Question

Rensselaer Advisers You are a vice president of Rensselaer Advisers (RA), which manages portfolios for institutional investors (primarily corporate pension plans) and wealthy individuals. In

Rensselaer Advisers

You are a vice president of Rensselaer Advisers (RA), which manages portfolios for institutional investors (primarily corporate pension plans) and wealthy individuals. In mid-2017 RA had about $1.1 billion under management, invested in a wide range of common-stock and fixed-income port- folios. Its management fees average 55 basis points (.55%), so RAs total revenue for 2017 will be about .0055 $1.1 billion = $6.05 million.

You are attempting to land a new client, Madison Mills, a conservative, long-established manufacturer of papermaking felt. Madison has established a defined-benefit pension plan for its employees. RA would manage the pension assets that Madison has set aside to cover defined- benefit obligations for retired employees.

Defined benefit means that an employer is committed to pay retirement income according to a formula. For example, annual retirement income could equal 40% of the employees average salary in the five years prior to retirement. In a defined-benefit plan, retirement income does not depend on the performance of the pension assets. If the assets in the fund are not sufficient to cover pen- sion benefits, the company is required to contribute enough additional cash to cover the shortfall. Thus the PV of promised retirement benefits is a debt-equivalent obligation of the company.35

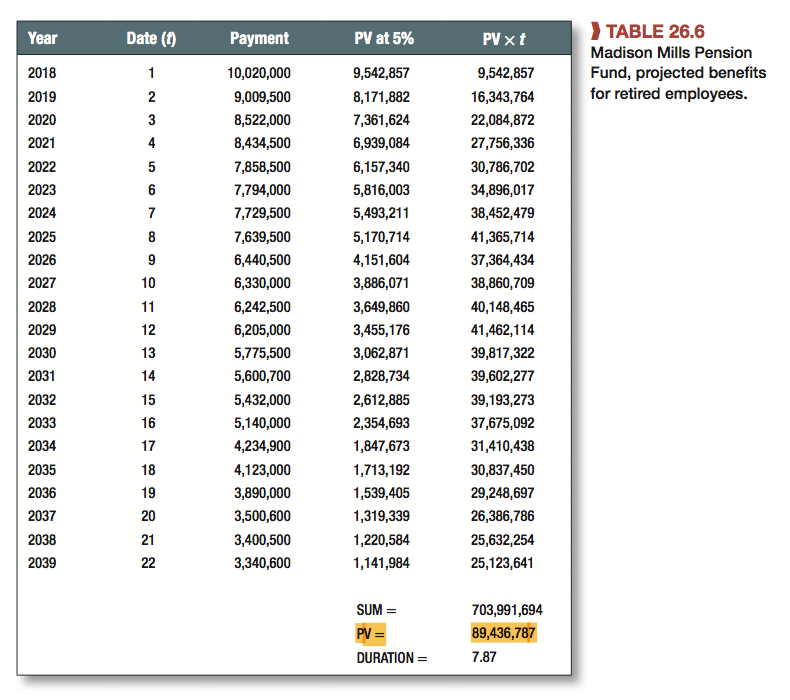

Table 26.6 shows Madisons obligations to its already retired employees from 2018 to 2036. Each of these employees receives a fixed dollar amount each month. Total dollar payments decline as the employees die off. The PV of the obligations in Table 26.6 is about $89 million at the cur- rent (2017) 5% long-term interest rate. Table 26.6 also calculates the duration of the obligations at 7.87 years.

Madison has set aside $90 million in pension assets to cover the obligations in Table 26.6, so this part of its pension plan is fully funded.36 The pension assets are now invested in a diversified portfolio of common stocks, corporate bonds, and notes.

After reviewing Madisons existing portfolio, you schedule a meeting with Hendrik van Wie, Madisons CFO. Mr. van Wie stresses Madisons conservative management philosophy and warns against speculation. He complains about the performance of the previous manager of the pen- sion assets. He suggests that you propose a plan of investing in safe assets in a way that minimizes exposure to equity markets and changing interest rates. You promise to prepare an illustration of how this goal could be achieved.

Later you discover that RA has competition for Madisons investment management business. SPX Associates is proposing a strategy of investing 70% of the portfolio ($63 million) in index funds tracking the U.S. stock market and 30% of the portfolio ($27 million) in U.S. Treasury secu- rities. SPX argues that their strategy is safe in the long run, because the U.S. stock market has delivered an average risk premium of about 7% per year. In addition, SPX argues that the growth in its stock market portfolio will far outstrip Madisons pension obligations. SPX also claims that the $27 million invested in Treasuries will provide ample protection against short-term stock market volatility. Finally, SPX proposes to charge an investment management fee of only 20 basis points (.20%). RA had planned to charge 30 basis points (.30%).

QUESTIONS

1. Prepare a memo for Mr. van Wie explaining how RA would invest to minimize both risk and exposure to changing interest rates. Give an example of a portfolio that would accomplish this objective. Explain how the portfolio would be managed as time passes and interest rates change. Also explain why SPXs proposal is not advisable for a conservative company like Madison.

RA manages several fixed-income portfolios. For simplicity, you decide to propose a mix of the following three portfolios:

A portfolio of long-term Treasury bonds with an average duration of 14 years.

A portfolio of Treasury notes with an average duration of 7 years.

A portfolio of short-term Treasury bills and notes with an average duration of 1 year.

The term structure is flat, and the yield on all three portfolios is 5%.

2. Sorry, you lost. SPX won and implemented its proposed strategy. Now the recession of 2018 has knocked down U.S. stock prices by 20%. The value of the Madison portfolio, after paying benefits for 2018, has fallen from $90 million to $78 million. At the same time interest rates have dropped from 5% to 4% as the Federal Reserve relaxes monetary policy to combat the recession.

Mr. van Wie calls again, chastened by the SPX experience, and he invites a new pro- posal to invest the pension assets in a way that minimizes exposure to the stock market and changing interest rates. Update your memo with a new example of how to accomplish Mr. van Wies objectives. You can use the same portfolios and portfolio durations as in Question 1. You will have to recalculate the PV and duration of the pension benefits from 2019 onward. Assume a flat term structure with all interest rates at 4%. (Hint: Madisons pension obliga- tions are now underfunded. Nevertheless you can hedge interest rate risk if you increase the duration of the pension assets.)

Year 2018 2019 TABLE 26.6 Madison Mills Pensionn Fund, projected benefits for retired employees. Date (t) Payment Pv at 5% 10,020,000 9,009,500 8,522,000 8,434,500 7,858,500 7,794,000 7,729,500 7,639,500 6,440,500 6,330,000 6,242,500 6,205,000 5,775,500 5,600,700 5,432,000 5,140,000 4,234,900 4,123,000 3,890,000 3,500,600 3,400,500 3,340,600 9,542,857 8,171,882 7,361,624 6,939,084 6,157,340 5,816,003 5,493,211 5,170,714 4,151,604 3,886,071 3,649,860 3,455,176 3,062,871 2,828,734 2,612,885 2,354,693 1,847,673 1,713,192 1,539,405 1,319,339 1,220,584 1,141,984 9,542,857 16,343,764 22,084,872 27,756,336 30,786,702 34,896,017 38,452,479 41,365,714 37,364,434 38,860,709 40,148,465 41,462,114 39,817,322 39,602,277 39,193,273 37,675,092 31,410,438 30,837,450 29,248,697 26,386,786 25,632,254 25,123,641 2021 4 2023 2024 2027 10 12 13 2031 15 16 2033 2034 18 19 20 21 2037 2039 SUM = 703,991,694 89,436,787 7.87 DURATION =Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started