Answered step by step

Verified Expert Solution

Question

1 Approved Answer

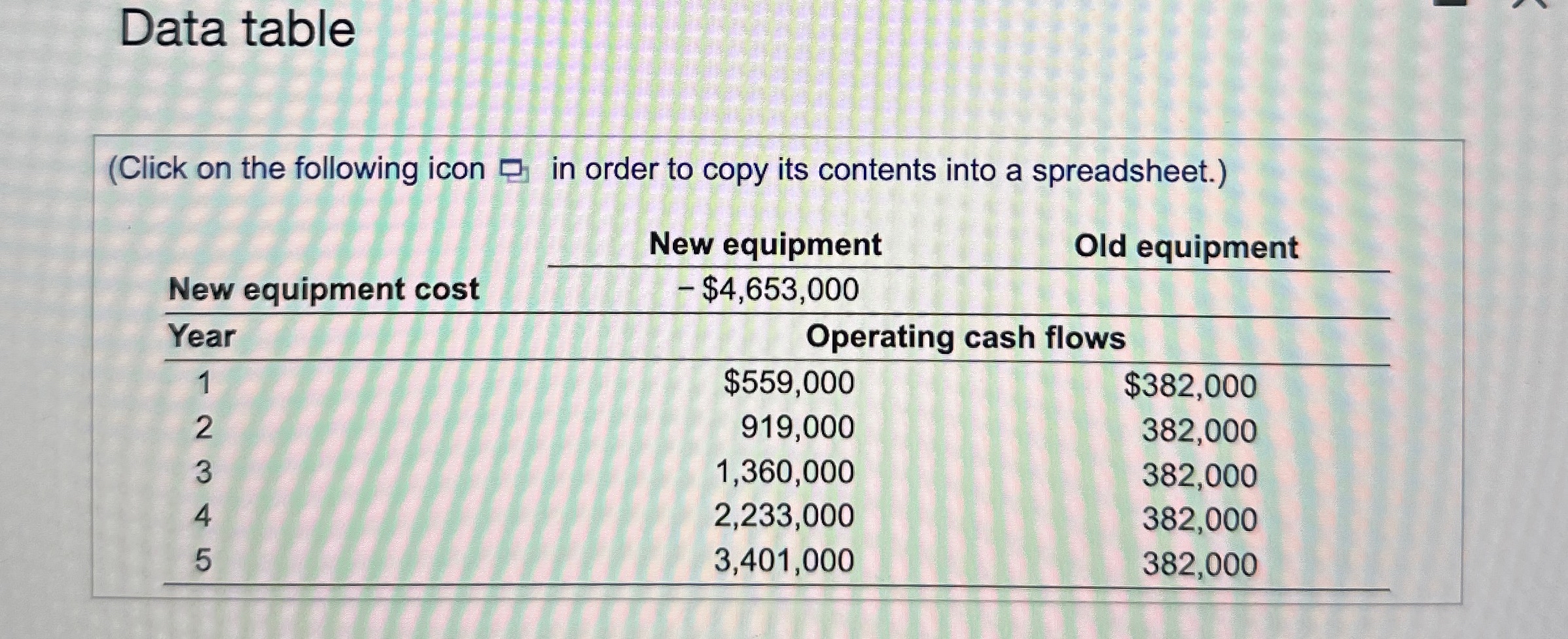

Replacement versus expansion cash flows Tesla Systems has estimated the cash flows over the five - year lives of a project that will install new

Replacement versus expansion cash flows Tesla Systems has estimated the cash flows over the fiveyear lives of a project that will install new equipment to replace old equipment. If the firm makes this investment, it will sell the old equipment and receive aftertax proceeds of $ If the firm decides not to undertake this project, the old equipment will remain in service and generate the cash flows listed in years through and it will have no value after five years. These cash flows are summarized in the following table:

a What are the incremental cash flows for this project? Assume the new equipment has no market value after years.

b Instead, suppose that Tesla Systems' business is booming and that the new machine expands the firm's capacity. If they buy new equipment, they will generate cash flows as shown in the table, but they will leave the old equipment in service, and it will continue to generate $ in cash flow in each of the next five years. Now what are the incremental project cash flows?

a Calculate the incremental cash flows for this replacement decision: Enter a positive number for a cash inflow and a negative number for a cash outflow and round all numbers to the nearest dollar.

tableYearNew Equipment,Old Equipment,Incremental Cash Flows$$$

Data table

Click on the following icon in order to copy its contents into a spreadsheet.

tableNew equipment,Old equipmentNew equipment cost,$YearOperating cash flows,$$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started