Answered step by step

Verified Expert Solution

Question

1 Approved Answer

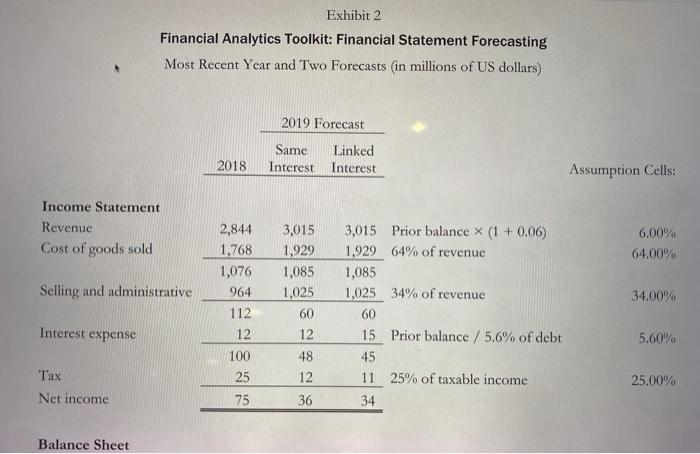

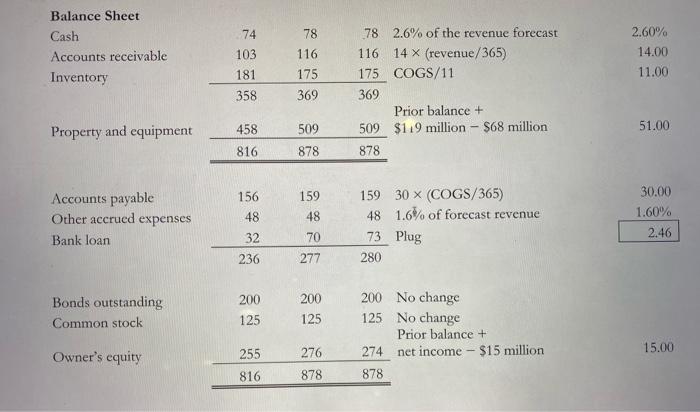

Replicate Exhibit 2 from the note . Do not only type the numbersuse equations where necessary to complete the table. The prior two financial statements

Replicate Exhibit 2 from the note . Do not only type the numbersuse equations where necessary to complete the table.

