Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Remaining Time: 59 minutes, 15 seconds. A Question Completion Status: 8 9 10 11 12 Moving to another question will save this response. Question

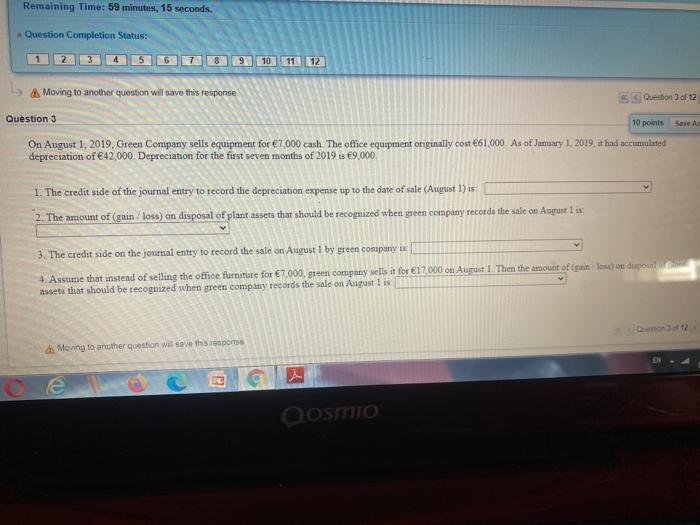

Remaining Time: 59 minutes, 15 seconds. A Question Completion Status: 8 9 10 11 12 Moving to another question will save this response. Question 3 Question 3 of 12 10 points Save Am On August 1, 2019, Green Company sells equipment for 7,000 cash The office equipment originally cost 61,000. As of January 1, 2019, it had accumulated depreciation of 42,000. Depreciation for the first seven months of 2019 is 9,000 1. The credit side of the journal entry to record the depreciation expense up to the date of sale (August 1) is 2. The amount of (gain/loss) on disposal of plant assets that should be recognized when green company records the sale on August 1 is 3. The credit side on the journal entry to record the sale on August 1 by green company is 4. Assume that instead of selling the office furniture for 7,000, green company sells it for 17.000 on August 1. Then the amount of (gain/loss) on disposal assets that should be recognized when green company records the sale on August 1 is Moving to another question will save this response e Qosmio Question 3 of 12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started