Answered step by step

Verified Expert Solution

Question

1 Approved Answer

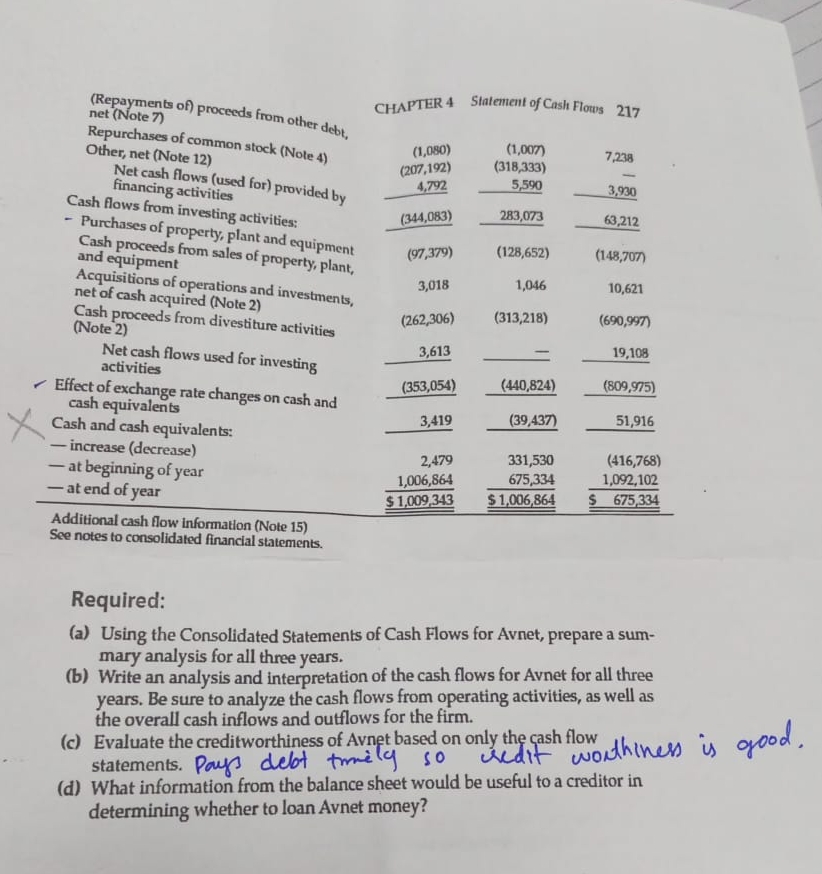

( Repayments of ) proceeds from other debt, net ( Note 7 ) Repurchases of common stock ( Note 4 ) Other, net ( Note

Repayments of proceeds from other debt, net Note

Repurchases of common stock Note

Other, net Note

Net cash flows used for provided by financing activities

Cash flows from investing activities:

Purchases of property, plant and equipment Cash proceeds from sales of property, plant, and equipment

Acquisitions of operations and investments, net of cash acquired Note

Cash proceeds from divestiture activities Note

Net cash flows used for investing activities

Effect of exchange rate changes on cash and cash equivalents

Cash and cash equivalents:

increase decrease

at beginning of year

at end of year

Additional cash flow information Note

See notes to consolidated financial statements.

Required:

a Using the Consolidated Statements of Cash Flows for Avnet, prepare a summary analysis for all three years.

b Write an analysis and interpretation of the cash flows for Avnet for all three years. Be sure to analyze the cash flows from operating activities, as well as the overall cash inflows and outflows for the firm.

c Evaluate the creditworthiness of Avnet based on only the cash flow statements. Poygs debt tmenety so cedit wouthiness is oood.

d What information from the balance sheet would be useful to a creditor in determining whether to loan Avnet money?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started