Question

Remmers Company manufactures desks. Most of the companys desks are standard models and are sold on the basis of catalog prices. At December 31, 2014,

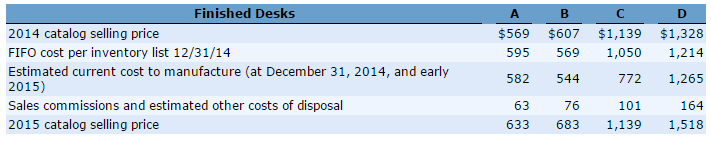

Remmers Company manufactures desks. Most of the companys desks are standard models and are sold on the basis of catalog prices. At December 31, 2014, the following finished desks  appear in the companys inventory.

appear in the companys inventory.

The 2014 catalog was in effect through November 2014, and the 2015 catalog is effective as of December 1, 2014. All catalog prices are net of the usual discounts. Generally, the company attempts to obtain a 20% gross profit on selling price and has usually been successful in doing so. At what amount should each of the four desks appear in the companys December 31, 2014, inventory, assuming that the company has adopted a lower-of-FIFO-cost-or-market approach for valuation of inventories on an individual-item basis?

Item A:

Item B:

Item C:

Item D:

Finished Desks 2014 catalog selling price FIFO cost per inventory list 12/31/14 Estimated current cost to manufacture (at December 31, 2014, and early 2015) Sales commissions and estimated other costs of disposal 2015 catalog selling price $569 $607 $1,139 $1,328 595 569 1,050 1,214 582 544 772 1,265 164 633 683 1,139 1,518 63 76 101Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started