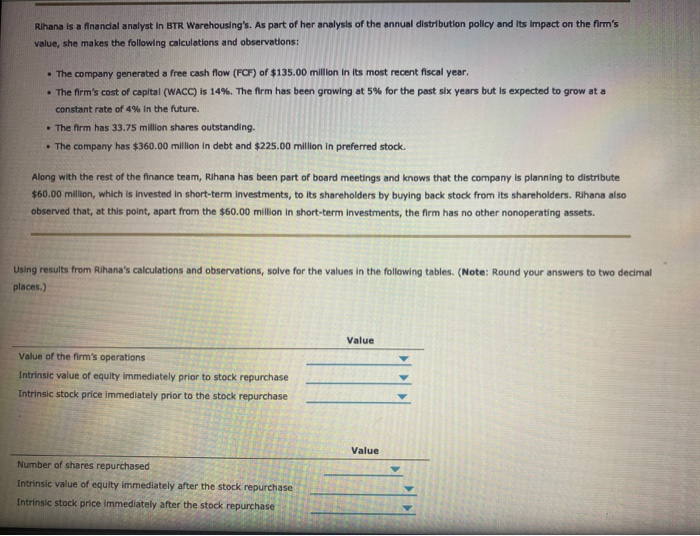

Remember that the primary goal of a firm is to maximize shareholder wealth by increasing the firm's intrinsic value. It is thus important to understand the impact of distributions-both in the form of dividends or stock repurchases on the firm's value. Consider the following situation: Rihana is a financial analyst in BTR Warehousing's. As part of her analysis of the annual distribution policy and its impact on the firm's value, she makes the following calculations and observations: The company generated a free cash flow (FCF) of $135.00 million in its most recent fiscal year. . The firm's cost of capital (WACC) is 14%. The firm has been growing at 5% for the past six years but is expected to grow at a constant rate of 4% in the future. The firm has 33.75 million shares outstanding. The company has $360.00 million in debt and $225.00 million in preferred stock. Along with the rest of the finance team, Rihana has been part of board meetings and knows that the company is planning to distribute $60.00 million, which is invested in short-term investments, to its shareholders by buying back stock from its shareholders. Rihana also observed that, at this point, apart from the $60.00 million in short-term investments, the firm has no other nonoperating assets. Using results from Rihana's calculations and observations, solve for the values in the following tables. (Note: Round your answers to two decimal places.) Rihana is a financial analyst in BTR Warehousing's. As part of her analysis of the annual distribution policy and its impact on the firm's value, she makes the following calculations and observations: The company generated a free cash flow (FCF) of $135.00 million in its most recent fiscal year. The firm's cost of capital (WACC) is 14%. The firm has been growing at 5% for the past six years but is expected to grow at a constant rate of 4% in the future. . The firm has 33.75 million shares outstanding. The company has $360.00 million in debt and $225.00 million in preferred stock. Along with the rest of the finance team, Rihana has been part of board meetings and knows that the company is planning to distribute $60.00 million, which is invested in short-term investments, to its shareholders by buying back stock from its shareholders. Rihana also observed that, at this point, apart from the $60.00 million in short-term investments, the firm has no other nonoperating assets. Using results from Rihana's calculations and observations, solve for the values in the following tables. (Note: Round your answers to two decimal places.) Value Value of the firm's operations Intrinsic value of equity immediately prior to stock repurchase Intrinsic stock price immediately prior to the stock repurchase > Number of shares repurchased Intrinsic value of equity immediately after the stock repurchase Intrinsic stock price Immediately after the stock repurchase