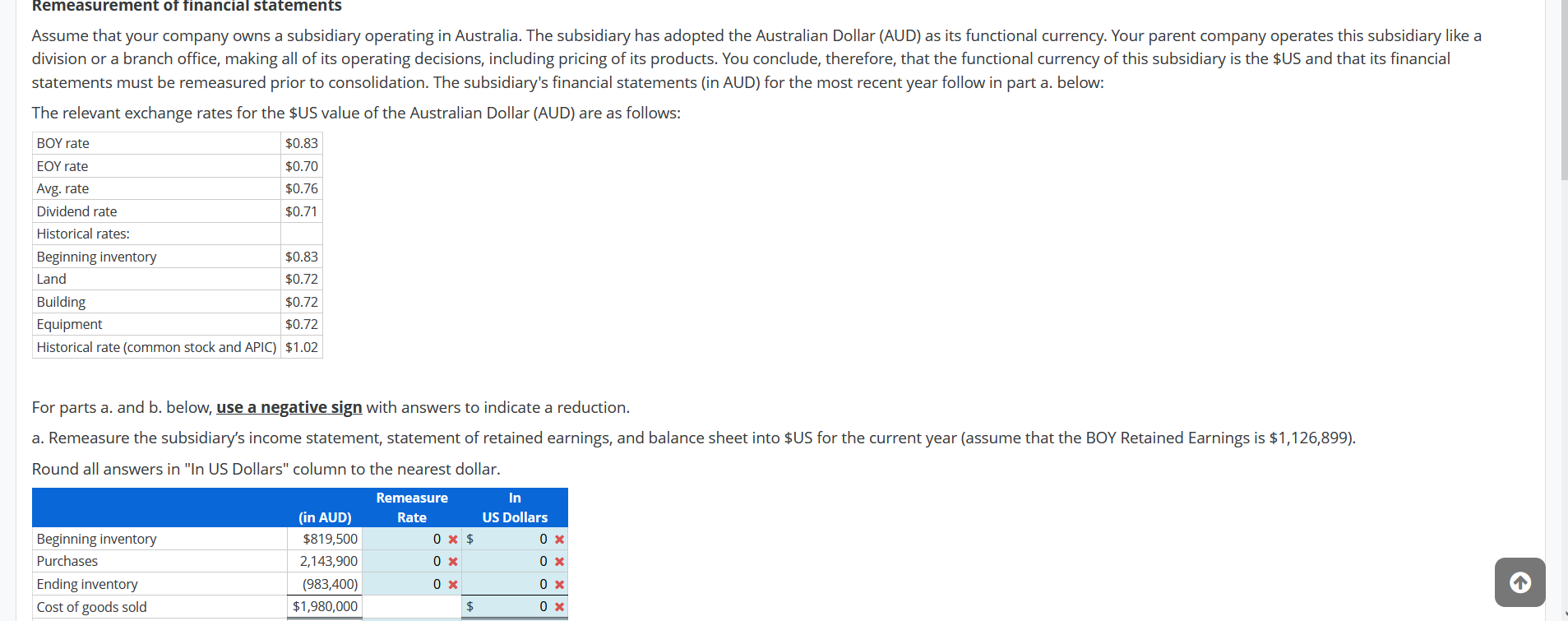

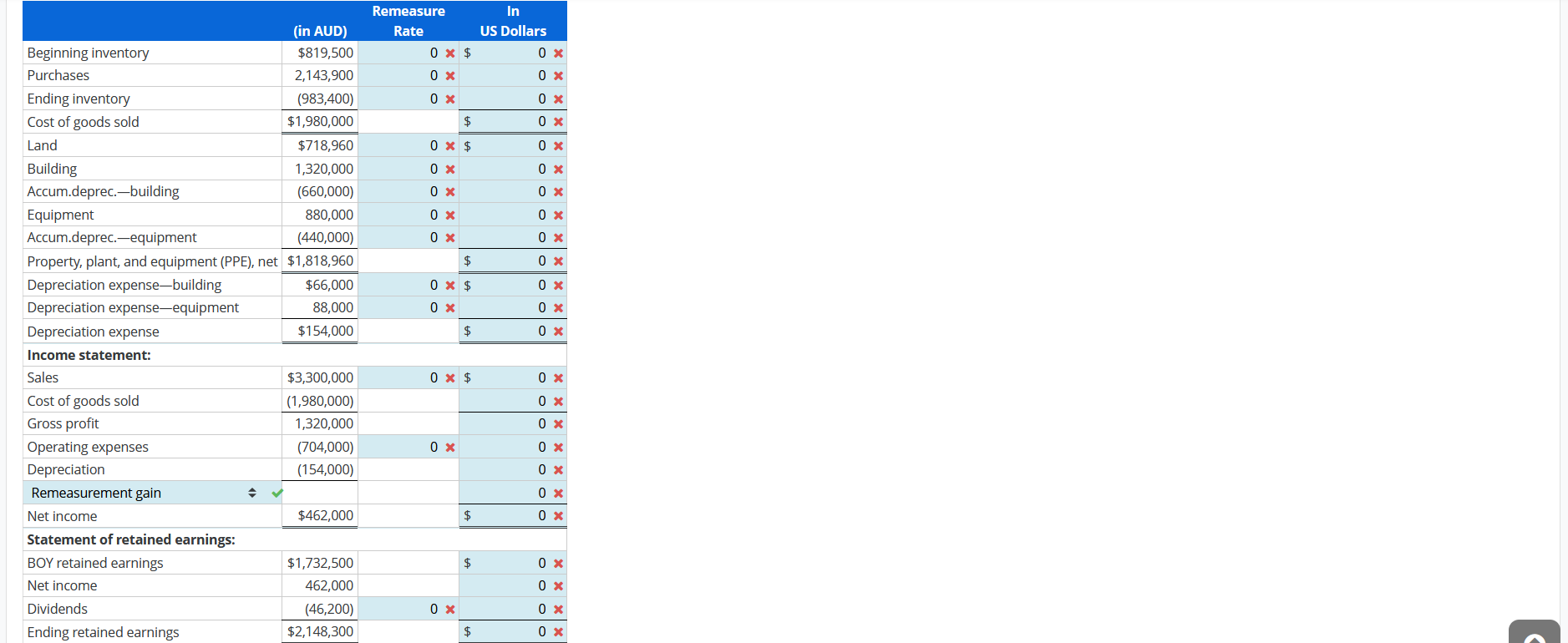

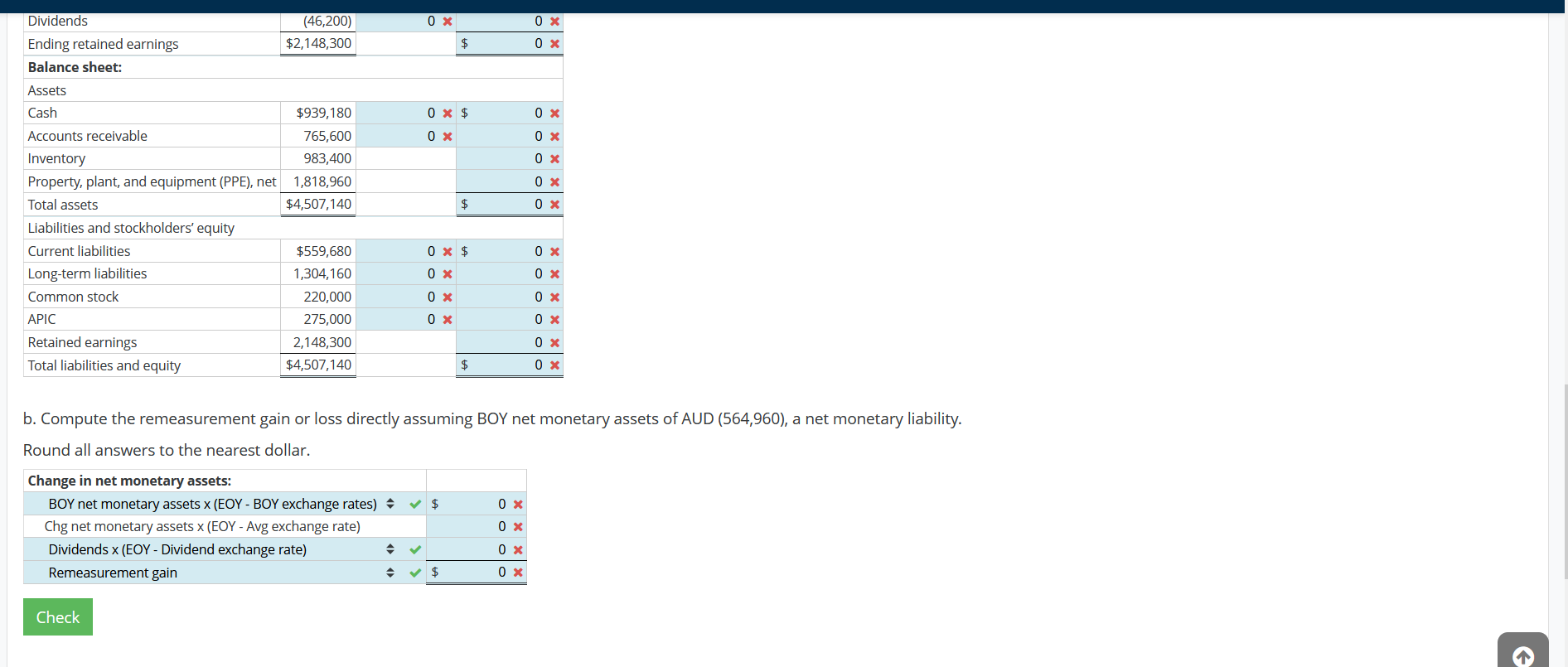

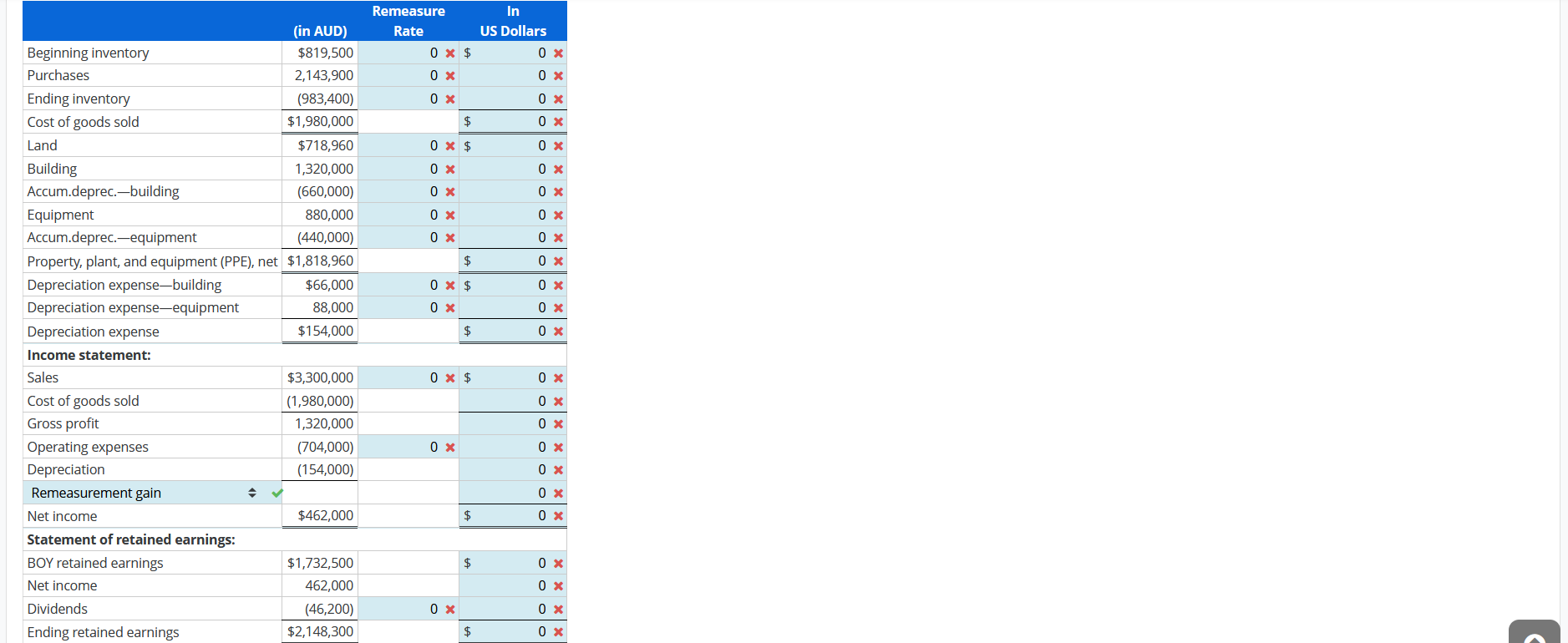

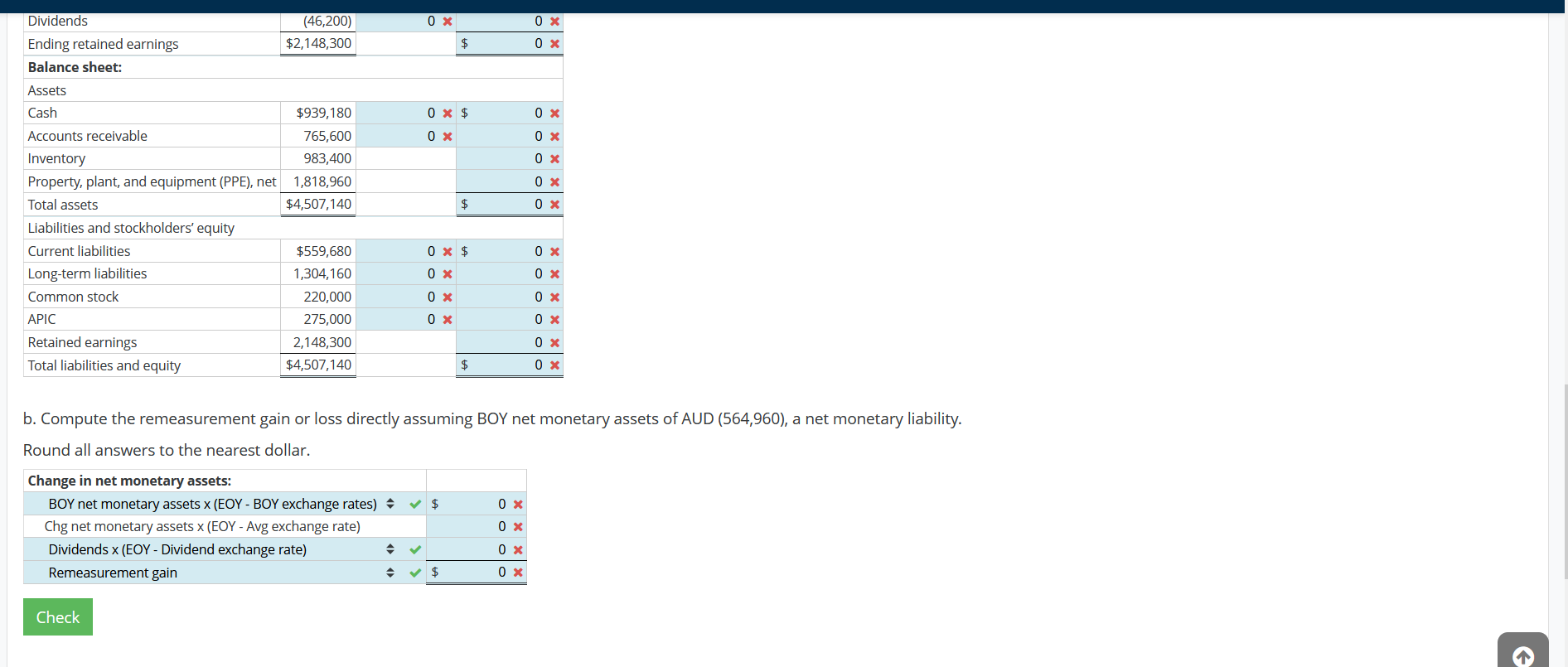

Remeasurement of financial statements Assume that your company owns a subsidiary operating in Australia. The subsidiary has adopted the Australian Dollar (AUD) as its functional currency. Your parent company operates this subsidiary like a division or a branch office, making all of its operating decisions, including pricing of its products. You conclude, therefore, that the functional currency of this subsidiary is the $US and that its financial statements must be