Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Renee travels from Augusta to Cleveland on a business trip. Seven days of the trip are spent conducting business activities and three day is

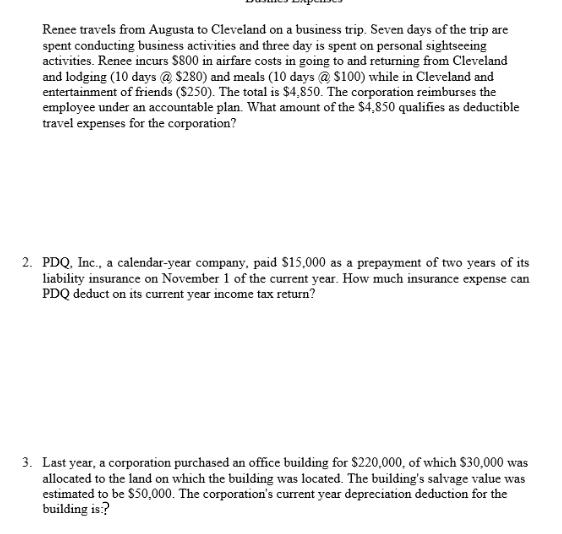

Renee travels from Augusta to Cleveland on a business trip. Seven days of the trip are spent conducting business activities and three day is spent on personal sightseeing activities. Renee incurs $800 in airfare costs in going to and returning from Cleveland and lodging (10 days @ $280) and meals (10 days @ $100) while in Cleveland and entertainment of friends ($250). The total is $4,850. The corporation reimburses the employee under an accountable plan. What amount of the $4,850 qualifies as deductible travel expenses for the corporation? 2. PDQ, Inc., a calendar-year company, paid $15,000 as a prepayment of two years of its liability insurance on November 1 of the current year. How much insurance expense can PDQ deduct on its current year income tax return? 3. Last year, a corporation purchased an office building for $220,000, of which $30,000 was allocated to the land on which the building was located. The building's salvage value was estimated to be $50,000. The corporation's current year depreciation deduction for the building is?

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1To determine the amount of deductible travel expenses for the corporation we need to identify the businessrelated expenses incurred by Renee during t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started