Answered step by step

Verified Expert Solution

Question

1 Approved Answer

REMEMBER. I NEED RED TEXT TO BE SOLVED. THANKS CHEGGEEE Question No. 2: (105) MJ Electronics Company's actual sales and purchases for April and May

REMEMBER. I NEED RED TEXT TO BE SOLVED. THANKS CHEGGEEE

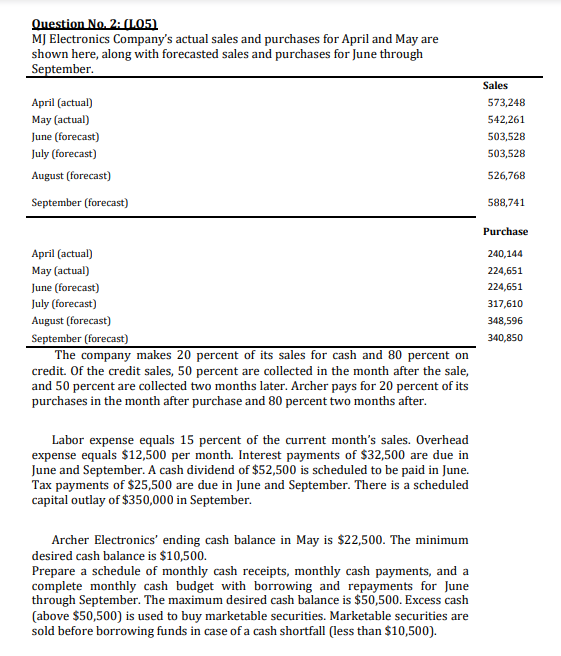

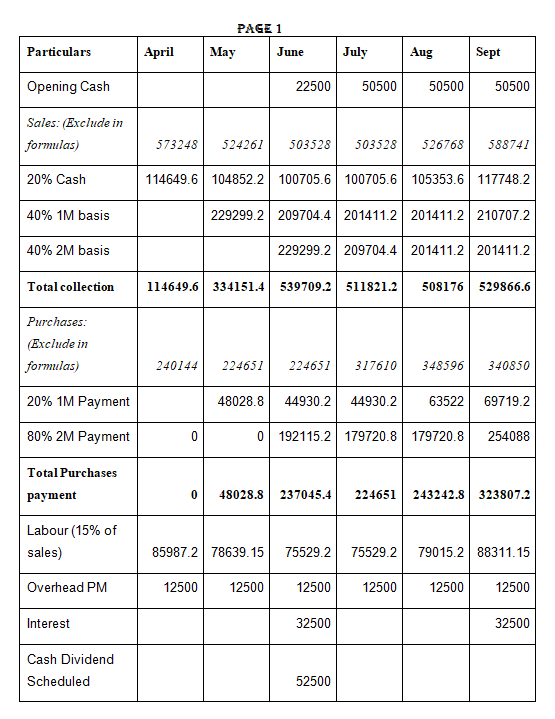

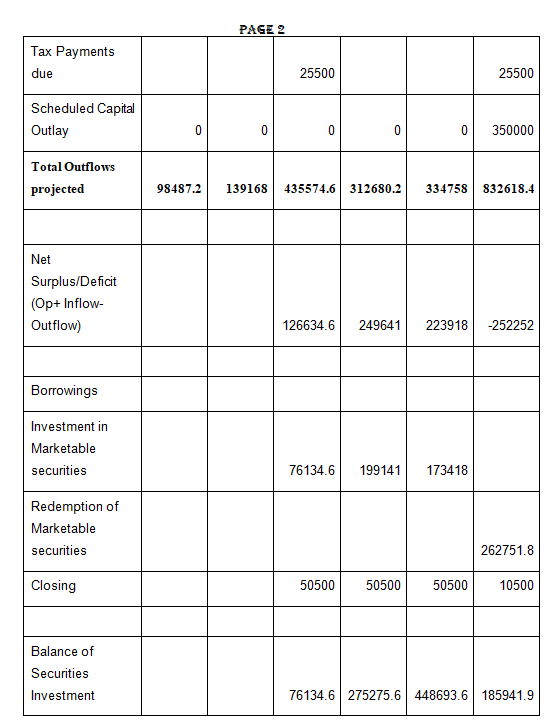

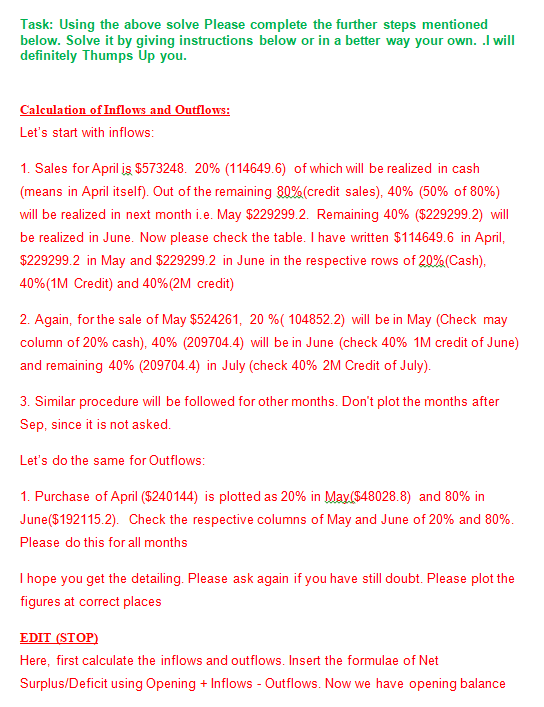

Question No. 2: (105) MJ Electronics Company's actual sales and purchases for April and May are shown here, along with forecasted sales and purchases for June through September April (actual) May (actual) June (forecast) July (forecast) August (forecast) September (forecast) Sales 573,248 542,261 503,528 503,528 526,768 588,741 Purchase April (actual) May (actual) June (forecast) July (forecast) August (forecast) September (forecast) The company makes 20 percent of its sales for cash and 80 percent on credit. Of the credit sales, 50 percent are collected in the month after the sale, and 50 percent are collected two months later. Archer pays for 20 percent of its purchases in the month after purchase and 80 percent two months after. 240,144 224,651 224,651 317,610 348,596 340,850 Labor expense equals 15 percent of the current month's sales. Overhead expense equals $12,500 per month. Interest payments of $32,500 are due in June and September. A cash dividend of $52,500 is scheduled to be paid in June. Tax payments of $25,500 are due in June and September. There is a scheduled capital outlay of $350,000 in September. Archer Electronics' ending cash balance in May is $22,500. The minimum desired cash balance is $10,500. Prepare a schedule of monthly cash receipts, monthly cash payments, and a complete monthly cash budget with borrowing and repayments for June through September. The maximum desired cash balance is $50,500. Excess cash (above $50,500) is used to buy marketable securities. Marketable securities are sold before borrowing funds in case of a cash shortfall (less than $10,500). PAGE 1 May June Particulars April July Aug Sept Opening Cash 22500 50500 50500 50500 Sales: (Exclude in formulas) 573248 524261 503528 503528 526768 588741 20% Cash 114649.6 104852.2 100705.6100705.6 105353.6 117748.2 40% 1M basis 229299.2 209704.4 201411.2 201411.2210707.2 40% 2M basis 229299.2 209704.4 2014 11.2 2014112 Total collection 114649.6 334151.4 539709.2 511821.2 508176 529866.6 Purchases: (Exclude in formulas) 240144 224651 224651 317610 348596 340850 20% 1M Payment 48028.8 44930.2 44930.2 63522 69719.2 80% 2M Payment 0 0192115.2179720.8 179720.8 254088 Total Purchases payment 0 48028.8 237045.4 224651 243242.8 323807.2 Labour (15% of sales) 859872 78639.15 75529.2 75529.2 790152 88311.15 Overhead PM 12500 12500 12500 12500 12500 12500 Interest 32500 32500 Cash Dividend Scheduled 52500 PAGE 2 Tax Payments due 25500 25500 Scheduled Capital Outlay 0 0 0 0 0 350000 Total Outflows projected 98487.2 139168 