Answered step by step

Verified Expert Solution

Question

1 Approved Answer

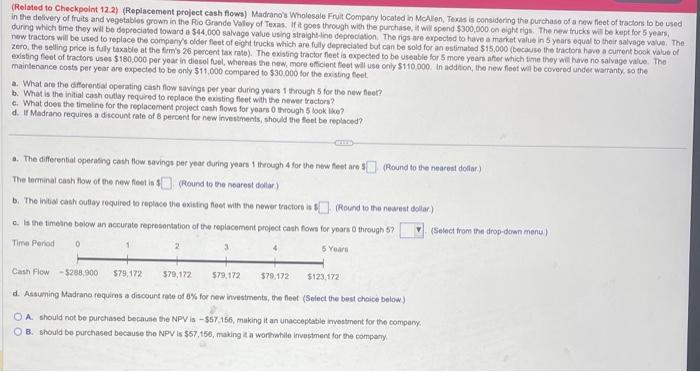

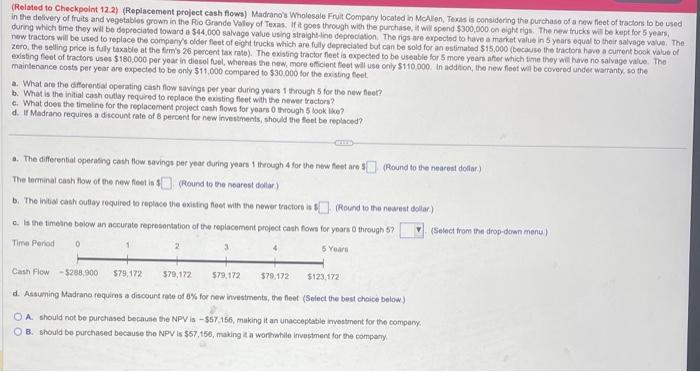

Replacement Project Cash Flows. PLEASE HELP. URGENT. maintenance costa per year are expected to be anty 511,000 compared to $30.000 for the existing foet. a.

Replacement Project Cash Flows. PLEASE HELP. URGENT.

maintenance costa per year are expected to be anty 511,000 compared to $30.000 for the existing foet. a. What are the difforentas operating cash flow sawingt pet year during years 1 through 5 for the new fleer? b. What is the initial cash outiay required to replace the existing fleet with the newer tractors? c. What does the timaline for the replacement project casth flows for yoars 0 through 5 book Ike? d. If Madrano requires a discount rale of 8 percent for new investments, should the foet be replaced? a. The differential operating cath flow savings per ynar during years 1 theough 4 for the nenw teet are 1 (Round to the nearest dollar.) The Inminal cash flow of the new feet is 1. (Round to the noarest doilar) b. The initial cash outlay required to replace the oxisting feet with the newer tractort is i ifound to the neavest dollar). c. It the timesine below an accurate reprosentation of the replacement preject cash fows for yoars 0 through 5 ? (Select from the drop-doan menu) Time \& d. Assuming Madrane fequires a discouns rele of 8% for new investments, the fleet (Select the best chaice below) A. should not bo purchased because the NPV is 557,156, making it an unaccepeable imestment for tho company. B. Shorid bo purchased because the NPV is $57,156, naking is a worthatile investment for the compary maintenance costa per year are expected to be anty 511,000 compared to $30.000 for the existing foet. a. What are the difforentas operating cash flow sawingt pet year during years 1 through 5 for the new fleer? b. What is the initial cash outiay required to replace the existing fleet with the newer tractors? c. What does the timaline for the replacement project casth flows for yoars 0 through 5 book Ike? d. If Madrano requires a discount rale of 8 percent for new investments, should the foet be replaced? a. The differential operating cath flow savings per ynar during years 1 theough 4 for the nenw teet are 1 (Round to the nearest dollar.) The Inminal cash flow of the new feet is 1. (Round to the noarest doilar) b. The initial cash outlay required to replace the oxisting feet with the newer tractort is i ifound to the neavest dollar). c. It the timesine below an accurate reprosentation of the replacement preject cash fows for yoars 0 through 5 ? (Select from the drop-doan menu) Time \& d. Assuming Madrane fequires a discouns rele of 8% for new investments, the fleet (Select the best chaice below) A. should not bo purchased because the NPV is 557,156, making it an unaccepeable imestment for tho company. B. Shorid bo purchased because the NPV is $57,156, naking is a worthatile investment for the compary

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started