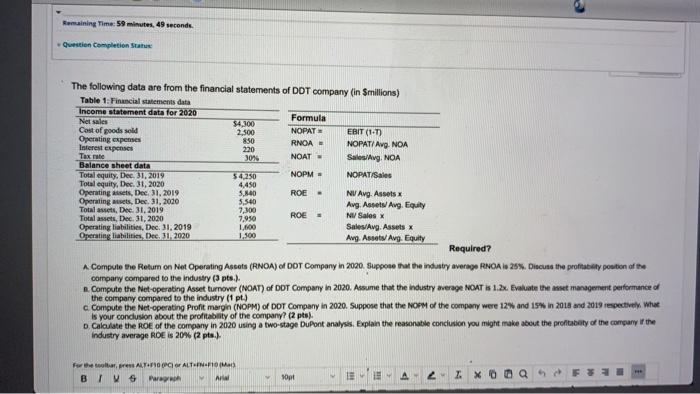

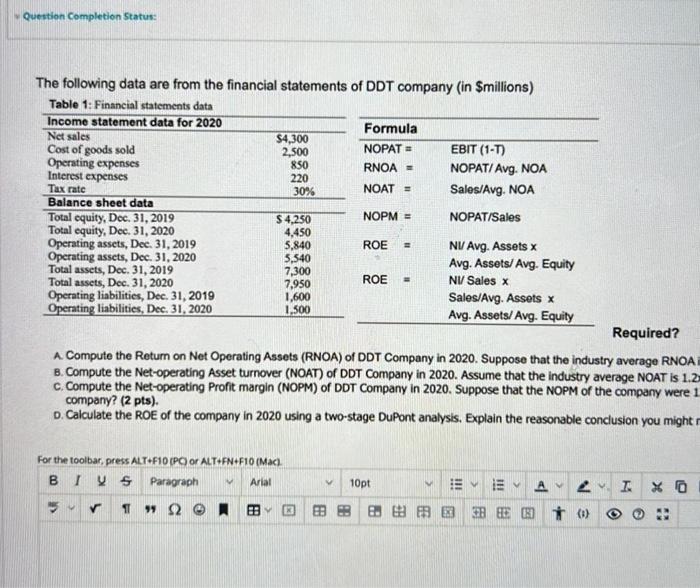

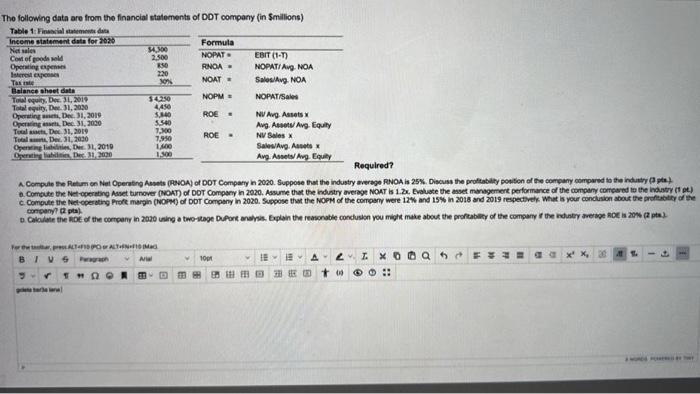

Remaining Time: 59 minutes, 49 seconds. Question Completion Status - The following data are from the financial statements of DOT company (in millions) Table 1: Financial statements data Income statement data for 2020 Formula Net sales 54.300 Cost of goods sold 2.500 NOPAT EBIT (1-T) Operating expenses 850 RNOA Interest Expenses 220 NOPATI Avg. NOA Tax rate 30% NOAT SalesAvgNOA Balance sheet data Total equity, Dec 31, 2019 54.250 NOPM - NOPAT/Sales Total equity, Dec 31, 2020 4.450 Operating sets, Dec 31, 2019 5,840 ROE NV Avg. Assets Operating sets, Dec 31, 2020 5,540 Avg. Assets Avg. Equity Total assets, Dec 31, 2019 7,300 Total assets, Dec 31, 2020 7.950 ROE NW Sales Operating liabilities, Dec 31, 2019 1.100 Sales/Avg. Assets Operating liabilities, Dec.31.2020 1,500 Ang Asset Avg. Equity Required? Computo the Retum on Net Operating Ascats (RNOA) of DOT Company in 2020. Suppone that the industry average RNA 25%. Discuss the profitability pontion of the company compared to the industry (3pts.) Compute the Net operating Asset turnover (NOAT) of DOT Company in 2020. Assume that the industry average NOT is 1.2X. Evaluate the asset management performance of the company compared to the industry (1 pt) c Compute the Net operating profit margin (NOPM) of DOT Company in 2020. Suppose that the NOPM of the comperry were 12% and 15% in 2018 and 2019 respective Whee is your conclusion about the profitability of the company? (2 pts). Calculate the ROE of the company in 2020 using a two-stage DuPont analysis. Explain the reasonable conclusion you might make about the profitability of the company the industry average ROE is 20% (2 pts... for the warren ALT PALTH INFO BIVS Pro AW opt XX Question Completion Status: The following data are from the financial statements of DDT company (in Smillions) Table 1: Financial statements data Income statement data for 2020 Formula Net sales $4,300 Cost of goods sold 2,500 NOPAT = EBIT (1-T) Operating expenses 850 RNOA = NOPAT/ Avg. NOA Interest expenses 220 Tax rate 30% NOAT = Sales/Avg. NOA Balance sheet data Total equity, Dec. 31, 2019 $ 4,250 NOPM = NOPAT/Sales Total equity, Dec 31, 2020 4.450 Operating assets, Dec. 31, 2019 5,840 