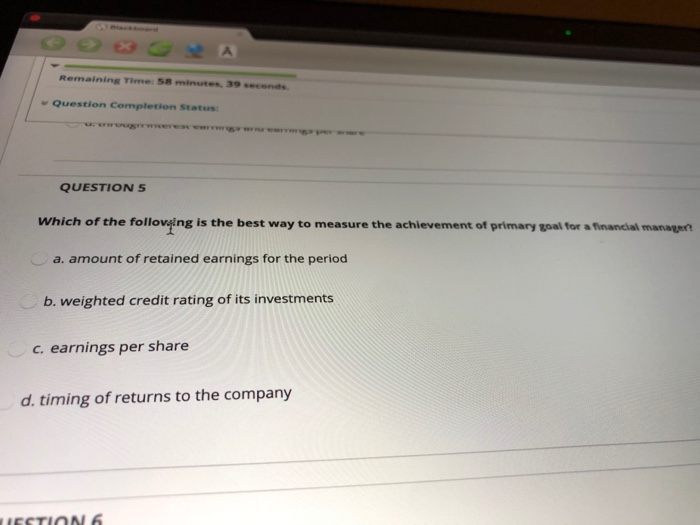

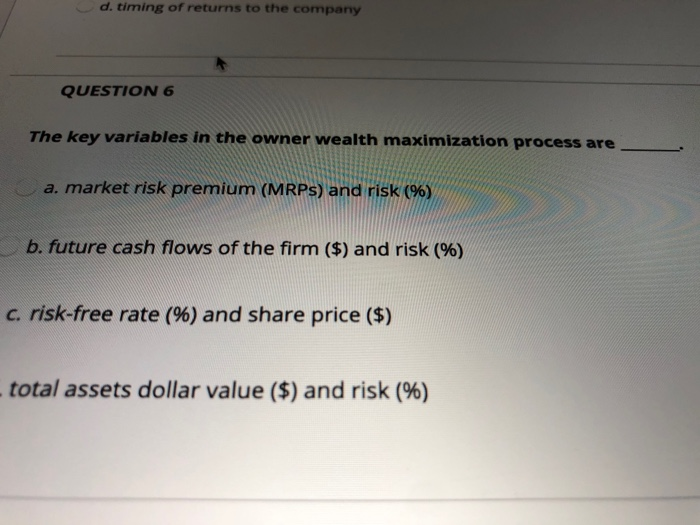

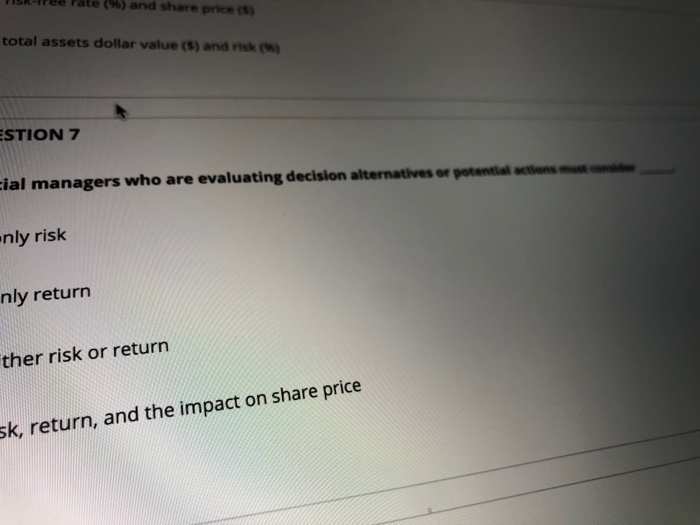

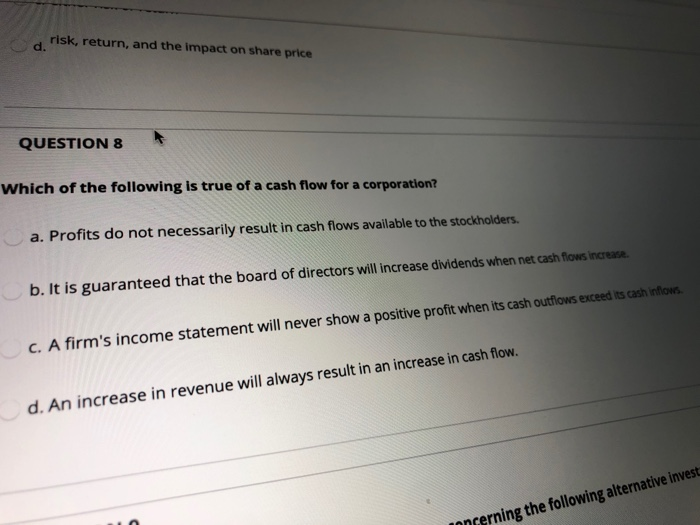

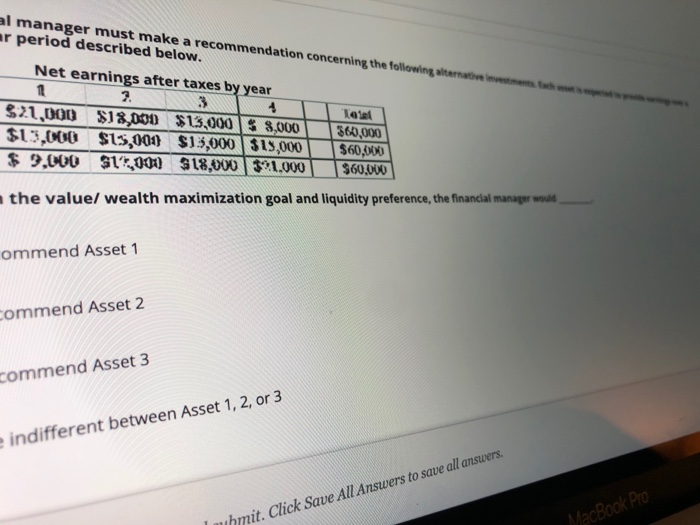

Remaining Time: 58 minutes, 39 seconds Question completion Status QUESTIONS Which of the folloveing is the best way to measure the achievement of primary goal for a financial manager a. amount of retained earnings for the period b. weighted credit rating of its investments c. earnings per share d. timing of returns to the company TESTION 6 d. timing of returns to the company QUESTION 6 The key variables in the owner wealth maximization process are a. market risk premium (MRPs) and risk (%) b. future cash flows of the firm ($) and risk (%) c. risk-free rate (%) and share price ($) total assets dollar value ($) and risk (%) (%) and share price (5) total assets dollar value (5) and risk ESTION 7 cial managers who are evaluating decision alternatives or potential actions nly risk nly return ther risk or return sk, return, and the impact on share price risk, return, and the impact on share price d. QUESTION 8 Which of the following is true of a cash flow for a corporation? a. Profits do not necessarily result in cash flows available to the stockholders. b. It is guaranteed that the board of directors will increase dividends when net cash flows increase c. A firm's income statement will never show a positive profit when its cash outflows exceed its cash intows. d. An increase in revenue will always result in an increase in cash flow. moncerning the following alternative invest al manager must make a recommendation concerning the following alternatievements ar period described below. Net earnings after taxes by year Tel 1 2. 