CASH FLOW STATEMENT FOR BLUEBERRY INCORPORATED FOR THE YEAR ENDED DECEMBER 31, 2020, USING THE INDIRECT METHOD. For the toolhar pres

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started