ROE NI Avg. Assets Operating assets, Dec. 31, 2020 5,540 Total assets, Dec 31, 2019 Avg. Assets/ Avg. Equity 7,300 ROE Total assets, Dec. 31, 2020 7,950 NI/ Sales x Operating liabilities, Dec. 31, 2019 1,600 Sales/Avg. Assets Operating liabilities, Dec. 31, 2020 1,500 Avg. Assets/ Avg. Equity Required? A Compute the Return on Net Operating Assets (RNOA) of DDT Company in 2020. Suppose that the industry average RNOA B. Compute the Net-operating Asset turnover (NOAT) of DDT Company in 2020. Assume that the industry average NOAT is 1.2 c. Compute the Net-operating Profit margin (NOPM) of DDT Company in 2020. Suppose that the NOPM of the company were 1 company? (2 pts). D. Calculate the ROE of the company in 2020 using a two-stage DuPont analysis, Explain the reasonable conclusion you might For the toolbar, press ALT+F10 PC or ALT+FN+F10 (Maci. BTV 5 Paragraph Arial V v 10pt E A IX 1 1 B. 98 E ) The following data are from the financial statements of DDT company in Smillions) Table 1: Financial statemente data Income statement data for 2020 Formula Net sales SMO Cowl of de 2.500 NOPAT EBIT (1-T) Operating 356 RNOA steps NOPAT/Avg. NOA 220 Tax son NOAT- Sales Avg. NOA Balance sheet dat Tits Des 2017 S250 NOPME NOPAT/ Total equity, De 31,2030 4,450 Operating Dec. 31, 2019 ROE NV Avg Assets Opening Dec. 31.2000 S540 Tools, Dec 31, 2019 7.00 Avg Asset Avg. Equity Tolc, D. 31,2030 7,950 ROE - NV Sales Operglis, De 11, 2010 140 Sales Avg. Assets Der beste 11.2000 Ang Assets) Avg Equity Required? A Compute the Relum on Net Operating Ass (NOA) of DOT Company in 2020. Suppose that the industry average RNOA IS 25%. Discuss the profitability position of the company compared to the industry Compute the eterno Aset turnover (NOAT) of DOT Company in 2020. Assume that the industry average NOAT I8 1.2x Evaluate the asset management performance of the company compared to the industry) c. Compute the Net operating profit margin (NOM) of DOT Company in 2020. Suppose that the NOPM of the company were 12 and 15% in 2018 and 2019 respectively. What is your conclusion about the prototy of the company Calculate the role of the company in 2020 using a two-stage Dufort www.Explain the reasonable conduson you might make about the profile of the company the average HOEN 20 APO AMG BIVS NU THQA DED IXO 1001 BA 2 Ht