435574.6 312680.2 334758 832618.4 Net Surplus/Deficit (Op+ Inflow- Outflow) 126634.6 249641 223918 -252252 Borrowings Investment in Marketable securities 76134.6 199141 173418 Redemption of Marketable securities 262751.8 Closing 50500 50500 50500 10500 Balance of Securities Investment 76134.6275275.6448693.6 185941.9 Task: Using the above solve Please complete the further steps mentioned below. Solve it by giving instructions below or in a better way your own. I will definitely Thumps Up you. Calculation of Inflows and Outflows: Let's start with inflows: 1. Sales for April is $573248. 20% (114649.6) of which will be realized in cash (means in April itself). Out of the remaining 80% (credit sales), 40% (50% of 80%) will be realized in next month i.e. May $229299.2. Remaining 40% ($229299.2) will be realized in June. Now please check the table. I have written $114649.6 in April, $229299.2 in May and $229299.2 in June in the respective rows of 20%(Cash), 40%(1M Credit) and 40%(2M credit) 2. Again, for the sale of May $524261, 20 %( 104852.2) will be in May (Check may column of 20% cash), 40% (209704.4) will be in June (check 40% 1M credit of June) and remaining 40% (209704.4) in July (check 40% 2M Credit of July). 3. Similar procedure will be followed for other months. Don't plot the months after Sep, since it is not asked. Let's do the same for Outflows: 1. Purchase of April ($240144) is plotted as 20% in May($48028.8) and 80% in June($192115.2). Check the respective columns of May and June of 20% and 80%. Please do this for all months I hope you get the detailing. Please ask again if you have still doubt. Please plot the figures at correct places EDIT (STOP) Here, first calculate the inflows and outflows. Insert the formulae of Net Surplus/Deficit using Opening + Inflows - Outflows. Now we have opening balance of May. This will give the result of surplus available, so that investment is securities can be find out as max closing balance is available. Now opening of July is available. Similar exercise for July and August. Now, we have September opening balance. Net Deficit is coming. We want minimum balance $10500. We got the balance required. I have also updated the value of investment in marketable securities each year, which is more than the required balance in Sept. Hence, better to redeem them instead of borrowing from outside. Hence, you go!!! Assumptions made: 1. Labour is assumed to be paid in same month (Not informed in question), Since labour class generally don't wait for next month and they have to be paid. . 2. Interest is said to be due on the months. Since the banking payments can't be delayed if you want to have a good profile, hence, assuming to be paid in the same month. Both the assumptions are although informed, but take them every time. There has never been a question where the assumption proved other way. I hope you got my point. Please comment if you have any doubtStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started