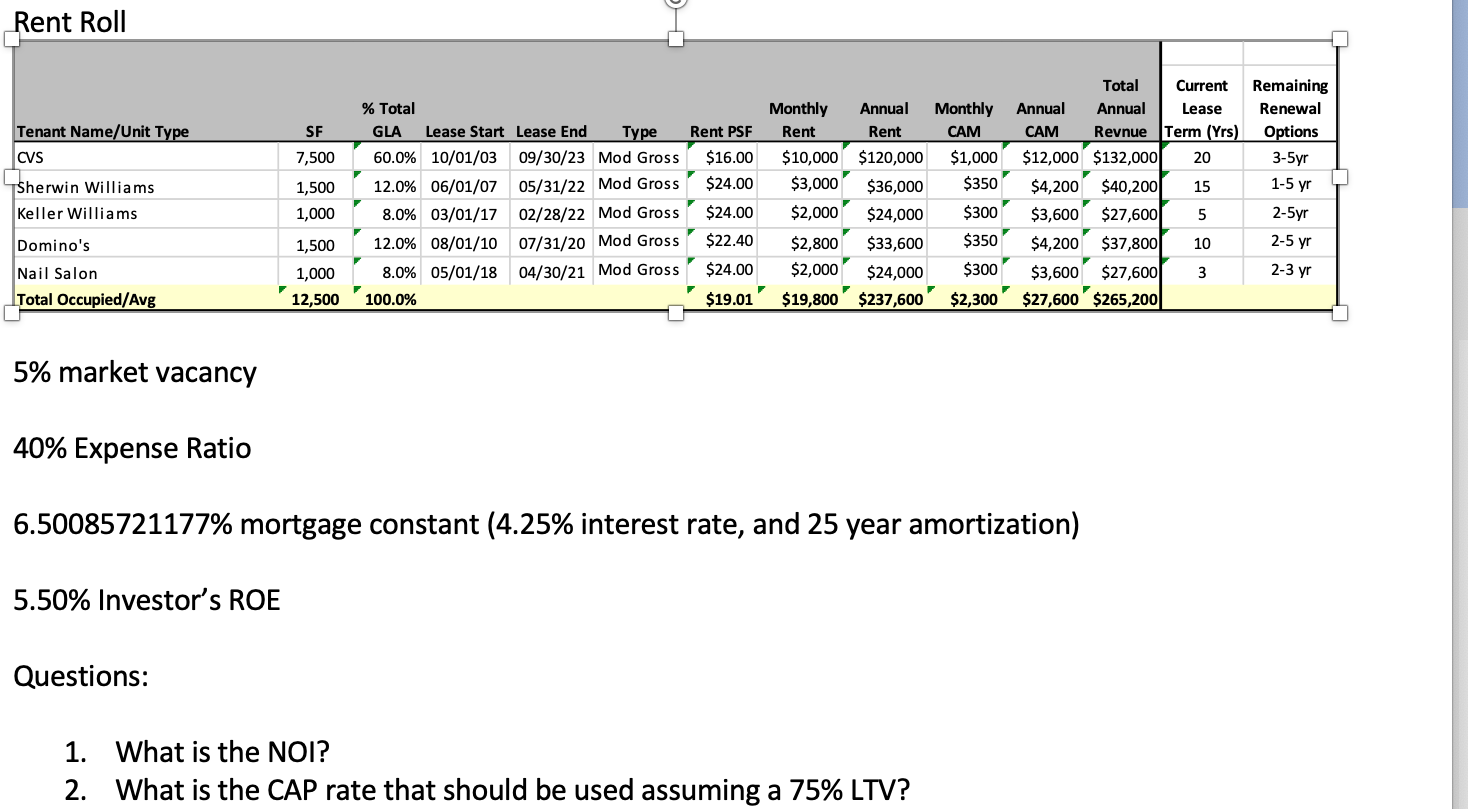

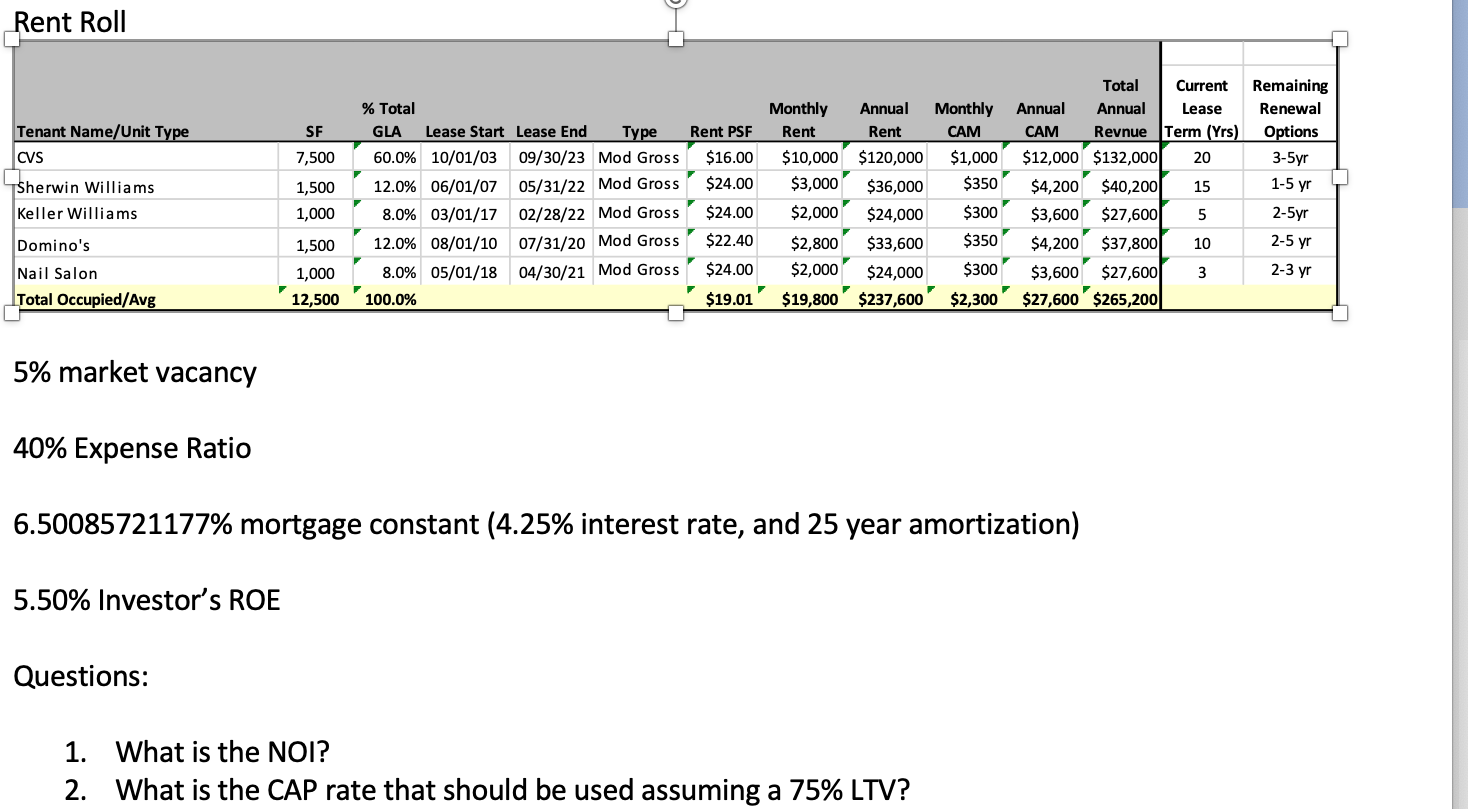

Rent Roll SF Rent PSF Tenant Name/Unit Type CVS 7,500 $16.00 $24.00 Monthly CAM $1,000 $350 $300 % Total GLA Lease Start Lease End Type 60.0% 10/01/03 09/30/23 Mod Gross 12.0% 06/01/07 05/31/22 Mod Gross 8.0% 03/01/17 02/28/22 Mod Gross 12.0% 08/01/10 07/31/20 Mod Gross 8.0% 05/01/18 04/30/21 Mod Gross 100.0% TSherwin Williams Keller Williams 1,500 1,000 Remaining Renewal Options 3-5yr 1-5 yr 2-5yr 2-5 yr 2-3 yr Monthly Annual Rent Rent $10,000 $120,000 $3,000 $36,000 $2,000 $24,000 $2,800 $33,600 $2,000 $24,000 $19,800 $237,600 Total Current Annual Annual Lease CAM Revnue Term (Yrs) $12,000 $132,000 20 $4,200 $40,200 15 $3,600 $27,600 5 $4,200 $37,800 10 $3,600 $27,600 3 $27,600 $265,200 $24.00 1,500 $22.40 Domino's Nail Salon Total Occupied/Avg $350 $300 1,000 $24.00 12,500 $19.01 $2,300 5% market vacancy 40% Expense Ratio 6.50085721177% mortgage constant (4.25% interest rate, and 25 year amortization) 5.50% Investor's ROE Questions: 1. What is the NOI? 2. What is the CAP