remeasured prior to consolidation. The subsidiary's financial statements (in AUD) for the most recent year follow in part a. below: The relevant exchange rates for the $US value of the Australian Dollar (AUD) are as follows: BOY rate $0.83 EOY rate $0.70 Avg. rate $0.76 Dividend rate $0.71 Historical rates: Beginning inventory $0.83 Land $0.72 Building $0.72 Equipment $0.72 Historical rate (common stock and APIC) $1.02 For parts a. and b. below, use a negative sign with answers to indicate a reduction. a. Remeasure the subsidiary's income statement, statement of retained earnings, and balance sheet into $US for the current year (assume that the BOY Retained Earnings is $1,126,899). Round all answers in "In US Dollars" column to the nearest dollar. Remeasure Rate In US Dollars 0 x $ 0 x (in AUD) $819,500 2,143,900 (983,400) $1,980,000 OX Beginning inventory Purchases Ending inventory Cost of goods sold 0 x 0 x 0 x $ 0 x Remeasure Rate In US Dollars 0 X $ 0 x 0 x 0 x 0 x OX $ 0 x 0 x $ 0 x 0 x 0 x 0 x 0 x 0 x OX 0 x 0 x $ 0 x 0 X 0 x $ OX 0 X (in AUD Beginning inventory $819,500 Purchases 2,143,900 Ending inventory (983,400) Cost of goods sold $1,980,000 Land $718,960 Building 1,320,000 Accum.deprec.building (660,000) Equipment 880,000 Accum.deprec.