Answered step by step

Verified Expert Solution

Question

1 Approved Answer

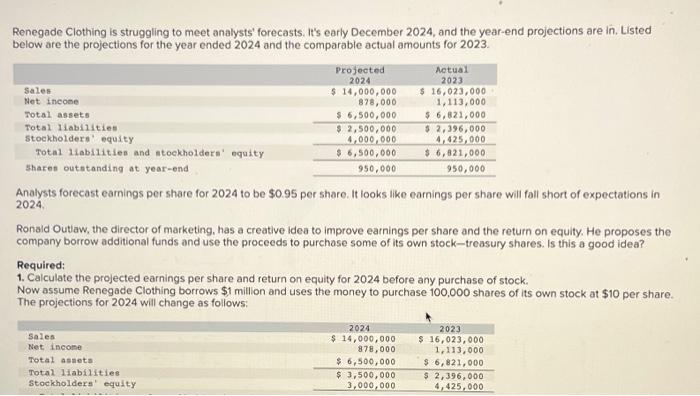

Renegade Clothing is struggling to meet analysts' forecasts. It's early December 2024, and the year-end projections are in. Listed below are the projections for the

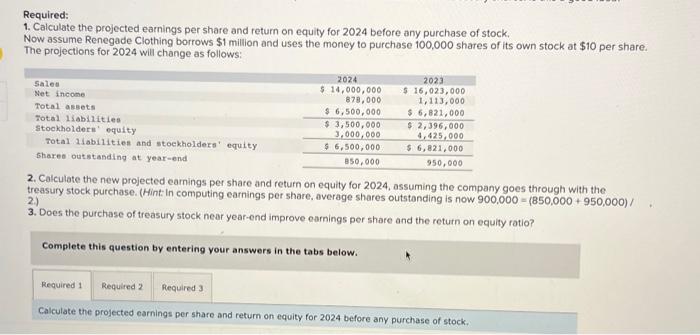

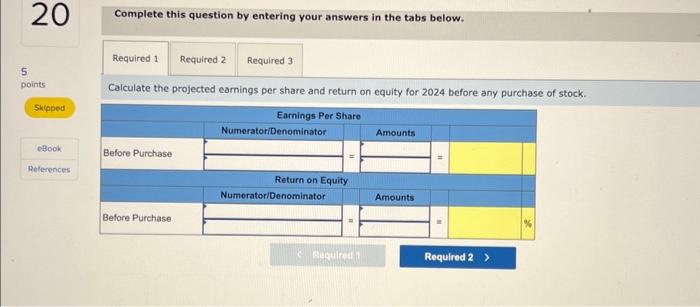

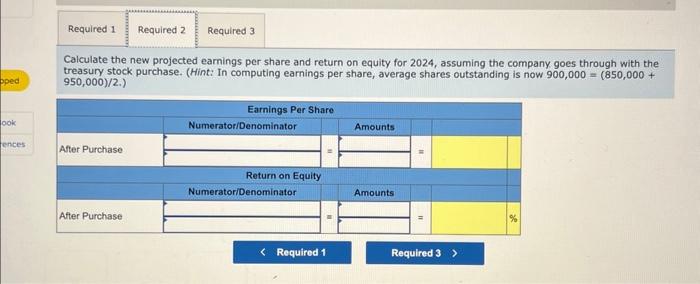

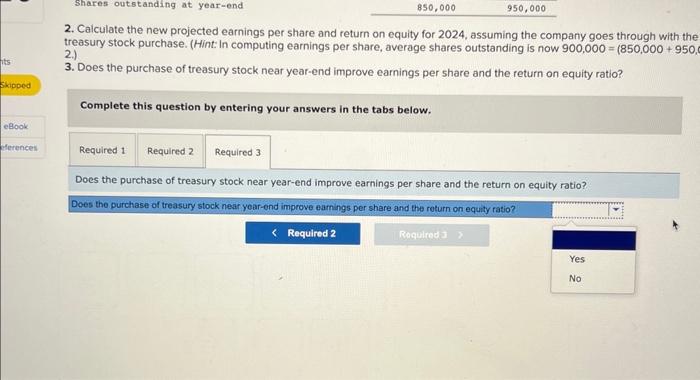

Renegade Clothing is struggling to meet analysts' forecasts. It's early December 2024, and the year-end projections are in. Listed below are the projections for the year ended 2024 and the comparable actual amounts for 2023. Sales. Net income Total assets Total liabilities Stockholders' equity Total liabilities and stockholders' equity Shares outstanding at year-end Projected 2024 Sales Net income $ 14,000,000 878,000 $ 6,500,000 $ 2,500,000 4,000,000 $ 6,500,000 950,000 Analysts forecast earnings per share for 2024 to be $0.95 per share. It looks like earnings per share will fall short of expectations in 2024. Total assets Total liabilities Ronald Outlaw, the director of marketing, has a creative idea to improve earnings per share and the return on equity. He proposes the company borrow additional funds and use the proceeds to purchase some of its own stock-treasury shares. Is this a good idea? Stockholders' equity Actual 2023 Required: 1. Calculate the projected earnings per share and return on equity for 2024 before any purchase of stock. Now assume Renegade Clothing borrows $1 million and uses the money to purchase 100,000 shares of its own stock at $10 per share. The projections for 2024 will change as follows: $ 16,023,000. 1,113,000 $ 6,821,000 $ 2,396,000 4,425,000 $ 6,821,000 950,000 2024 $ 14,000,000 878,000 $ 6,500,000 $ 3,500,000 3,000,000 2023 $ 16,023,000 1,113,000 $ 6,821,000 $ 2,396,000 4,425,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started