Question

Renaissance Roof Racks (RRR) Ltd accepts three orders during a five-month period and starts Month 1 with 1000 cash in the companys current account Order

Renaissance Roof Racks (RRR) Ltd accepts three orders during a five-month period and starts Month 1 with £1000 cash in the company’s current account

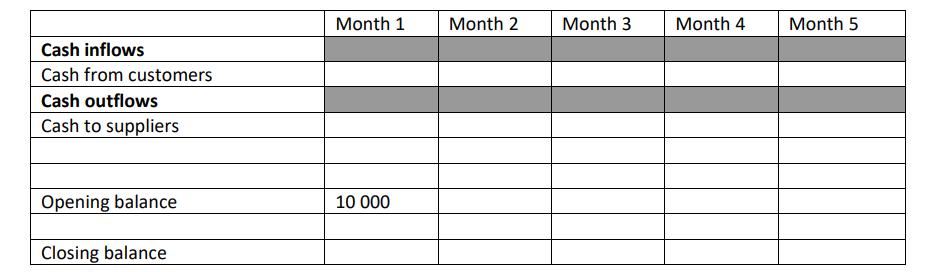

Order 1: revenue is received in cash in Month 1 from customers amounting to £10 000. However, RRR has negotiated a trade credit period where the costs of the order (£6 000) do not have to be paid in cash to RRR’s supplier until Month 3.

Order 2: RRR deliver orders to customers in Month 2 but customers will not pay the invoice of £20 000 until Month 5. The costs (£14 000) of the orders will have to be paid in cash to suppliers in Month 4.

Order 3: RRR deliver a £30 000 order to customers in Month 4 but only receive 50% of the invoice in cash in Month 5, with the remaining balance being paid in Month 6 (outside the cash-flow forecast period). Costs to suppliers (£18 000) have to be paid in cash one month after the customer made the order. a) In the table below, calculate the profitability of each order

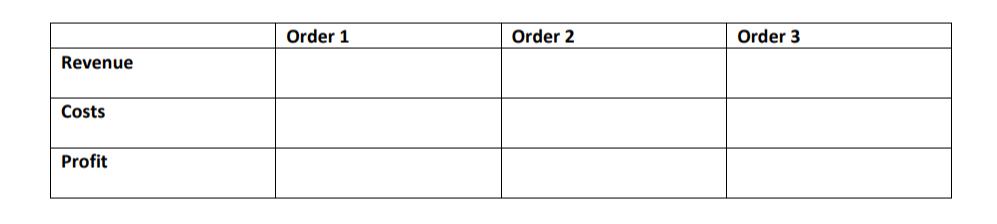

a) In the table below, calculate the profitability of each order.

b) Should RRR accept all three of the orders?

c) Using the table below, now complete RRR’s cash flow forecast.

Revenue Costs Profit Order 1 Order 2 Order 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started