3 4 $21,000 $18,000 $13,000 3 8.000 $13,000 $15,000 $13,000 315,000 $ 7,000 $13,000 $18,000 371.000 3600,000 $60,000 $60.000 the value/ wealth maximization goal and liquidity preference, the financial manager would ommend Asset 1 commend Asset 2 commend Asset 3 e indifferent between Asset 1, 2, or 3 ihmit. Click Save All Answers to save all answers. MacBook Pro Remaining Time: 58 minutes, 39 seconds Question completion Status QUESTIONS Which of the folloveing is the best way to measure the achievement of primary goal for a financial manager a. amount of retained earnings for the period b. weighted credit rating of its investments c. earnings per share d. timing of returns to the company TESTION 6 d. timing of returns to the company QUESTION 6 The key variables in the owner wealth maximization process are a. market risk premium (MRPs) and risk (%) b. future cash flows of the firm ($) and risk (%) c. risk-free rate (%) and share price ($) total assets dollar value ($) and risk (%) (%) and share price (5) total assets dollar value (5) and risk ESTION 7 cial managers who are evaluating decision alternatives or potential actions nly risk nly return ther risk or return sk, return, and the impact on share price risk, return, and the impact on share price d. QUESTION 8 Which of the following is true of a cash flow for a corporation? a. Profits do not necessarily result in cash flows available to the stockholders. b. It is guaranteed that the board of directors will increase dividends when net cash flows increase c. A firm's income statement will never show a positive profit when its cash outflows exceed its cash intows. d. An increase in revenue will always result in an increase in cash flow. moncerning the following alternative invest al manager must make a recommendation concerning the following alternatievements ar period described below. Net earnings after taxes by year Tel 1 2. 3 4 $21,000 $18,000 $13,000 3 8.000 $13,000 $15,000 $13,000 315,000 $ 7,000 $13,000 $18,000 371.000 3600,000 $60,000 $60.000 the value/ wealth maximization goal and liquidity preference, the financial manager would ommend Asset 1 commend Asset 2 commend Asset 3 e indifferent between Asset 1, 2, or 3 ihmit. Click Save All Answers to save all answers. MacBook Pro