Answered step by step

Verified Expert Solution

Question

1 Approved Answer

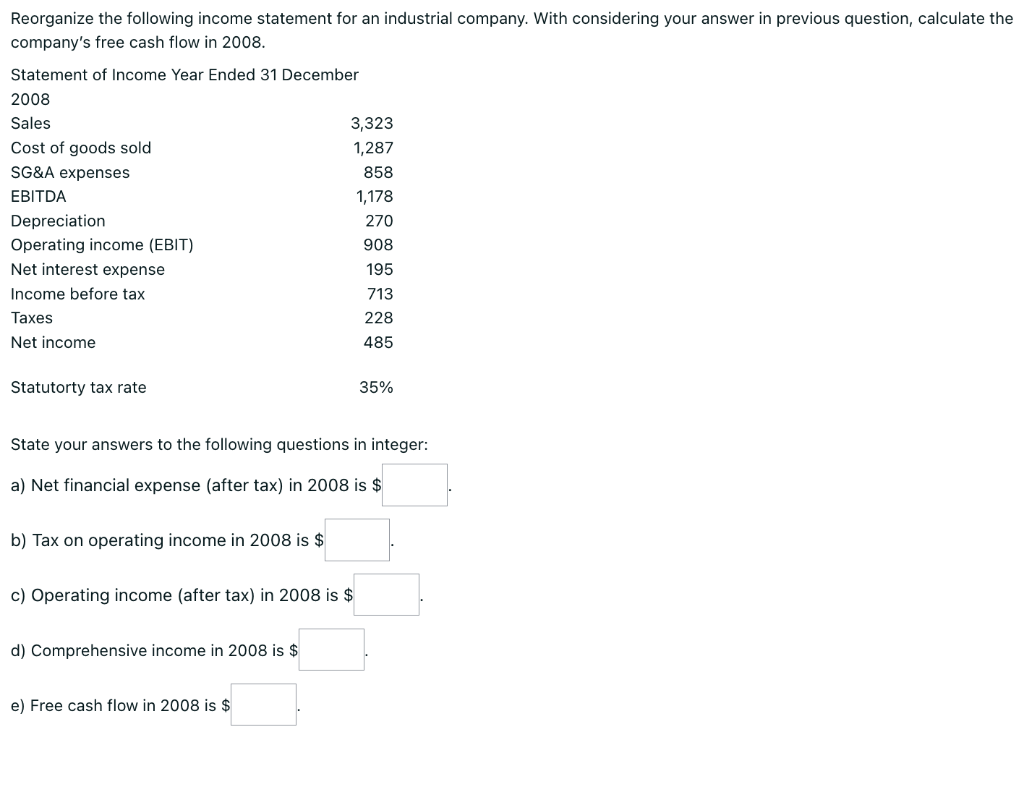

Reorganize the following income statement for an industrial company. With considering your answer in previous question, calculate the company's free cash flow in 2008.

Reorganize the following income statement for an industrial company. With considering your answer in previous question, calculate the company's free cash flow in 2008. Statement of Income Year Ended 31 December 2008 Sales 3,323 Cost of goods sold 1,287 SG&A expenses 858 EBITDA 1,178 Depreciation 270 Operating income (EBIT) 908 Net interest expense 195 Income before tax 713 Taxes 228 Net income 485 Statutorty tax rate 35% State your answers to the following questions in integer: a) Net financial expense (after tax) in 2008 is $ b) Tax on operating income in 2008 is $ c) Operating income (after tax) in 2008 is $ d) Comprehensive income in 2008 is $ e) Free cash flow in 2008 is $

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

A 332300 128700 85800 117800 27000 90800 19500 71300 22800 48500 1 Sales ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started