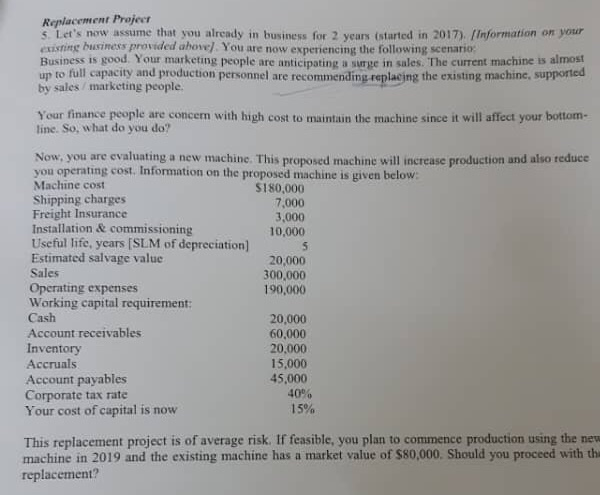

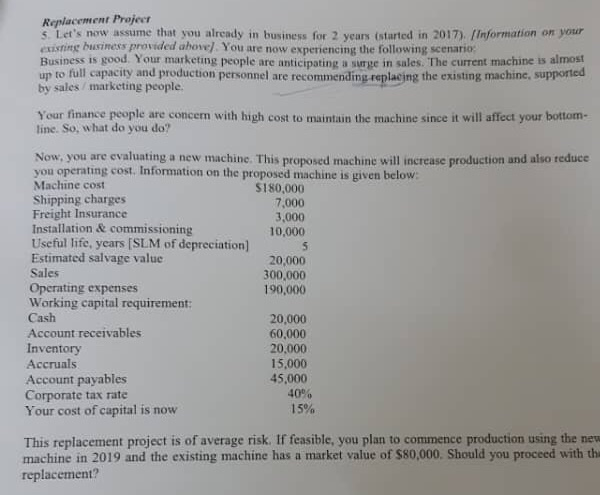

Replacement Projecr s. Let's now assume that you already in business for 2 years (started in 2017), Information on your existing business provided ahovel You are now experiencing the following scenario Business is good. Your marketing people are anticipating a surge in sales. The current machine is almost up to full capacity and production personnel are recommending replacing the existing machine, supported by sales/ marketing people Your finance people are concern with high cost to maintain the machine since it will affect your bottom- line. So, what do you do? Now, you are evaluating a new machine. This proposed machine will increase production and also reduce you operating cost, Information on the proposed machine is given below Machine cost Shipping charges Freight Insurance Installation &commissioning Useful life, years [SL.M of depreciation) Estimated salvage value Sales $180,000 7,000 3,000 10,000 20,000 300,000 190,000 Operating expenses Working capital requirement: Cash Account receivables Inventory Accruals 20,000 60,000 20,000 15,000 45,000 40% 15% Account payables Corporate tax rate Your cost of capital is now This replacement project is of average risk. If feasible, you plan to commence production using the new machine in 2019 and the existing machine has a market value of $80,000. Should you proceed with th replacement? Replacement Projecr s. Let's now assume that you already in business for 2 years (started in 2017), Information on your existing business provided ahovel You are now experiencing the following scenario Business is good. Your marketing people are anticipating a surge in sales. The current machine is almost up to full capacity and production personnel are recommending replacing the existing machine, supported by sales/ marketing people Your finance people are concern with high cost to maintain the machine since it will affect your bottom- line. So, what do you do? Now, you are evaluating a new machine. This proposed machine will increase production and also reduce you operating cost, Information on the proposed machine is given below Machine cost Shipping charges Freight Insurance Installation &commissioning Useful life, years [SL.M of depreciation) Estimated salvage value Sales $180,000 7,000 3,000 10,000 20,000 300,000 190,000 Operating expenses Working capital requirement: Cash Account receivables Inventory Accruals 20,000 60,000 20,000 15,000 45,000 40% 15% Account payables Corporate tax rate Your cost of capital is now This replacement project is of average risk. If feasible, you plan to commence production using the new machine in 2019 and the existing machine has a market value of $80,000. Should you proceed with th replacement