-equipment (440,000) Property, plant, and equipment (PPE), net $1,818,960 Depreciation expense-building $66,000 Depreciation expense-equipment 88,000 Depreciation expense $154,000 Income statement: Sales $3,300,000 Cost of goods sold (1,980,000) Gross profit 1,320,000 Operating expenses (704,000) Depreciation (154,000) Remeasurement gain Net income $462,000 Statement of retained earnings: BOY retained earnings $1,732,500 Net income 462,000 Dividends (46,200) Ending retained earnings $2,148,300 $ 0 X 0 * $ 0 x OX 0X 0 x 0X 0 x 0 x $ 0 x $ OX 0 X OX 0 x $ 0 x OX 0 x $ 0 x 0 x $ OX OX 0 x 0 x OX Dividends (46,200) Ending retained earnings $2,148,300 Balance sheet: Assets Cash $939,180 Accounts receivable 765,600 Inventory 983,400 Property, plant, and equipment (PPE), net 1,818,960 Total assets $4,507,140 Liabilities and stockholders' equity Current liabilities $559,680 Long-term liabilities 1,304,160 Common stock 220,000 APIC 275,000 Retained earnings 2,148,300 Total liabilities and equity $4,507,140 $ 0 x 0 x $ 0 x 0 X 0 X OX 0 X 0 x 0x 0X $ 0 x b. Compute the remeasurement gain or loss directly assuming BOY net monetary assets of AUD (564,960), a net monetary liability. Round all answers to the nearest dollar. $ OX Change in net monetary assets: BOY net monetary assets x (EOY - BOY exchange rates) Chg net monetary assets x (EOY - Avg exchange rate) Dividends x (EOY - Dividend exchange rate) Remeasurement gain 0 x 0 x $ 0 x Check