Answered step by step

Verified Expert Solution

Question

1 Approved Answer

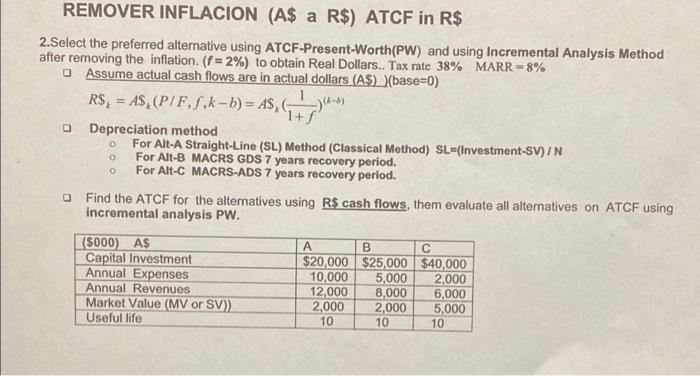

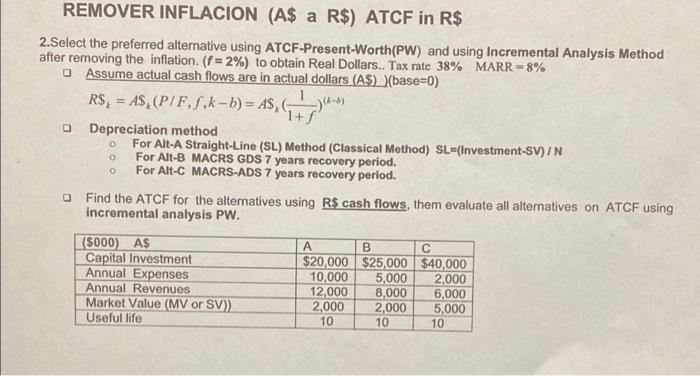

remove inflation (A$ to R$) ACTF in R$ REMOVER INFLACION (A$ a R$) ATCF in R$ 2. Select the preferred alternative using ATCF-Present-Worth(PW) and using

remove inflation (A$ to R$) ACTF in R$

REMOVER INFLACION (A$ a R$) ATCF in R$ 2. Select the preferred alternative using ATCF-Present-Worth(PW) and using Incremental Analysis Method after removing the inflation. (f=2%) to obtain Real Dollars.. Tax rate 38% MARR=8% Assume actual cash flows are in actual dollars (AS))(base=0) R$, = A$,(P/F,/,k - b) = A$,-)--) Depreciation method For Alt-A Straight-Line (SL) Method (Classical Method) SL-(Investment-SV)/N For Alt-B MACRS GDS 7 years recovery period. For Alt-C MACRS-ADS 7 years recovery period. Find the ATCF for the alternatives using R$ cash flows, them evaluate all alternatives on ATCF using incremental analysis PW. 1+f 0 o O (5000) A$ Capital Investment Annual Expenses Annual Revenues Market Value (MV or SV) Useful life B $20,000 $25,000 $40,000 10,000 5,000 2,000 12,000 8,000 6,000 2,000 2,000 5,000 10 10 10 REMOVER INFLACION (A$ a R$) ATCF in R$ 2. Select the preferred alternative using ATCF-Present-Worth(PW) and using Incremental Analysis Method after removing the inflation. (f=2%) to obtain Real Dollars.. Tax rate 38% MARR=8% Assume actual cash flows are in actual dollars (AS))(base=0) R$, = A$,(P/F,/,k - b) = A$,-)--) Depreciation method For Alt-A Straight-Line (SL) Method (Classical Method) SL-(Investment-SV)/N For Alt-B MACRS GDS 7 years recovery period. For Alt-C MACRS-ADS 7 years recovery period. Find the ATCF for the alternatives using R$ cash flows, them evaluate all alternatives on ATCF using incremental analysis PW. 1+f 0 o O (5000) A$ Capital Investment Annual Expenses Annual Revenues Market Value (MV or SV) Useful life B $20,000 $25,000 $40,000 10,000 5,000 2,000 12,000 8,000 6,000 2,000 2,000 5,000 10 10 10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started