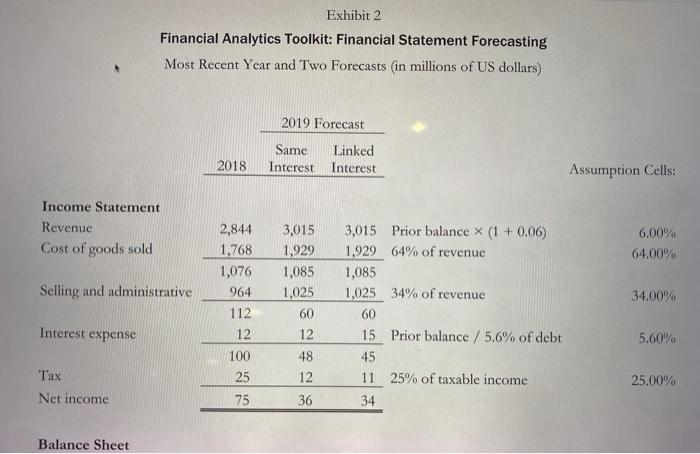

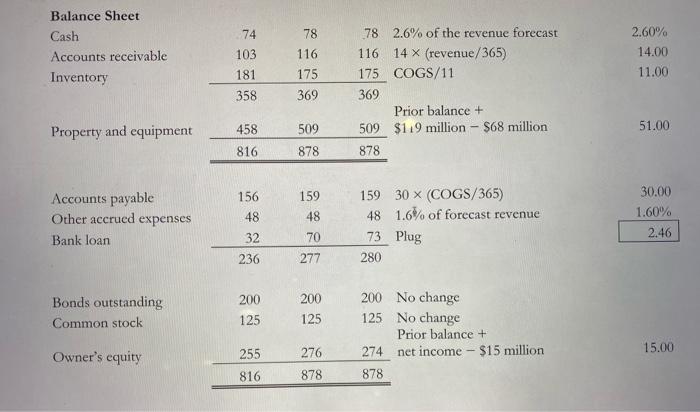

The prior two financial statements play an important role in the forecast. First, the revenue forecast is based on growing the 2018 revenue; the forecast property and equipment balance and the forecast owner's equity balance both start with the 2018 balance and make changes; and we need both the 2017 and 2018 financial statements to determine the dividend. Specifically, the dividend is implied by the change in owner's equity between the prior two years and the net income in 2018. This can be determined to be $15 million. One complication that arises in most forecasts is that the interest expense for a forecasted year will depend on the amount of debt needed that year. The amount of debt needed, in turn, will depend on the amount of net income...which is affected by the interest expense. This circularity is not a substantial technical challenge spreadsheet programs can usually solve for the right outcome. The typical approach is to plug in a starting amount for interest expense (the prior year is a good candidate) and then as a final step, link the interest expense to the debt balance. Exhibit 2 presents two forecasts for Morgan Industries for 2019, along with the 2018 results. In the first forecast, the interest expense is simply set to the prior year amount. There is no circularity. In the second, the interest expense has been linked to the amount of debt outstanding at the end of the year. Please note a few observations on good modelling technique. Any spreadsheet should have its assumptions listed explicitly rather than buried in the spreadsheet. Id Exhibit 2, those cell values are shown to the far right Note that this includes the net change in the property and equipment account of $51 million = $119 million - $68 million, and the dividend of $15 million. Also note that there is a cell devoted to the implied change in the bank loan of $2.46 million. This is not a forecast, but the net outcome of all the other forecasts combined: it is boxed to highlight this outcome. A reasonable conclusion from the forecast is that even with worsening market conditions affecting margins and receivables, there is only a slight change in the bank loan. This can likely be accommodated by the bank. Exhibit 2 Financial Analytics Toolkit: Financial Statement Forecasting Most Recent Year and Two Forecasts (in millions of US dollars) 2019 Forecast 2018 Same Linked Interest Interest Assumption Cells: Income Statement Revenue Cost of goods sold 6.00% 64.00% Selling and administrative 34.00% 2,844 1,768 1,076 964 112 12 100 25 75 3,015 1,929 1,085 1,025 60 12 48 12 36 3,015 Prior balance X (1 + 0.06) 1,929 64% of revenue 1,085 1,025 34% of revenue 60 15 Prior balance / 5.6% of debt 45 11 25% of taxable income 34 Interest expense 5.60% Tax Net income 25.00% Balance Sheet Balance Sheet Cash Accounts receivable Inventory 74 103 181 358 78 116 175 369 2.60% 14.00 11.00 78 2.6% of the revenue forecast 116 14 x (revenue/365) 175 COGS/11 369 Prior balance + 509 $1.9 million - $68 million 878 458 Property and equipment 51.00 509 878 816 Accounts payable Other accrued expenses Bank loan 159 48 156 48 32 236 159 30 x (COGS/365) 48 1.6% of forecast revenue 73 Plug 280 30.00 1.60% 2.46 70 277 200 Bonds outstanding Common stock 200 125 125 200 No change 125 No change Prior balance + 274 net income - $15 million 878 15.00 Owner's equity 255 276 878 816 The prior two financial statements play an important role in the forecast. First, the revenue forecast is based on growing the 2018 revenue; the forecast property and equipment balance and the forecast owner's equity balance both start with the 2018 balance and make changes; and we need both the 2017 and 2018 financial statements to determine the dividend. Specifically, the dividend is implied by the change in owner's equity between the prior two years and the net income in 2018. This can be determined to be $15 million. One complication that arises in most forecasts is that the interest expense for a forecasted year will depend on the amount of debt needed that year. The amount of debt needed, in turn, will depend on the amount of net income...which is affected by the interest expense. This circularity is not a substantial technical challenge spreadsheet programs can usually solve for the right outcome. The typical approach is to plug in a starting amount for interest expense (the prior year is a good candidate) and then as a final step, link the interest expense to the debt balance. Exhibit 2 presents two forecasts for Morgan Industries for 2019, along with the 2018 results. In the first forecast, the interest expense is simply set to the prior year amount. There is no circularity. In the second, the interest expense has been linked to the amount of debt outstanding at the end of the year. Please note a few observations on good modelling technique. Any spreadsheet should have its assumptions listed explicitly rather than buried in the spreadsheet. Id Exhibit 2, those cell values are shown to the far right Note that this includes the net change in the property and equipment account of $51 million = $119 million - $68 million, and the dividend of $15 million. Also note that there is a cell devoted to the implied change in the bank loan of $2.46 million. This is not a forecast, but the net outcome of all the other forecasts combined: it is boxed to highlight this outcome. A reasonable conclusion from the forecast is that even with worsening market conditions affecting margins and receivables, there is only a slight change in the bank loan. This can likely be accommodated by the bank. Exhibit 2 Financial Analytics Toolkit: Financial Statement Forecasting Most Recent Year and Two Forecasts (in millions of US dollars) 2019 Forecast 2018 Same Linked Interest Interest Assumption Cells: Income Statement Revenue Cost of goods sold 6.00% 64.00% Selling and administrative 34.00% 2,844 1,768 1,076 964 112 12 100 25 75 3,015 1,929 1,085 1,025 60 12 48 12 36 3,015 Prior balance X (1 + 0.06) 1,929 64% of revenue 1,085 1,025 34% of revenue 60 15 Prior balance / 5.6% of debt 45 11 25% of taxable income 34 Interest expense 5.60% Tax Net income 25.00% Balance Sheet Balance Sheet Cash Accounts receivable Inventory 74 103 181 358 78 116 175 369 2.60% 14.00 11.00 78 2.6% of the revenue forecast 116 14 x (revenue/365) 175 COGS/11 369 Prior balance + 509 $1.9 million - $68 million 878 458 Property and equipment 51.00 509 878 816 Accounts payable Other accrued expenses Bank loan 159 48 156 48 32 236 159 30 x (COGS/365) 48 1.6% of forecast revenue 73 Plug 280 30.00 1.60% 2.46 70 277 200 Bonds outstanding Common stock 200 125 125 200 No change 125 No change Prior balance + 274 net income - $15 million 878 15.00 Owner's equity 255 276 878 816

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started