rate that should be used assuming a 75% LTV? Rent Roll SF Rent PSF Tenant Name/Unit Type CVS 7,500 $16.00 $24.00 Monthly CAM $1,000 $350 $300 % Total GLA Lease Start Lease End Type 60.0% 10/01/03 09/30/23 Mod Gross 12.0% 06/01/07 05/31/22 Mod Gross 8.0% 03/01/17 02/28/22 Mod Gross 12.0% 08/01/10 07/31/20 Mod Gross 8.0% 05/01/18 04/30/21 Mod Gross 100.0% TSherwin Williams Keller Williams 1,500 1,000 Remaining Renewal Options 3-5yr 1-5 yr 2-5yr 2-5 yr 2-3 yr Monthly Annual Rent Rent $10,000 $120,000 $3,000 $36,000 $2,000 $24,000 $2,800 $33,600 $2,000 $24,000 $19,800 $237,600 Total Current Annual Annual Lease CAM Revnue Term (Yrs) $12,000 $132,000 20 $4,200 $40,200 15 $3,600 $27,600 5 $4,200 $37,800 10 $3,600 $27,600 3 $27,600 $265,200 $24.00 1,500 $22.40 Domino's Nail Salon Total Occupied/Avg $350 $300 1,000 $24.00 12,500 $19.01 $2,300 5% market vacancy 40% Expense Ratio 6.50085721177% mortgage constant (4.25% interest rate, and 25 year amortization) 5.50% Investor's ROE Questions: 1. What is the NOI? 2. What is the CAP rate that should be used assuming a 75% LTV